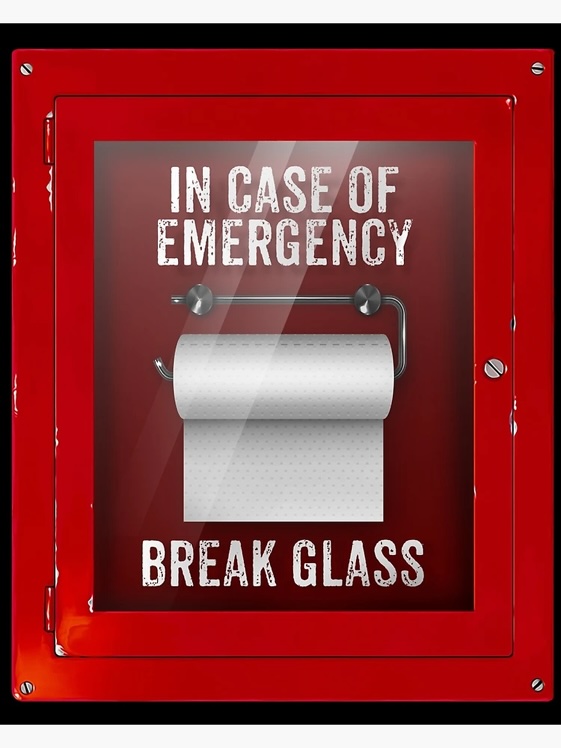

The situation with Star Entertainment is now well and truly beyond a joke. It’s time for emergency action. Under Australian corporate law, any shareholder (or group thereof) with 5% or more voting rights can call an extraordinary general meeting, and that’s exactly what needs to now happen. And the agenda for this meeting? One item: fire the entire board.

In an ASX filing yesterday, Star announced that its last-ditch AU$940 million (US$595 million) refinancing proposal from Salter Brothers Capital had collapsed. No surprise there – the deal had too many conditions precedent that Star wasn’t in a position to deliver. To use a great Australian expression: Blind Freddy could see it wouldn’t work.

In an ASX filing yesterday, Star announced that its last-ditch AU$940 million (US$595 million) refinancing proposal from Salter Brothers Capital had collapsed. No surprise there – the deal had too many conditions precedent that Star wasn’t in a position to deliver. To use a great Australian expression: Blind Freddy could see it wouldn’t work.

Let’s back up a bit and in plain language examine precisely where this company is at.

It seems almost an aside that this is a casino company with, in a sense, no casino licenses! As a result of the Bell report, Star was found unsuitable to hold a casino license way back in October 2022, and then found unsuitable again in August 2024, with the NSW Independent Casino Commission (NICC) appointing Nicholas Weeks as Special Manager (I call him a “special babysitter”) until Star can somehow navigate their way back to suitability, if they can do that at all. Mere days ago NICC confirmed Star’s Sydney casino license will remain suspended for at least another six months, to 30 September 2025 – assuming it survives that long. It gets to continue to trade only under babysitter Weeks.

No offence to Weeks, my “babysitter” expression has nothing to do with the person doing the babysitting and instead is a reflection of the company being babysat.

It’s a similar disaster in Queensland, where Star was found unsuitable to hold a license for its Gold Coast property, also in October 2022. It’s never returned to suitability, and the Queensland government was set to suspend Star’s license for 90 days from 31 March until an 11th hour reprieve with a mere four days to go, with the Queensland government allowing Star to continue to trade through to 30 September 2025 – again, if it survives that long, and again, under the watchful babysitting of Nicholas Weeks.

Let’s move on to Star’s corporate situation, which is no less bleak.

Trading in Star shares has been suspended for more than a month as the company is “unable to lodge its financial accounts” for the six months ended 31 December 2024. The ASX due date for lodging these accounts was 28 February 2025, resulting in a trading halt from 1 March onwards. Star shares remain frozen, for more than a month now, at a pitiful AU$0.11, less than 2% of its all-time high price on 4 February 2018 of AU$5.73.

An ASX filing by Star yesterday said, “The Company continues to be unable to lodge its half year financial report for the period ended 31 December 2024 in the absence of an appropriate refinancing solution …” and bluntly continued, “… there remains material uncertainty as to the Group’s ability to continue as a going concern.”

In plain language: there’s a decent chance we’re going broke here. Busto. Bankrupt. Tapped out. Down to the felt.

Rumor has it that Star is, yet again, down to its last few million dollars in the bank – and for a company said to be burning through over AU$1 million a day – that’s simply running on fumes. It seems Star could be mere days away from total collapse.

Remember that 1980s film, The NeverEnding Story? Star seems to have invented its own version! To the outside observer, it seems that every time Star is about to go broke, it pulls a rabbit out of a hat to just hang on that little bit longer. Just another day, just another week, just another month.

You want examples? Ok, here’s a few. How about selling off parts of the farm to try to keep the rest of the farm, like the Brisbane Treasury building and the Sydney Lyric Theatre, described by some as “fire sales”. Or convincing Chow Tai Fook and Far East Consortium to cough up AU$35 million (US$22 million) at short notice, enough to keep things going for another month.

The cynical amongst us might think CEO Steve McCann’s extraordinarily healthy pay packet – AU$10 million (US$6.3 million) according to the company’s 2024 financial accounts – has something to do with this “just another month” strategy, but maybe not. Who knows what Star management is thinking? I’ve given up trying to work out what drives their decisions. Oh, and while we’re on the subject of pay packets, Chairman Anne Ward is on over AU$600,000 a year in director’s fees according to those 2024 accounts, and that’s for a part-time job with seemingly no accountability! Nice work if you can get it!

Honestly, this is no way to run a company. Mum and Dad shareholders – actually all shareholders, deserve way better from this board. Trump may have created the Space Force in the US, but in Australia we have the “Star Farce”, which continues to roll out month after month after month under this board.

And the market has spoken. When your shares, that used to trade north of $5 apiece, have been frozen for over a month languishing at 11 cents, something is very, very wrong.

Here’s another gem from Star in yesterday’s filing, “The Company continues to explore liquidity solutions that might materially increase the Group’s liquidity position in the medium term, including engaging with Bally’s Corporation in relation to the proposal received on 10 March 2025.”

Oh, so now you start talking to Bally’s, after sitting on their proposal for 23 days, because you liked the Salter Brothers deal better. Apparently this is a company that can’t walk and chew gum simultaneously.

Here’s a straight-forward question: How is a company, that generated well north of AU$1 billion in gross revenue in 2022 and 2023, burning through some AU$8 million a week, according to those in the know.

The economics and margins of large-scale integrated resorts with casinos are quite well known. Sure, Australian wages are higher than the global norm, but any IR worth its salt should have a bottom-line profit margin of at least 20% of revenue. Some of them get that number to 30%, in rare cases I’ve seen 40%, and in one extreme case, Marina Bay Sands in Singapore, Adjusted EBITDA can top 50% in very profitable years.

You have to be pretty bad at business to lose money running a casino – especially one with a near monopoly in a city of some 5.5 million people!

And why on earth is everyone sitting around waiting for the perpetually incommunicado CEO Steve McCann or the equally silent Chairman Anne Ward to say something or make a decision? The truth is they are really quite powerless in this situation, and it is time for the shareholders to step in and Do Something.

Why are the shareholders of Star Entertainment sitting back and accepting this farcical situation?

In my view, the time has come for someone – anyone – to call an Extraordinary General Meeting of the company and demand the heads of the board. They are the ones that have been at the helm during this obliteration of shareholder value, and they have to pay the price. In all honesty, if all that happens to them is being fired, it is probably a cheap price to pay, and they should be thankful.

The next obvious question is then, who on earth would want to take their place? Well, there are answers to that question, but this article is already long enough so I’ll expand upon that issue next week. But whatever the next steps are, plain old-fashioned good governance dictates that this board simply has to go.