Progress and details of Cambodia’s draft gaming bill, the Law on the Management of Integrated Resorts and Commercial Gambling, was the main topic of discussion at the inaugural Cambodia International Gaming Conference.

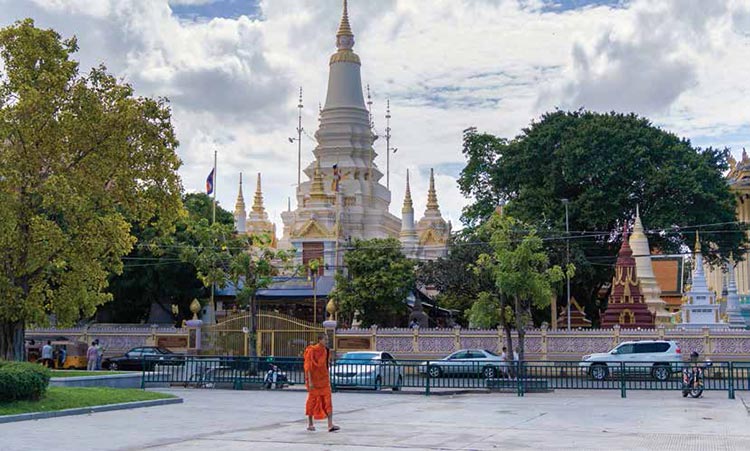

Set in the heart of the Indochina peninsula, the Kingdom of Cambodia has everything it could need to become the region’s next key tourism and leisure destination. But when it comes to gaming, one element has been missing from this equation – a long-touted legal framework to lay the foundations for the industry’s future development.

On 7 September 2018, Cambodia’s Ministry of Economy and Finance (MOEF) and the Ministry of Interior, in conjunction with Malaysian gaming machine supplier RGB International Bhd and Inside Asian Gaming, hosted the inaugural Cambodia International Gaming Conference (CIGC) at the Sofitel Phnom Penh Phokeethra, where the main topic of discussion was the Law on the Management of Integrated Resorts and Commercial Gambling (LMCG).

The LMCG is still some time away from becoming a reality, with Director General of the General Department of Financial Industry for the MOEF, H.E. Mey Vann, telling IAG he is “hopeful” of passing the bill into law by 2019.

“But it depends on how the parliament members agree,” he added. “This is a challenging question but it has already passed through many different procedures and we are hoping the parliament won’t have any objections now.

“The government wants to have this bill as soon as possible to ensure that the industry will be developed in the proper manner and also of course to meet the government target for tourist attractions. Investment is a must to help our economy grow stronger, more diversified and also for changing the country’s reputation for the image of attracting the high-standard operators of IRs.”

“The government wants to have this bill as soon as possible to ensure that the industry will be developed in the proper manner and also of course to meet the government target for tourist attractions. Investment is a must to help our economy grow stronger, more diversified and also for changing the country’s reputation for the image of attracting the high-standard operators of IRs.”

Casino gambling has exploded in Cambodia ever since NagaCorp obtained the first gaming license in the country in 1994. However, gambling in Cambodia has been illegal for locals since the Law on Suppression of Gambling was enacted in 1996.

Based on that prohibition, licenses have been granted under “exceptionality” principles, creating an unbalanced situation. The result has been a mushrooming of small casino operations in towns bordering Thailand and Vietnam, whose locals are also banned and therefore flock to these Cambodian casinos. Likewise, Chinese gamblers have shaped the coastal province of Sihanoukville, where the recent eruption of online gaming operations in particular made evident the need for the government to create a new legal framework from which it could control the sector. When it is enacted, the LMCG is expected to become the cornerstone for a newly professionalized and sound gaming industry.

“I think the new gaming draft bill has the potential to be transformational for the industry,” explained Partner at MdME Lawyers in Macau, Rui Pinto Proença, who helped advise the

Cambodian government during the early stages of drafting the bill.

“I believe in this case the policy goals are clear in the law – it’s job creation, it’s protection of the player, it’s creating a tourism industry and also creating tax revenues for the government.”

The draft law, which has been passed through the MOEF and MOI and is now being reviewed by the Council of Jurists of the Council of Ministers, currently stands at 12 chapters and 113 articles.

Among its key features is the division of Cambodia into three zones: prohibited, promoted and favored. The construction of IRs will only be allowed in the promoted zones, such as Sihanoukville and Koh Kong. Casinos located in favored zones will need to undertake certain reforms to adapt to the new legislation if they want to keep operating. Gambling in the rest of the country will be prohibited to preserve cultural and religious roots.

Another key step in introducing the LMGC will be the creation of a regulator, to be known as the Integrated Resorts Management and Commercial Gambling Committee (GMC). The regulator, comprising seven members from seven different ministries, would be in charge of most aspects of the gaming industry including licensing, collecting taxes and other approvals. In this respect, the legislation includes a dual licensing model: development and ownership, and operation, each of which will require different licenses and different requisites.

The GMC will also oversee responsible gaming initiatives. Asked how Cambodia should best approach responsible gaming, Lawrence Hoc Nang Fong, Assistant Professor of Gaming and Hospitality Management at the University of Macau, told IAG, “At the very beginning I would suggest the government leads the project and tries to get all the stakeholders, especially the casino operators, to be engaged in this kind of thing. That’s the entry point.”

The CIGC saw more than 300 attendees including a large number of casino operators from across Cambodia keen to hear more information about the draft gaming law, including expert analysis and opinion from a variety of industry experts.

Most notable however was Mey Vann, who was quick to explain to the audience during his welcome speech exactly why the LMGC is so important.

“We have developed the gaming industry for a very long time without having proper rules and regulations,” he later told IAG. “We have seen the gaming industry grow very fast and the government has had many challenges to enforce the current regulations, so we decided to take the gambling industry in Cambodia to an international level.

“The current operators are mostly local, most have limited knowledge. With the new development of current gaming industry attractions in our country we decided to draft the bill by cooperating with the current operators and learning from the experiences of regulators around the world, from the US, from Europe. Then we engaged international consultants to draft our bill.

“By committing to the gambling industry in Cambodia we will attract the real professional gaming operators not only for gambling industry development but also for tourist attractions.”

In particular, the LMCG aims to attract foreign investment in truly world class IRs similar to that seen at NagaWorld in Phnom Penh.

“That’s why for the draft law we have consulted with standard operators and asked how they would like to have the casino bill in Cambodia in order to assure them [it is okay] to invest in Cambodia,” Mey Vann continued. In the eye of the standard operators, Cambodia is still missing a lot of standard enforcement procedures so this bill already provides all of the investors’ requirements to meet with standard compliance that is recognized at the international level.”

It was noted during the conference that the draft bill has not been warmly welcomed by all operators – primarily those that might best be described as “maverick” in the border towns of Poipet and Bavet, as well as the rapidly growing Sihanoukville.

But for larger operations such as Donaco International’s Star Vegas, located in Poipet along the border with Thailand, regulation can only be a positive.

“Donaco of course is a public company and listed on the ASX – we are the second publicly listed company that owns a casino in Cambodia after Naga – and as a listed company we certainly welcome all of the principals in the draft law,” said Donaco Executive Director Ben Reichel. “Greater consistency and transparency we think will be positive. A minimum capital requirement for casinos is also a good thing for the country – that will help tidy up some of the business. And I think tighter regulation of junket operators is positive as well. We’re happy to work within whatever the framework of the legislation turns out to be.”

Discussing the challenge Star Vegas faces in the currently unregulated market, Reichel added, “Our

competitors [in Poipet] are not listed and although there are some very professional, well run operators that we get on very well with, some of them are more on the cowboy end quite frankly.

“Sihanoukville is a different kettle of fish because of the Chinese investment that is happening there and it will be very interesting to see how that market shakes out – because it will shake out. There will be a rationalization of the number of casinos there.

“The new decree will be part of that process. That’s why we do think it is very positive. To have a more professional standard of regulation is something that makes us more comfortable.”