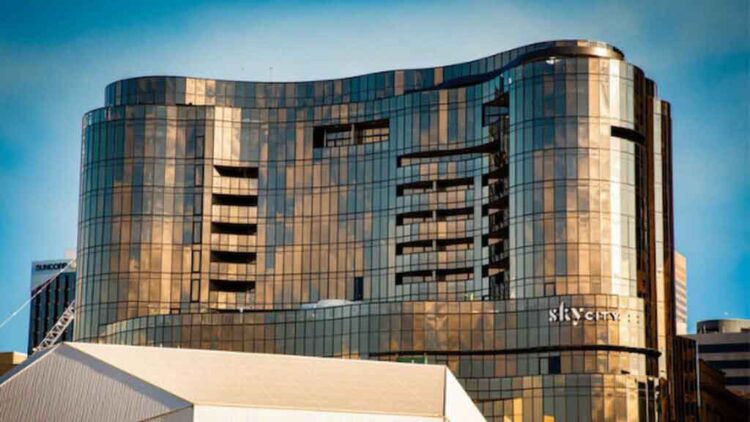

SkyCity Entertainment Group revealed early Monday that it expects to impair its Australian integrated resort assets at SkyCity Adelaide to the tune of AU$86.2 million (US$57.5 million), reflecting assumptions related to the introduction of mandatory carded play at the SkyCity Adelaide casino in 2026, as well as additional legal and compliance costs associated with SkyCity Adelaide’s uplift programs.

The company also expects to record a tax adjustment of NZ$129.6 million (US$78.4 million) following recent changes to New Zealand tax legislation that no longer allow owners to depreciate commercial buildings with an estimated useful life of 50 years or more for tax purposes.

Both the impairment and tax adjustment are non-cash, SkyCity said, and do not impact the group’s underlying EBITDA or net profit after tax for the financial year ended 30 June 2024.

Despite the impairment, SkyCity said it remains committed to implementing mandatory carded play across its casinos as this will significantly increase its visibility and control of customer play, and simplify many parts of its current AML/CTF and host responsibility operations.

The company, which recently reached an AU$67 million (US$40.5 million) settlement agreement with AUSTRAC related to breaches of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, added that the primary objective over the coming years is to ensure SkyCity has strongly performing risk management systems, a culture which prioritises compliance with SkyCity’s obligations and customer care, and a business which is seen as a good corporate citizen, worthy of retaining its casino licences.

“The impairment is a non-cash accounting adjustment at balance date. SkyCity Adelaide continues to be a strategically important asset within the wider SkyCity Group,” said SkyCity CEO Jason Walbridge.

The adjustment related to a change in New Zealand’s tax legislation results in an increase in the SkyCity Group’s deferred taxation liability of NZ$129.6 million and a corresponding one-off charge to tax expense of NZ$129.6 million because the tax base, from a depreciation perspective,of its New Zealand buildings is effectively reduced to nil, SkyCity explained.

In more positive news, the company revealed via a separate filing Monday that it has finalized agreements to extend NZ$465 million (US$281 million) of debt facilities across three, four and seven-year maturities, utilizing a combination of its United States Private Placement (USPP) program and its syndicated revolving credit facility.

The transactions will ensure SkyCity has no debt maturing before May 2027, followed by a “balanced distribution” of debt maturities between FY27 and FY31.

“We are very pleased to have finalized these key funding extensions and would like to thank both our bank syndicate and USPP lenders for their ongoing support,” said Walbridge. “With this important refinancing in place, we can continue to focus on our business transformation programs and opportunities in front of us.”