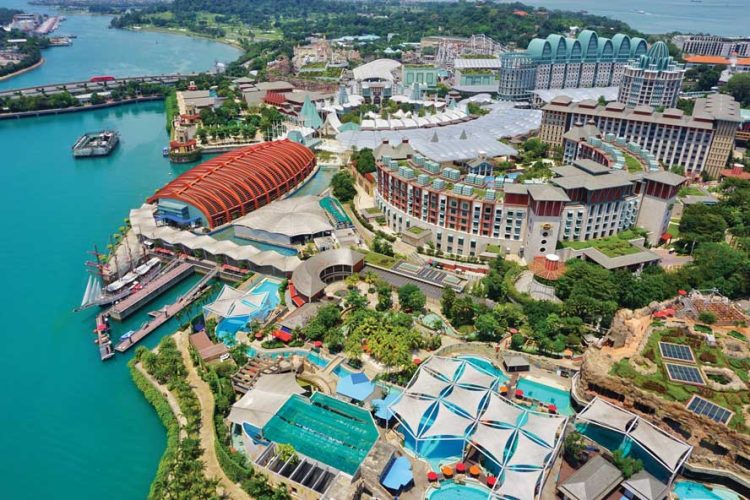

Genting Singapore reported total revenue of SG$612 million (US$459 million) for the three months to 31 December 2024, representing a 9% sequential increase thanks to strength in gaming at its Singapore IR, Resorts World Sentosa.

According to information released overnight, the Q4 result included gaming revenues of SG$416 million (US$312 million) – down 6% year-on-year but 26% higher compared with the September 2024 quarter. Although gaming volumes were down across the board, Genting benefited from a high 3.50% win rate in VIP.

Non-gaming revenues fell by 10% year-on-year and 17% quarter-on-quarter to SG$192 million (US$144 million).

Adjusted EBITDA of SG$225 million (US$169 million) was down 1% year-on-year but up 37%, with the company citing seasonality, the impact of a strong Singapore dollar and elevated travel costs.

The 4Q24 results brought total revenues at RWS for 2024 to SG$2.53 billion (US$1.88 billion) – up 5% on 2023 – with gaming up 3% to SG$1.70 billion (US$1.28 billion) and non-gaming up 6% to SG$817 million (US$613 million). Adjusted EBITDA of SG$960 million (US$720 million) was down 6% year-on-year however.

A final dividend of 2.0 cents per share has been declared.

While the company’s 4Q24 results were largely in line with consensus, Genting Singapore said in its results announcement that it is in the midst of “transformative progress” that it expects to hold it in good stead, with preparations for RWS 2.0 now well advanced as well as key technological innovations across the resort.

We [are] integrating marketing efforts, automating and streamlining processes to enhance productivity,” the company said. “Together with these efforts, a significant investment will be made for a technological refresh that will embrace the use of artificial intelligence (AI) to improve efficiency and create personalised experiences.

“These projects will stretch into 2025/26. With the deployment of these technological advancements, earnings will exhibit good incremental results from the full launch of RWS 1.5 in the third quarter of 2025 onwards.

“We remain agile, staying ahead of tourism trends by enhancing our existing offerings with innovative events and experiences. These efforts support the resilience of our business.”

On the company’s RWS 2.0 development, and earlier upgrades that have been referred to as RWS 1.5, Nomura analysts noted that the new Minion Land theme zone at Universal Studios opened on 14 February 2025 with management pointing to strong early visitation. An early 3Q25 opening of the new all-suite hotel and the Singapore Oceanarium has been confirmed, although this reveals a three-month delay in the opening timeline of the hotel versus earlier guidance.

“The Oceanarium will be closed for 2.5 months for refurbishment in 1H25 before it opens in July 25,” said Nomura’s Tushar Mohata and Alpa Aggarwal in a note.

“For the retail space, Genting Singapore received the temporary occupation permit a month back and tenants are now allowed inside for renovating the space. Management expects some shops to open in Apr-May 2025, but the majority of the shops will open in July 25 and will reach 70-80% occupancy.

“The [RWS 2.0] waterfront development’s groundbreaking was held in November 2024 and is expected to be completed by 2030.”