Ratings agency Fitch has cut its revenue expectations for Genting Malaysia – operator of Malaysia’s Resorts World Genting plus casinos in New York and Europe – by around 5% on average for 2023 and 2024, citing its slower than expected recovery through the first half of the year.

Nevertheless, in a note Fitch Ratings said it has maintained Genting Malaysia’s Long-Term Issuer Default Rating (IDR) at “BBB” with a stable outlook and affirmed a “BBB” rating on the company’s US$1 billion unsecured notes due 2031 on strong domestic outlook and the support of its more diversified parent, Genting Berhad.

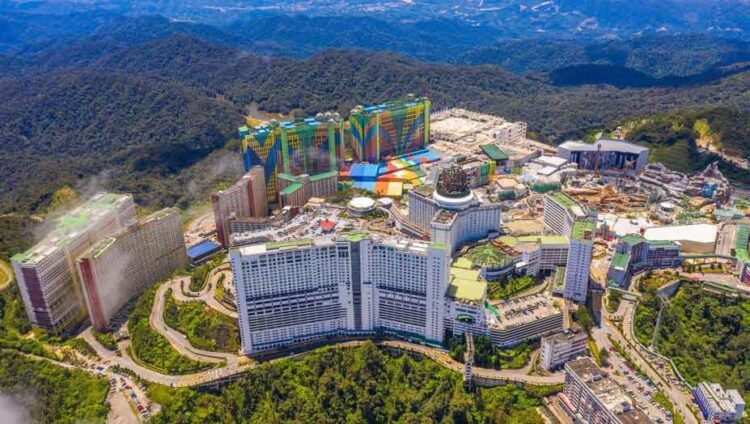

Describing Genting Malaysia’s IDR as being “equalized” by its 49% stronger parent, the agency wrote, “Revenue in 2022 and 1H23 in Malaysia (Resorts World Genting), which contributes over 60% of Genting Malaysia’s consolidated figure, was lower than our expectations, affected by factors such as heavy rainfall at the turn of 2023 and a landslide in late 2022, hindering access to the resort.

“As a result, we have cut our revenue expectations to around 90% to 95% of the 2019 level in 2023 and 2024, from around 95% to 100%. Revenue growth should be driven by a steady increase in domestic traffic and higher international tourists, supported by the likely repair of the access road by 1H24.”

While Fitch maintained Genting Malaysia’s ratings, it has placed the “BBB-” IDR of the company’s wholly owned subsidiary, Genting New York LLC, and the “BBB-” rating on its US$525 million senior unsecured notes due 2026 on Rating Watch Negative (RWN).

This, the agency explained, incorporates the risk that it may not win a full-scale casino licence in downstate New York, for which the bidding process is underway.

“In that case, we think Genting New York’s strategic importance to the Genting group and incentives for Genting Berhad to provide support are likely to be weaker, which could lead to Genting New York’s IDR being downgraded by more than one notch,” it said.

Should Genting win a full New York license to add table games at Genting New York’s slots-only Resorts World New York City, the expected impact would be “access to a deep market, boosting Genting Malaysia’s geographic diversification and potentially lower tax on Genting New York’s gross gaming revenue from around 65% currently,” Fitch explained.

Further, Genting Malaysia’s rating is equalised with Genting’s IDR due to “High” strategic and operational incentives for support. We expect Genting Malaysia to continue contributing over 30% of Genting’s proportionately consolidated EBITDAR. Genting Malaysia’s subsidiary Genting New York is also well-placed to win a licence in New York City, which should drive significant growth for the group. The operational incentives are underpinned by the common Resorts World brand, a high degree of management overlap and the Resort Management Agreement with a Genting subsidiary for Genting Malaysia’s operations in Malaysia for a fee.”