Competition heats up at deadline as new contenders emerge for gaming licenses despite foreigners-only casino model

Contenders keep lining up to develop integrated resorts even as the foreigners-only casino market shows signs of stress and questions persist about whether the business model makes sense. South Korea’s government has said it will offer two gaming licenses for foreigners-only casinos to developers investing at least 1 trillion won ($891 million) in resort projects. With 420 million people from Asia’s two biggest economies within a three hour flight, including the northern China market that’s closer to South Korea than to Macau, investors are intrigued and their doubts quieted.

South Korea had 6.1 million visitors from China last year, 43% of total arrivals of 14.2 million. Standard Chartered Bank forecasts a 15% compound annual growth rate for Chinese arrivals over the next two years, toward a total of 10 million by 2020. For Chinese, South Korea isn’t just close but aspirational. There’s hallyu the Korean wave of pop culture that has captivated much of Asia, symptomatic of a highly developed consumer society. From cosmetics to cosmetic surgery to mobile computing power, South Korea beats what’s available in China.

Investors are betting that Chinese visitors will keep coming despite recent media warnings about the dangers of gambling in Korea, that Middle Eastern Respiratory Syndrome (MERS) will be a passing phenomenon as SARS proved to be for Hong Kong and Macau, and that visitors will be tempted to gamble more by better properties. Just last month, in the midst of MERS gloom, city officials in Incheon, about 40 minutes from the capital Seoul, announced plans to develop a resort with China’s Macrolink Group, a mining company diversified into sectors from real estate to wine.

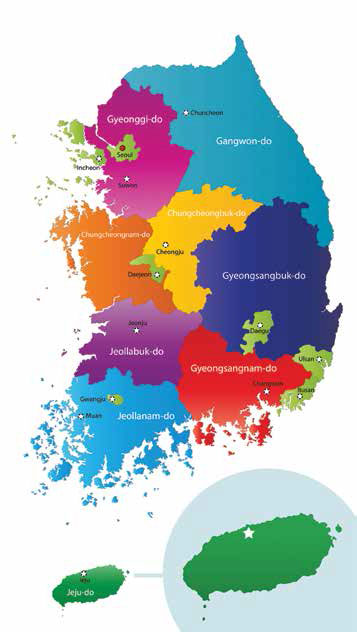

They enter a beehive of gaming interest and activity. South Korea already has 16 foreigners-only casinos, plus the remote Kangwon Land casino where Koreans may play that has greater revenue than all the foreigners-only casinos combined. The offer of two additional licenses reportedly drew nearly three dozen IR proposals for South Korea’s Ministry of Culture, Sports and Tourism to evaluate. Most proposals are for the Incheon Free Economic Zone (IFEZ) on Yeongjong Island, site of the nation’s gateway airport, that has been a magnet for IR interest.

“Incheon is it for Korea,” Solaire Resort Korea Chairman and CEO David Shim says. Incheon International Airport, which handled 45 million passengers last year, is building a second terminal that will make it one of the biggest in the world, and has 100 million people within two hours’ flying time, including residents of Shanghai, Beijing, Tokyo and Osaka. Mr Shim points out that Seoul, Incheon and surroundings put Korea’s best 20 million consumers within an hour’s travel time of the zone, plus there are IFEZ benefits including tax exemptions and infrastructure support. And it looks likely there will be critical mass for Incheon as a gaming destination.

Korea has already licensed two IRs in the IFEZ. Korean operator Paradise broke ground in November on its $1.2 billion IR next to its current casino at the airport’s Grand Hyatt hotel, a 15-minute walk or five minute shuttle bus ride from the terminal. The new project includes Japanese gaming machine manufacturer Sega Sammy and is expected to open in 2017. Caesars Entertainment, partnered with Indonesia’s Lippo Group, won approval last year for an IR in a different section of Yeongjong, expected to be open when South Korea hosts the 2018 Winter Olympics.

GLOBAL INTEREST

Likely bidders for the new licenses are an eclectic mix. Hong Kong’s Chow Tai Fook Enterprises, headed by long-time Macau casino investor Cheng Yu-tung, has proposed a $1.6 billion IR project at Incheon. Bloomberry Resorts, developer of Solaire Resort and Casino in Manila, submitted plans for a $3.4 billion resort ($1.4 billion first phase) on Muui and Silmi islands, part of the IFEZ that will be connected to Yeongjong via bridge by 2018. Mohegan Tribal Gaming Authority (MGTA), which operates integrated resorts in the northeastern US under the Mohegan Sun brand, announced details late last month of a partnership with the Incheon International Airport Corporation to build an IR that could cost up to $5 billion adjacent to the airport’s second phase that would include a private air terminal.

Korea’s second largest foreigners-only operator, Grand Korea Leisure (GKL), partially owned by the government’s Korea Tourism Organization, expressed interest in an IR license but announced nothing further. A source in Korea says Macau’s Galaxy Entertainment Group and Melco International, the Lawrence Ho-controlled vehicle that’s a partner in Melco Crown, investigated projects, while other Macau operators were “sniffing around.” Korean language media reportedly named Galaxy and Cambodia’s NagaCorp among 34 license applicants meeting the 30th June deadline, but the companies haven’t confirmed whether that’s the case.

For casino developers, South Korea might be a winning play or a bad bet. Last year, revenue at the country’s 16 foreigners-only casinos increased a mere 0.3% to KRW1.36 billion, while revenue at Kangwon Land jumped 10%. For the first quarter of this year, Grand Korea Leisure (GKL) reported overall revenue rose 7% but profits fell due to a sharp rise in “non-operating expenses,” which appear to be promotional costs. Paradise reported its first quarter gaming revenue fell 11.6% year on year, with table drop down 22.7%. The slowdown in growth appears tied to China’s sluggish economy, President Xi Jinping’s anti-corruption crackdown and negative Chinese media reports about Korean casinos, particularly on Jeju Island, where some of the eight casinos are accused of having operated dishonest games.

Fitch Ratings warned last month that new foreigners-only IRs in Korea may struggle to produce double-digit returns due to growing competition regionally, citing the impending opening of new casino resorts in Vladivostok, Russia, the huge investment in Macau, and the estimated $5 billion in new IRs within Korea.

Paradise acknowledges that more Incheon casino resorts, particularly another one at the airport, could help or hurt its IR project. “We may face competition with global players,” Paradise Investor Relations Manager Hyejeong Shim says. “However new supply will bring attention and create new demand from North Asia, especially northeastern China.”

The new Paradise-Sega Sammy IR, replacing the Paradise casino at Grand Hyatt, will showcase Korean culture. “The complex will take advantage of Korea’s advanced technologies and hallyu and will have a theme park using 3D hologram technology, a hallyu star museum, Korean restaurants and art galleries,” Paradise revealed at the groundbreaking. “Visitotrs will be able to experience a Korean public bathhouse, or jjimjilban, at the premium healing spa.”

TOO SMALL?

The question remains whether that kind of resort, at that construction price point, will be enough to attract more players from northern China and beyond. “When one really thinks about it, we already have the small foreigners-only IRs that the ministry is proposing—for example Seven Luck COEX [at the convention center in Seoul’s fashionable Gangnam district]. But do tourists visit Korea to specifically experience the COEX facility?” KORE Policy & Management Consulting General Manager Tim Lee asks. “The same question would yield a different answer for Singapore’s Marina Bay Sands or the City Center at Las Vegas.”

KORE believes South Korea needs multi-billion dollar major league IRs to compete with Macau, Manila and what it sees as the likely legalization of casino gaming in Japan. In order to get that level of investment, the government would need what KORE calls an open casino policy that enables South Korea’s nearly 50 million citizens to play at all casinos on some basis.

“Regardless of the number of IRs, the more important matter is how the government will handle the open casino issue, which will decide on the diversity of interests and involvements by major casino operators and investors from outside Asia,” Mr Lee says. Steve Wynn, for example, has said he’d build a resort in South Korea, but only if locals can play. Mr Lee adds, “We are confident that Korea will become more competitive in the international market should it choose to adopt the Singapore model with restricted local play,” likely combining an entry tax with restrictions on frequency of visits.

A less radical change would be easing visa access for Chinese visitors. Jeju Island, a self-governing province off the republic’s southern coast, allows Chinese nationals 30 day visa-free access, but mainland South Korea requires Chinese to have visas for all but short transit visits. The MERS outbreak has led to South Korea waiving visa fees for Chinese tour groups, allowing groups bound for Japan 15 day visa-free stays in South Korea and extending visa validity from three months to six months. That could set the stage for more changes.

Prior to MERS, there was talk of a more liberal visa policy for Chinese nationals, such as 72 hour visa-free access or a visa waiver similar to Jeju’s. Caesars Entertainment President for International Development Steve Tight says he expects South Korea “will address the necessary regulations that are critical to the success in attracting key foreign gaming clients to Korea to support their objective of a thriving integrated resort industry.”

NUMBERS GAME

Mr Tight also expressed “full confidence that the Korean government will be thoughtful in its expansion of the foreigners-only IR industry in Korea.” In other words, that the authorities will issue an appropriate number of gaming licenses for the market, enough to produce critical mass for the destination but not so many that would challenge profitability.

Strategic Market Advisors Managing Director Matthew Landry believes four IRs can prosper in Incheon. “Before the current challenges in gaming revenue originating in China, I had estimated that the northeast China market could grow by ten-fold between 2014 and 2020. A dramatic cut, say half, still leaves billions in unmet demand. Analysts need to remember that China’s economy continues to grow at a substantial rate, and that can be enhanced easily through the exchange rate. As the [mainland China] economy gains more secure footing, consumer confidence will rise, and the timing should be positive for Incheon’s new facilities.”

Some observers have expressed concern about whether the new IRs will function as a cluster such as downtown Macau, Cotai or Manila’s Entertainment City. Except for the potential of two IRs around the airport, even proposed IRs elsewhere on Yeongjong will be double-digit minutes’ driving from each other and from the airport. For example, the Caesars IR will be 10-15 minutes northeast of the airport and the proposed Bloomberry site is roughly the same distance to the southwest.

“All clusters are not created equal,” Macomber International President Dean Macomber says. “Stepping out of one casino and being able to walk into another next door or across the street without getting soaked from humidity and/or a rainy season storm is synergistic. Casinos set apart by ‘I’m-not-sure-I-want-to-walk’ distances for physical, weather, safety, or other reasons diminish the potential of a cluster exponentially by the sum of their incremental impact.” Yeongjong will need an effective shuttle system (and lots of VIP cars) to make its critical mass felt on the ground.

Mr Macomber, with four decades of experience in US and Asia markets, believes IRs in the $1-2 billion class can create an attractive destination. “The product casinos sell and customers come to buy are compelling experiences, apparently more difficult and elusive to conceptualize and consistently deliver than might be expected,” he says. “While money helps, compelling experiences are not always a function of dollars alone, particularly after the US$1 billion threshold is crossed. And, given the uncertainties facing Asian gaming these days, the gaziillion dollar projects being bandied about may backslide into a more rational range that narrows the eventual competitive level.”

He also suggests the “unsettlement” across Asia, caused largely by lower Chinese high-roller overseas play, presents an opportunity for new destinations. “A consequence of this unsettlement is that a not immaterial portion of the capitalization of Macau companies and the net worth of their billionaire owners has taken to the sidelines with many of those remaining caught in the headlights not quite knowing what to do. Accordingly, governments, free economic zones, and potential joint venture partners would be well advised, if they want to get a project capitalized and started in the next six to twelve months, to take whomever comes along, imperfections and all,” Mr Macomber says. “Note that there will be winners: Asia is still undersupplied casino-wise and over some mid-term moving average increment— for example three to five years—should still outperform just about anywhere else in the world, barring unforeseen events.”

Editor at large Muhammad Cohen also blogs for Forbes on gaming throughout Asia and wrote Hong Kong On Air, a novel set during the 1997 handover about TV news, love, betrayal, high finance and cheap lingerie.