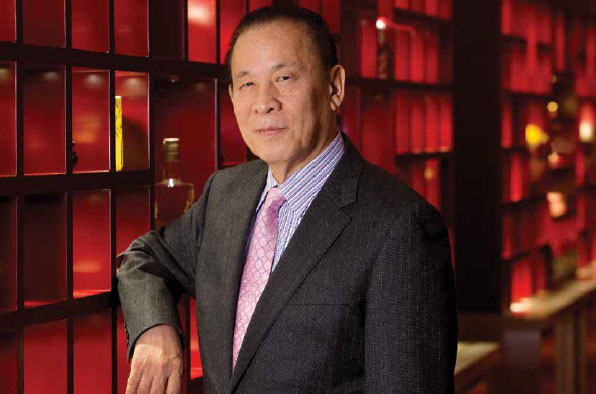

Kazuo Okada says he’s been “vindicated” of the accusations that led to his ouster as vice chairman at Wynn Resorts, so he should have succeeded Steve Wynn as chairman – and he still might.

Kazuo Okada says he’s been “vindicated” of the accusations that led to his ouster as vice chairman at Wynn Resorts, so he should have succeeded Steve Wynn as chairman – and he still might.

Kazuo Okada and Steve Wynn jointly created Wynn Resorts. In February 2012, Wynn Resorts directors removed Okada as vice chairman and redeemed Universal Entertainment’s 20% stake at a US$900 million discount, payable over 10 years, accusing Okada of granting improper hospitality to Philippine government officials.

Okada’s ouster initiated a legal battle that ended with a settlement in March this year. With their founders sidelined under different yet equally extraordinary circumstances, the companies settled with Universal receiving US$2.6 billion for its shares. Wynn also dropped its lawsuit against Okada, alleging misconduct as a director. Okada says that if he still ran Universal he would have wanted the shares back, making Universal Wynn’s largest shareholder again.

In this second installment of excerpts from his three-hour-plus interview with Inside Asian Gaming Editor at Large Muhammad Cohen, Okada recounts his history with Steve Wynn, who called Okada his best friend then removed him from their company.

Muhammad Cohen: Tell me about your relationship with Steve Wynn.

Kazuo Okada: The beginning was in 1998 when Universal went public. I realized that the pachinko business was not the only way to go, so in the long run you had to do something besides pachinko. I read in a book somewhere that it’s best to look for new opportunities during the best of times.

At that time, I had really wanted to get into the casino industry. So, I bet my future on the casino industry.

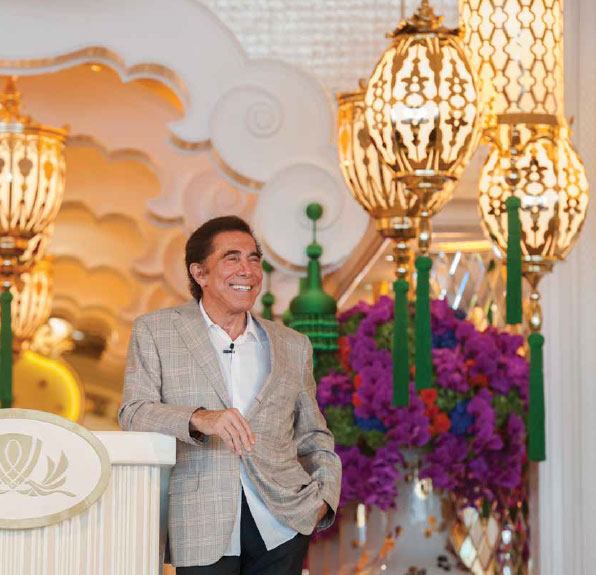

Back in 2000, I looked into Las Vegas and was introduced to Steve Wynn. At that time, he was working with the Mirage, including other casinos there. But around 2001, he had just lost his battle with MGM [for control of Mirage]. He was in a very unfortunate position.

The discussions between us went relatively well. He was in need of monetary support to move forward in the industry. At the time, Mr Wynn had just bought a property in Las Vegas that Howard Hughes used to own (the Desert Inn).

The initial discussions that took place with Mr Wynn was with the understanding that we would go 50-50 – 50% on the funds and 50% on the number of directors. The discussions were relatively simple and I welcomed that. I wanted to keep the story very simple.

The initial decision was to let Steve Wynn become chairman of the board and I would remain as vice chair. Wynn had the know-how of the design and the operation of the casino and the construction in that field. He did those matters with pride, experience and confidence.

At the beginning, things were working very well. I think he appreciated the fact that I was a relatively silent investor, not complaining very much, not putting too much input into things.

Things were very good for a fairly long time. Then [in late 2010/early 2011], Mr Wynn brought up to the board that he wanted to make a US$130 million donation to the [government-affiliated] University of Macau.

I raised some issues with that because, first, it was really unheard of to make that amount of donation. The university donation was his personal desire – I thought that it should come individually and not through the company. Also, I mentioned that perhaps US$10 million – which is still a relatively high amount – would be a sufficient amount to a university to receive significant recognition and appreciation.

At that time, Macau was a very successful market, one of the most affluent places on the globe – so why this particular university at this time? Part of me was asking, “Why are you really doing this? Why won’t you open up to what your intentions really are?”

When he didn’t truly give me a full answer, that’s when I started thinking that maybe he’s not truly open to me on everything. Not necessarily that he’s hiding something, but maybe he’s not at the same level of trust with me.

Prior to that, I had talked several times to Mr Wynn about truly making the 50-50 amount for the directors. I wanted more directors in my camp that would bring up my opinions and my thoughts – perhaps some more directors that understood Japanese. I had approached several Japanese attorneys who might fit the bill of becoming a board member and had raised this with Steve Wynn. But Steve Wynn asked us to wait, hold off a little longer.

But in 2011, with his divorce taking place, his wife was going to take 50% of his shares. Initially it was 50-50 shares between him and me, but with his wife about to take half of Steve Wynn’s 50%, I would then become the controlling shareholder.

MC: Did you ever think about taking over Wynn Resorts?

KO: I hadn’t really had ambitions of doing so. Going back in time, back to 2008, I had already bought some property in the Philippines and then I was thinking about moving forward and developing something on that in 2010.

I had explained to Steve Wynn that I had bought that property in the Philippines and that it was allowable to put up a casino on that property. Looking at the Philippines at that time, they were going through an economic growth of about 7% and it was ripe for development.

MC: Did you ask Mr Wynn to become a partner in that?

KO: Yes, I brought that up with Steve Wynn. I took Steve Wynn to the Philippines in June 2010 to show him.

At the time, PAGCOR, the government authority in charge of licensing, was in place and we went to visit [Efraim] Genuino, then chairman of PAGCOR.

Steve Wynn – when we went there – he looked at the property and he engaged for a decent amount of time in discussions with the chairman. He also discussed about trying to come back to investigate in November 2010.

MC: Where did things go wrong in the Philippines with Wynn?

KO: He didn’t go back to the Philippines [with me] in November. I went back to the board and I was perplexed because not only did he not go back, but he had said that there was no way he can develop something there.

Not only was his sudden change of attitude perplexing, but he also started mentioning that there must be something fishy going on in the Philippines. I believe he said there must be something like bribery taking place in the Philippines. I believe he may have even mentioned in rude terms that he would never go to a place that might have possible corruption, such as the Philippines. That was about the same time he was discussing the donation to the University of Macau.

I think the situation was also compounded by the fact that, up until then, I was the silent investor – I didn’t really raise any issues, didn’t raise any challenges – but now I raised a question regarding his thoughts about making the donation to University of Macau. I suspect it also compounded with the timing that he was about to split with his wife and then when I started asking for the increase in the number of directors in my camp.

Steve Wynn had asked me for specific authorization and acknowledgment for passing of half of his shares to his wife, would I have any issues with that? I had no issue, so I acknowledged that it was okay.

The timing was about 2011/2012 and in February 2012, Wynn Resorts started its lawsuit against me. The lawsuit was based on a report that was commissioned and conducted by Louis Freeh, an ex-FBI Director, and it included some reports about some ex-Universal employees who reportedly made possible payments to a PACGOR official.

In connection with that, [Steve Wynn] had mentioned that Mr Freeh will be doing an investigation, would I mind cooperating with it? I said I don’t mind, if something comes up, please let me know.

Mr Freeh came [to Manila] to ask questions and to investigate – that was February 2012. Freeh had brought up the issue about these entertainment fees. I told him that it was really not to my knowledge, that as chairman of a publicly traded company that has over 1,000 employees – the company has its own rules and those rules do not require a chairman of a company to authorize and acknowledge how much a sales department employee uses for travel, expenses or entertainment. So, it was not within my knowledge to be able to answer and really to provide any information concerning that.

Freeh explained to me that this employee, [Masato] Araki, had used money for entertainment fees, it was an excessive amount and that it would be a compliance violation.

Prior to Freeh mentioning this about Araki, another Universal employee by the name of Tokuda [Hajime Tokuda, Universal’s president at the time] had asked me whether we can terminate this Araki for excessive usage of funds. My answer was, as a chairman, that’s not really my place to determine who gets fired from a company. But if this person had in fact done what’s been said, then there’s probably no choice but to fire him.

This termination had taken place before Freeh had visited me in the Philippines. So, Freeh comes by and mentions Araki and the use of funds and I said, “Wait this is already a done matter. We know about Araki and he has already been terminated.”

When Freeh mentioned that in three years, they had used maybe about US$100,000 [the report alleges US$110,000], basically, my reaction was, “Wait, wait, wait … so over three years, it’s US$100,000? It’s about US$30,000 a year. Is this really a problem?”

Freeh, by the time he made his report to the board, the directors already knew the content. So I believe the board had already made its mind up to kick me out.

My suspicion is [Steve Wynn] may have thought that with his impending divorce and losing half of his shares, the fact that I would have more shares and more control than he would, plus the timing of when I was asking for more directors, he may have feared that I was literally trying to take over his company.

MC: But you never wanted to?

MC: But you never wanted to?

KO: Absolutely not. Even when I initially started asking him to get involved, I had thought that if the Philippines project was successful, having 50% of Wynn Resorts alongside that success was enough. Wynn Resorts would profit from an expanded operation in the Philippines and so Wynn Resorts would be a bigger and stronger company. Having a 50% share of a bigger and stronger company would be enough for me.

I had no initial plans of wanting to take over, but Steve Wynn – basically fearing that he was going to lose control – did anything within his power, including using the Freeh report, to basically slander and rub dirt and make me look negative and a criminal, in order to drive me out so that he would not lose control.

The method they took was the redemption of shares. I thought it was incredible that they could be redeemed … forcibly bought back. If someone can do that – globally speaking – what shares in a corporation are safe if someone can accuse you of something and say that you’re not fit or worthy of holding those shares? What corporate stock, what individual ownership of corporate stock is ever safe?

The Freeh report was shown as flawed, which indicates Wynn Resorts took an innocent man and drew him up to be a criminal. I was vindicated, Wynn withdrew its case, saying there were no grounds to proceed further.

MC: So why didn’t you sue Wynn Resorts or challenge the settlement?

KO: I would contemplate filing a separate suit against Wynn Resorts.

MC: What did you learn from working with Steve Wynn?

KO: He may not be good at many things, but one thing – design and construction, but mainly design – I’ve rarely met anyone who could get himself intricately involved and concentrated on that aspect of a project. He is a very charismatic person in that field.

MC: Did you feel any sense of justice with his exit from Wynn Resorts after what he did to you?

KO: When we first met, he was more down-to-earth, more laid back. He was very respectful. There are things [he’s] being accused of that in the early times, he wasn’t like that. Granted, after the explosive success that Wynn Resorts had, perhaps it went a little to his head … he became a little full of himself.

MC: Arrogant?

KO: Arrogant, yes.

Ed: Wynn Resorts and Steve Wynn did not accept invitations to respond.