Morgan Stanley says a cap in VIP commissions could be just the boost a recovering Macau market needs

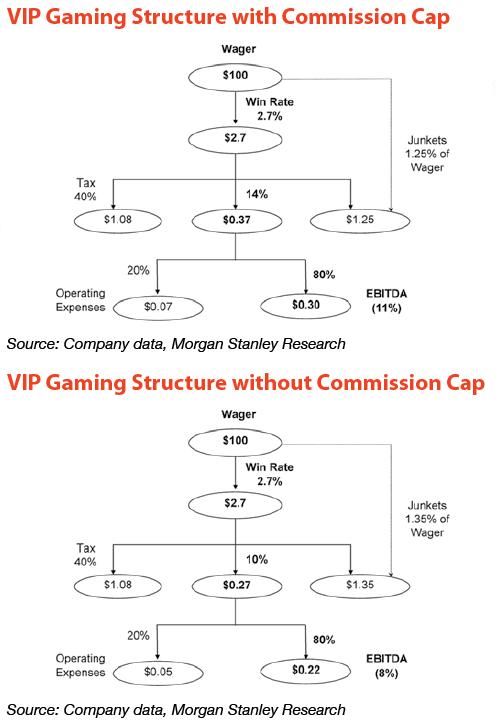

A cut in the upper level of Macau VIP chip commission rates of just 10 basis points (i.e., 0.10%) could lead to a dramatic improvement in pre-tax margins and pre-tax earnings for the territory’s casino operators, says a report from Morgan Stanley Research Asia/Pacific.

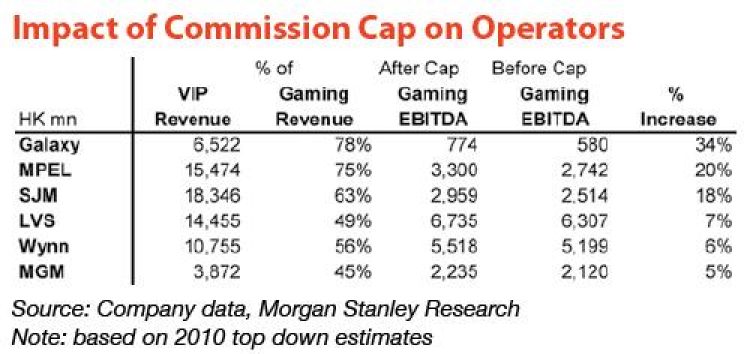

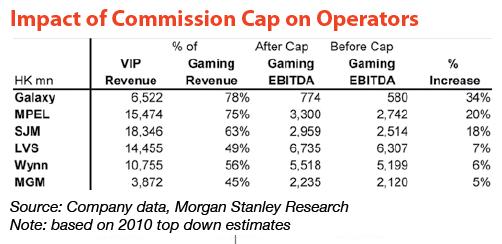

The report Macau Gaming & Property—Turning the Corner, by Praveen Choudhary and Corey Chan, says a cap on the upper level of commissions at 1.25% could boost margins on earnings before interest, taxation, depreciation and amortisation (EBITDA) by as much as 300 basis points, fuelled by a rise of up to 34% in EBITDA itself.

“We believe Galaxy to be the biggest beneficiary of such a move, followed by Melco and Sociedade de Jogos de Macau SA (SJM) based on higher contributions from the VIP segment,” say the authors.

Upward trend

Galaxy, in its first quarter 2009 results issued in late April, reported a 17% quarter on quarter increase in volume of VIP play to HK$55 billion, against what it said was a general market decline for the period of 22%. The company added that its total market share of Macau gaming revenue rose from 10% to 13% in 2008.

In early April, Amax Entertainment Holdings Ltd announced that rolling chip volume generated at Crown Macau by AMA International Limited (in which Amax has an indirect 80% effective interest on profit sharing) totalled HKD58.9 billion for the three months to 31st March.

The two financial models below outline what the authors say is the potential ‘before’ and ‘after’ effect of a 1.25% cap on commissions.

For the record, as of 31st March, Morgan Stanley held at least US$1 million in debt securities issued by Galaxy Entertainment Group. Morgan Stanley & Co. also makes a market in the securities of Melco Crown Entertainment Ltd.

Current rates

The report analysts say that based on discussion with the industry, they believe the current VIP rolling chip commission rate in Macau is around 1.33%. This amounts to an increase in average commissions of around one third in the space of less than two years, probably stimulated by the 1.35% offer made by Crown Macau’s management to Amax, the Hong Kong-listed junket aggregator in the fourth quarter of 2007.

“Talks on commission caps first surfaced in October 2008. However, several months have passed and some of the investors have given up hope,” say the report authors.

“We, however, believe that caps will be implemented in 2009 following several meetings involving the six operators over the last few weeks,” adds the paper.

The “several meetings” mentioned by the analysts is a reference to the Macau Gaming Operators’ Association (MGOA), founded earlier this year by the six Macau gaming licence holders. Dr Stanley Ho, Macau’s former gaming monopolist and chairman of SJM Holdings, the biggest single casino operator in the market, was recently quoted by the Chinese news agency Xinhua as saying he had “promised” (though didn’t specify to whom he had made the promise) not to talk about the commission rate for junket operators.

Agenda

Dr Ho’s assertion that VIP agent commissions are off the agenda seems to be contradicted by Francis Lui, Vice Chairman of Galaxy Entertainment Group, who told Inside Asian Gaming ahead of the next meeting of the MGOA planned for 18th May that he expected that agent commissions would indeed be a topic for discussion.

If the gaming trade body actively pursues among its members the idea of a commission cap, then it may remove the need for the Macau government in effect to impose one, albeit on a supposedly voluntary basis. That idea has been around since at least the summer of last year, rather than the October date mentioned by the report authors. Morgan Stanley says it does believe the government will act if nothing is agreed internally by the industry.

“We expect the Macau government to regulate commissions paid to junkets/promoters to be capped at 1.25%. We estimate the current commission rate is around 1.33% for the industry, although some junkets/promoters are paid even more,” explain the authors.

Despite the potential upside of the commission cap, Morgan Stanley points out there are what the analysts call “near-term headwinds” in the Macau market generally, including intensified competition as a result of the expected opening of City of Dreams in mid-June.

“We believe CoD will drive visitor arrivals up; however, it will also compete fiercely with Venetian for the mass and VIP share coming to [the] Cotai Strip. This could result in bigger discounts and narrower margins in the interim for both operations,” state the authors.

ROI down

Another issue identified by the research team and touched on in other analysts’ reports and previous stories in IAG, is that as the Macau market matures in terms of the number of venues, there is a tendency for return on capital investment to decay.

“We expect CoD and GMR [Galaxy’s currently mothballed Cotai resort, sometimes referred to as Galaxy Mega Resort] to deliver lower returns on investment than peers, such as Sands and Venetian, as the market matures and revenue growth slows down. Also, Galaxy and Melco currently deliver lower returns as shown in Exhibit 1.”

Overall though, Morgan Stanley Research justifies its generally bullish view on Macau on the basis of some positive news since the turn of the year.

“We expect Macau gaming revenue to decline by 11% in 1H09 before recovering in 2H09 (+4%YoY),” say the authors.

“This will translate into a 4% decline for 2009, which is better than consensus estimates of double-digit decline, in our view.”

The analysts point to the easing of China’s restrictions on permits issued under the Individual Visit Scheme; positive data from China’s economy and the market bounce associated with the coming opening of a new property, i.e., City of Dreams in June.

“Anecdotally, we have heard that in January the Guangdong government loosened the visa approval process to Macau,” states the report.

Restrictions eased

“It now takes 15-30 days per application versus three months previously. According to a SCMP report, a proposal to make multiple-entry visas available to all Guangdong residents to visit Hong Kong and Macau was raised in the last meeting attended by Chief Executives of SARs.”

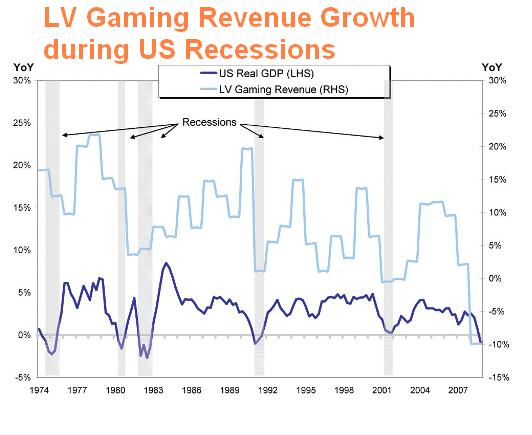

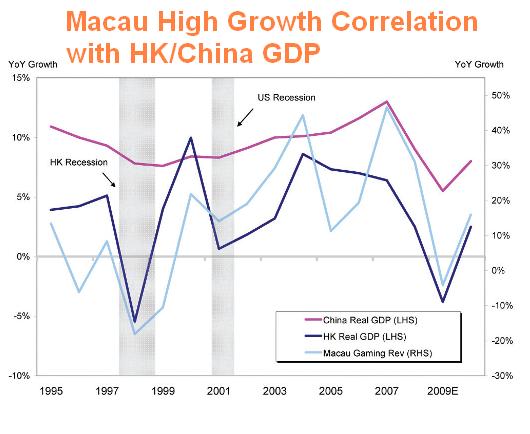

Revenue growth in key gaming markets such as Macau and Las Vegas is closely correlated with GDP growth in the national economy, add the researchers.

“Our Chinese economist Wang Qing expects China GDP to recover in 2H09 on simulative effects from the multi-trillion-RMB fiscal package and expansionary

monetary policy. The fact that Chinese GDP grew 6.1% YoY in 1Q09, above our economist team’s (5%) forecasts, also offers some encouragement on the outlook for the Chinese economy,” says Morgan Stanley.

The analysts say there is evidence in the quarter on quarter growth in revenue and visitors seen in the first quarter of 2009 to support the idea that the Macau market has found the bottom of the market.

DSEC, Macau’s Statistics and Census Service, says Macau’s visitor arrivals totalled 5.45 million people in the first quarter of 2009, down by 9.6% year-on-year, but an improvement on the quarter-on-quarter decline from the final quarter of 2008.

“City of Dreams is on track to open in June with 500 gaming tables. Launch of new casinos generally attracts traffic in Macau. For example, the opening of Venetian supported visitation growth of 29% YoY in September 2007, a month after opening,” points out the report.

“Our Attractive Industry view is underpinned by visible signs of improvement in visitor arrival and gaming revenue, potential margin expansion based on cost-cutting measures, commission caps, and the belief of medium-term fundamentals being intact,” conclude the authors.