This month the Korean government is expected to announce the winners in its request-for-proposal process to build two new integrated resorts. Will there be any?

By Steven Ribet, Managing Editor,

After a roaring start a year ago South Korea’s plan to build two more integrated resorts is foundering and could even fall flat. Nearly three dozen parties expressed interest when invitations were first sent out in February 2015. But by the final deadline last November 30, full proposals actually submitted had dwindled to just six. Korea’s Ministry of Culture, Sports and Tourism (MCST) says the number left in the running is now only two.

The winners are due to be announced this month (February), but analysts are saying the scheme may be scrapped. A Korean academic, meanwhile, reckons the government may be pressured into postponing, or revising down its requirements.

Koreas love affair with integrated resorts has been going on for three years. The country today has 16 licensed foreigner-only casinos operating in tourist hotspots, plus just one open to its own citizens in a remote, run-down inland mining area. Foreigners, predominantly Chinese and Japanese, flock to these gambling halls, which are typically on a scale of around 40 tables. Aside from paying muchneeded taxes many argue they do little for the Korean economy.

A typical integrated resort, by contrast, involves a massive investment of at least a billion US dollars. With leisure facilities galore backed up up by a thousand-plus hotel rooms, it should accommodate over a million visitors each year, employing thousands of locals and boosting tourism nationally.

Tourism from China was burgeoning when Korea gave the go-ahead for its first IR in 2013. It’s a US$1.7 billion joint venture between the largest domestic casino operator Paradise Group and Japanese gaming company Sega Sammy, slated to open next year. Construction on a second started soon after; a tie up between Indonesia’s Lippo conglomerate and Las Vegas’ Caesars Entertainment that should start operations in 2018. It is projected to cost US$1.9 billion. Both are now under construction on Yeongjong island, a free-trade zone in Incheon City some 50 kilometers west of Seoul, that houses the country’s main airport and aims to become a mini-Macau.

National gambling revenue had seen nine straight years of growth when MCST issued the request for concepts for two more IRs in February last year. The surge in visitor numbers to Korea from the main target market China was continuing, shooting up 42% to 6.1 million in 2014 alone.

MCST’s requirements for bidders were relatively strict. An investment of at least 1 trillion won (about US$850 million) was specified, to build more than 1,000 five-star hotel rooms, conference facilities, 20,000 square meters of retail space and amenities for leisure and culture, including a “themed attraction” costing at least US$60 million. Gambling could take up no more than 5% of the resort’s total floor space. As before, the casino would be off-limits to Koreans.

In spite of these demands, by the June 30 deadline 34 parties had submitted a plan. Among them were Macau’s Melco Crown, which proposed to build its IR at the Incheon cruise terminal on the Korean mainland a few kilometers across from Yeongjong, and the Philippines’ Bloomberry Resorts.

Bloomberry’s concept was among the most publicized. The operator of the Solaire Resort and Casino in Manila proposed a project spanning a pair of smaller islands; Muui and Silmi just off Yeongjong’s southwestern corner. Twice-daily tide changes making it possible to walk across the sea channel separating the two would provide a unique attraction. On top of this natural marvel, Bloomberry’s IR would feature an all-weather waterpark, weddings by New York designer Vera Wang and a Tommy Hilfiger/Karl Lagerfeld center to foster new talent in fashion, art and entertainment. Copying Steve Wynn’s Treasure Island show in from 1990s Las Vegas, there would even be an amphitheater staging recreations of historic Korean naval battles.

On top of five locations on Yeongjong island and one at the nearby Incheon cruise terminal, MCST was offering bidders three other sites for development. Jeju Island might have seemed a natural choice. Located off South Korea’s south coast it is already Korea’s number two tourist destination with eight operating licensed casinos; the largest concentration in the country. Yet Korea’s political structure gives Jeju autonomy to grant its own casino licenses, so it was not included in the national IR proposal process. Outside Yeongjong and the Incheon cruise terminal, therefore, the three other locations were Korea’s second largest city Busan, which already has two casinos, and sites at cruise terminals in the southern port cities of Yeosoo and Jinhae.

In the event however, nearly all proposals submitted were for Yeongjiong or the neighboring mainland cruise terminal, with prospects of ocean borne tourists patronizing the others not considered attractive enough. “Seoul is still faraway the top tourism destination for Chinese. The Yeongjong sites are all 10 to 15 minutes away from its gateway airport,” explains Brian Lee, an analyst at brokerage and investment group CLSA. “Korea’s southern coast is not yet attractive to Chinese tourists, and has few other facilities for entertainment or sightseeing.”

Unsurprisingly, then, the proposals of the four frontrunners that emerged during the autumn were all for Yeongjong. These bidders were seen as strong because of a credit rating of BBB or above, good connections within the Korean government and experience with big projects catering to Chinese.

In addition to Bloomberry, one was state-owned Grand Korea Leisure, which now runs two casinos in Seoul and one in Busan under the “Seven Luck” brand. Another was the Chinese property developer Macrolink, which signed an agreement to partner up with the Incheon City Government. The fourth was Chow Tai Fook, a Hong Kong hotel, property and jewelry conglomerate that is building casinos in Australia and Vietnam.

Yet by late November all four had dropped out, together with all but six of the original 34 applicants. And for the November 30 deadline, only two deposited the US$50 million guarantee required by MCST. What happened?

For starters, four of the last six did not have the BBB rating demanded by MCST, and instead submitted investment guarantees by potential partners. Three of them were mid-tier Korean construction companies or resort operators – Ocean View, Booyoung World and Yeosoo Kyungdo – with no track record of big projects. The other was Global Gaming Asset Management (GGAM), a US firm headed by William Weidner, who used to be president and COO of Las Vegas Sands but no longer has the wherewithal of the global gaming giant behind him.

For more qualified candidates, the main reason for pulling out was undoubtedly given by GKL which cited “shrunken demand” from China when announcing its withdrawal. Last year the mainland’s souring economy, together with president Xi Jinping’s crusade against corruption, sent revenues plummeting in Asia’s gaming capital Macau and spread chills across the wider region. “The profitability of new casinos will be low, especially if they have to invest so much in non-gaming attractions,” says Yang Il-woo, an analyst at Samsung Securities.

Last summer’s Shanghai stock market crash heralded the downturn in China. At the same time, the Middle East Respiratory Syndrome (MERS) virus hit Korea causing 186 to fall sick and killing 36. That was one reason visitor arrivals in the country fell by 40% year-on-year, in the months of May, June and July. And on top of MERS, police in China started cracking down on Korean casinos’ marketing operations. In June, officers arrested 13 Paradise and GKL employees who had been organizing golf events in China, along with other marketing activities.

Korean casinos run their own direct marketing activities. That contrasts with other Asian casinos that depend on junket operators for Chinese VIP customers. Junkets have very strong networks in China, which enables them to neatly tiptoe around local laws prohibiting the soliciting of people to go abroad and gamble.

“GKL is state-owned, so the arrest of its marketers in China created a political problem,” says Yang Il-woo.

It’s not hard to see why a Chinese developer like Macrolink would get cold feet about building a Korean casino under such a change of environment. “A major reason for the four cancellations was the burden of regulatory risk from the Chinese government,” says Brian Lee at CLSA.

Among casino operators that never entered the bidding process, Steve Wynn has said he would consider building a casino in Korea should the government allow it to serve locals. Some commentators, indeed, suggest that in demanding huge investment, but only giving license to admit foreigners, MCST is asking too much and offering too little.

“There are alternatives to Korea because in a couple of years Japan may want to open casinos. The return will be better there because Japan will permit its own people to gamble,” says Yang Il-woo. Whatever the truth, Mohegan Sun and Imperial Pacific (MCST confirmed them as the only two entrants left but otherwise declined to comment for this article) still express great enthusiasm for building an IR in Korea.

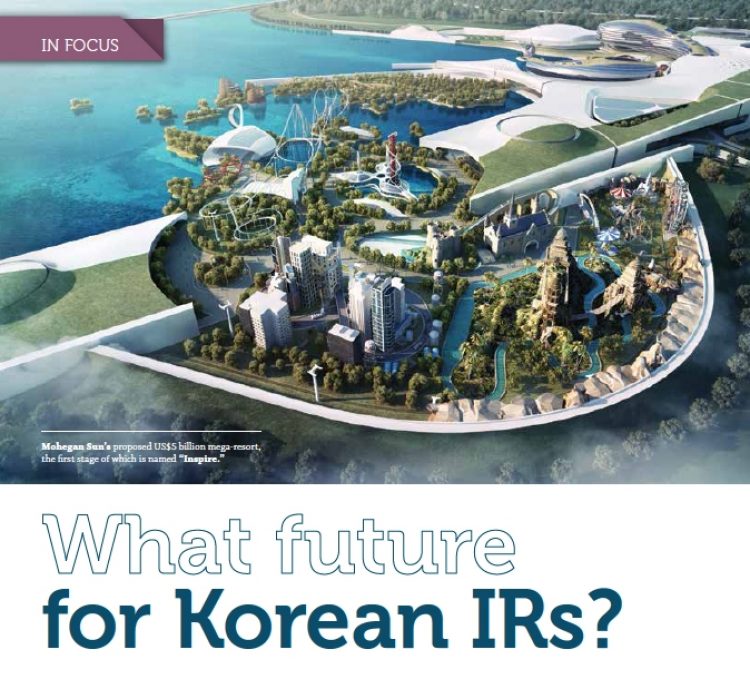

“We think Korea is an incredible market opportunity,” says tribal gaming operator Mohegan Sun’s CEO Bobby Soper. “Not only does Korea itself have 50 million people, but there are 700 million people in northern China within a 2-hour flight of Seoul. Our site is at Incheon airport which serves 45 million passengers annually, forecast to rise to 60 million.”

Mohegan Sun’s targeting of both Koreans and foreigners comes from a plan that aims to raise over half of its revenue from nongaming. A mere 3% of floor area will be devoted to gambling. “We’re taking a lesson from Macau,” says Soper, referring to the collapse of the city’s VIP segment. “Our business model is not high-end, although we do plan to capture some of it. We’re building an amenitydriven property, with a focus on premium mass-market.”

With a projected US$5 billion to build out on 325 hectares over 20 years, the first phase of Mohegan Sun’s project, called “Inspire”, will include 1,200 suites in three luxury hotels, a 15,000 seat arena (billed as “one of the most spectacular entertainment venues in Asia”), 20,000 square meters of luxury retail and a unique “beauty and wellness hub” offering cosmetic surgery. South Korea is a worldleader in this field. So after relaxing in a spa, visitors will be able to get a nose job. Outdoors there will be a state-of-the-art theme park and an eco-park with an aquarium and recreational activities such as climbing and “glamping” (luxury camping in safari-style tents). The casino itself will offer over 200 tables and 1,500 slots. Uniquely, Mohegan Sun has agreed to work with Incheon International Airport to build the first private air terminal in Asia.

Mohegan Sun will take the majority share of a consortium to build all of this, with the Korean construction materials-supplier KCC as its main partner. Another partner ran a junket operation in Macau. Soper declined to detail the “three or four” remaining members of his consortium, although he did say all of them have experience in Asian gaming. To add to this, Soper counts Mohegan Sun’s flagship resort in Connecticut, which serves 35,000 visitors each day, as a qualification, together with the estimated 20,000 jobs he reckons his proposed IR should create in Korea.

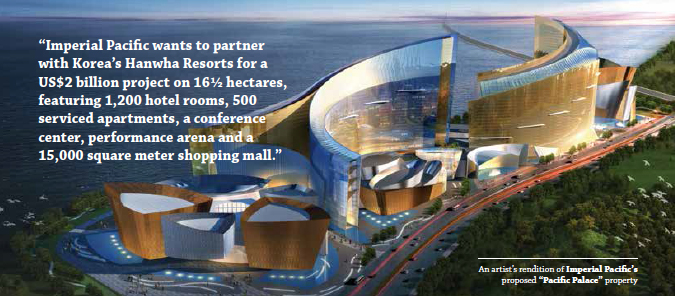

Mass- market may indeed be today’s trend in Asian gambling. But Hong Kong-listed Imperial Pacific, the second party left in the game, is not following fashion. Its unabashedly high-end “Pacific Palace” is proposed for a site next to the Lippo-Caesar’s Entertainment IR now being built in Yeongjong’s Midan City which, targeting mass-market, is not seen as a competitor.

A director of Pacific Palace who declined to be named says the reaction to the downturn in Macau’s VIP segment has been overdone. “It’s just a correction of an unhealthy market; back to business as normal, which is still very good,” he says. “We will not be targeting Koreans or the mass-market. We will concentrate on what is in our hand, and what is in our hand proves we can be really successful providing VIP service to the highest standard in the world.”

Imperial Pacific recently opened a casino on Saipan after obtaining a 40-year gambling monopoly there. The Pacific island is 4½ hours by plane from China. According to the executive, profits from the casinos 50 tables averaged US$195 million in each of its first two months of operation, November and December. That’s more than half the total for all 16 foreigner-only casinos in Korea.

The executive says the super-rich Chinese who patronize Saipan go there for its pure, unpolluted environment. Imperial Pacific sells to them through part-ownership of Macau junket promoter Hengsheng. After Korea, it is looking to develop one or two more IRs around the Pacific, to achieve synergies in marketing to Chinese, Russian and Japanese high rollers. “Our Korean offering will be more urban and modern than Saipan’s sunshine and clear air and water,” the Imperial Pacific executive says. “Local companies don’t have our experience in marketing to Chinese, so it’s a natural fit.”

Imperial Pacific wants to partner with Korea’s Hanwha Resorts for a US$2 billion project on 16½ hectares, featuring 1,200 hotel rooms, 500 serviced apartments, a conference center, performance arena and a 15,000 square meter shopping mall. The project’s indoor theme park will be “not Disneyland, not international” but rather focused on Korea’s strong contemporary pop-culture. “Korea has a lot of famous artists in cinema, television and music, but they’ve never used them to create a theme park,” says the executive. “We have a very strong background in entertainment. We are going to create something that has never been seen in Korea before.”

Will MCST be convinced by all of this? According to analysts, neither Mohegan Sun nor Imperial Pacific have good connections within the Korean government. Mohegan Sun lacks experience in the Asian market. Imperial Pacific does not have a proven track record in managing large resorts.

“I don’t believe any candidate will be selected as a new player in the current bidding process,” says Yang Il-woo at Samsung. “Perhaps the only qualified is Mohegan Sun, but they don’t have any relationship with the Korean government, so the possibility is quite low.”

Brian Lee at CLSA says, “The Korean government was very aggressive to introduce these casino resorts in 2013 and 2014. In those days the overall market was very good and there was no kind of regulatory issue from the Chinese government. But overall conditions have deteriorated. In my view the whole process could be postponed or fall through.”

At Seoul National University, economics professor Pyo Hak-gil made a study of the case for building new IRs in Korea. His initial estimate of demand for more than two has been scaled back to “1.2 or 1.4 after accommodating the China shock.”

“I don’t think the government can cancel the whole plan just because there are only two bidders left,” he says. “Local government is committed to this and killing it would be politically burdensome.”

Says Pyo, “On the other hand, the government wants competition so an uncontested process would be an embarrassment. I think it may invite more local bidders and lower its conditions. These things may turn out to be flexible.”