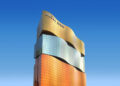

Macau’s VIP slump resulted in a 1% decline in second-quarter revenue for MGM China Holdings to US$828 million.

VIP revenue fell 18% year on year at the company’s sole casino, which was worse than the 5.8% drop market-wide during the period. The company (HKSE: 2282) blamed it on a 10% decline in turnover from the sector and said luck also played a part, with hold percentage of 2.7% down from Q2 2013’s 2.9%

The mass market was strong, however, beating the city as a whole at +41% in main floor table revenue, a performance driven by a 35.3% gain in main-floor baccarat and resulting in a 3% increase in EBITDA year on year to $210 million.

The company also announced a dividend of US$136 million payable on 1st September, $69 million of which is headed to parent MGM Resorts International, whose US business is picking up noticeably on the strength of a post-recession recovery in Las Vegas tourism.

MGM’s 10 resorts on the Las Vegas Strip reversed a Q2 2013 loss to post a profit of $105.5 million, or 21 cents a share, for the three months ended 30th June, beating the estimate of analysts polled by Thomson Reuters by 11 cents. A year ago, the company lost $92.9 million, or 19 cents a share.

Net revenue company-wide was up 4% to $2.6 billion on the strength of a 7.7% jump in Strip revenues to $1.34 billion. At CityCenter, which the company manages and holds 50% ownership, net revenue from resort operations increased 9% to $304 million. Revenue per available room, a key metric of hotel profitability, was up 6% across the company’s Strip portfolio.

“Las Vegas continues to trend in the right direction,” Credit Suisse gaming analyst Joel Simkins said. “With a fresh asset base and a number of key amenities MGM remains positioned to capitalize on increased demand in 2014.”

Redevelopment of TheHotel at Mandalay Bay into the Delano Las Vegas is expected to be completed in October, the company said, and plans are in the works to renovate the rest of Mandalay’s rooms and add 300,000 square feet of convention space to the property.

“It’s a good time to be the largest land owner on the Strip,” said Chairman and CEO James Murren.