Social casino gaming is booming. In 2017, the global social gaming industry generated a whopping US$106 billion in revenues, with the social casino segment generating US$4.5 billion in revenues. Not surprisingly China, Japan and Korea generated 90% of the games revenue in the region.

Asia is the second largest social casino market after North America with revenues of around US$900 million – and that number is growing with an eye popping 250% year-on- year growth. JP Morgan estimates the industry will see 8% to 10% revenue growth in the Asia Pacific region in the coming year.

Eager to build and promote their brands, savvy land-based casino companies have devoted significant amounts of capital to get into the social sphere as they recognize the branding , excellent crossover promotions and the to grow their databases. Given the sizable costs and licensing restrictions associated with operating an online casino site, working with a good social casino platform makes a lot of sense.

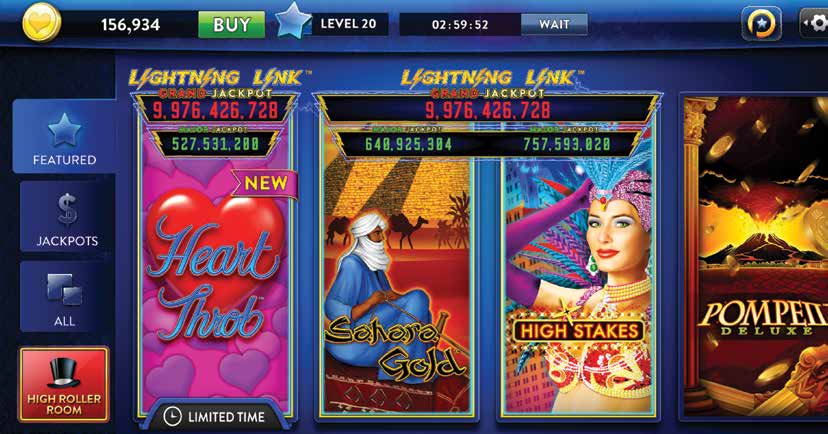

The most popular games are slots, bingo and poker which are easily played on mobile devices. Over the past couple of years there has been a definite and pronounced shift to mobile platforms. This reflects a move away from PC-based platforms where social media giant Facebook, which in 2012 and 2013 was estimated to have 59% market share, today has an estimated 23% market share.

Mobile technology today features fantastic graphics with great sound quality, which make the games all the more engaging and at the end of the day is what publishers are looking for. Sticky games with high entertainment value are what it is all about and publishers do not have to reinvent new games to meet these goals.

In terms of game development, over the past five years there have in fact been few new game innovations or significant game upgrades. After all, the core basics of a slot, bingo or poker game are already there. Slotomania, although the oldest social slot game on the market, is still the most popular offering today with more than 20 million likes on Facebook. In terms of publishers, Playtika remains the largest social casino publisher and the most popular of the social casino portals with around 29% market share, closely followed by Double Down and Scientific Games at 8%. Zynga and Madfish come in next with around 7% market share each.

Regulation is non-existent because social casino gaming with no or payout schedule is not considered to be gambling. Also, very few people understand the difference between gambling and social games. Interestingly, we recently saw China move to ban all forms of social Texas Hold’em Poker. In the US, gambling requires the presence of three elements: consideration, and some sort of . Players bet on the outcome of an uncertain event to win a larger amount. Social games are not gambling if they eliminate one of the three elements.

Because the games are not regulated, operators are free to set the odds at any level they want. In fact, these games are almost never truly random. Game developers do not want players to get bored so the game becomes easier if a player is stuck on a certain level, or alternatively gets harder if the player is winning too quickly. This Dynamic Game Balancing (DGB) is automatic, because game designers want players to stay engaged and these games become very entertaining as a result.

So if it is not considered gambling, how do social casino game providers generate the large revenues we see today?

There are three main revenue models:

1. Free with in-app purchases (IAPs) – the most common and lucrative model. Distributing a free, entirely open-access game attracts players to download the app. Once players are engaged, IAPs offer additional credits, discounts and incentive chances to skip ahead or enhance the playing experience.

2. Freemium apps – Freemium apps involve some form of “upgrade”, perhaps to unlock exclusive levels. Non-game apps, particularly media providers, often use this model in the form of a “paywall” protecting premium content.

3. Paid/Premium – Pay your money and get your game, the old-fashioned way. Parents, many of whom have decried IAPs as honey-traps, tend to like this model. Minecraft, for example, is a global smash hit and can be purchased once and played almost infinitely.

Savvy and successful operators optimize trigger activities and focus on microdata detail. For example, what prompts a player to purchase an IAP? Trigger activities like getting stuck on a level or having to wait 30 minutes for some seeds drive IAPs. Understanding how these trigger activities work and analyzing individual or macro-level data is critical for showing the right paid products to the right players at the right time.

For operators today, the main challenges are the rise of user acquisition and ongoing development costs. Compared to running an online casino site these costs are still much lower, but nevertheless, as any operator will tell you, having good marketing strategies to fish where the fish are is the difference between success and failure.

Not only do social casino developers have to compete with their direct competitors, but also with successful online operators, land-based casinos and other social or mobile game developers that are looking to enter the social casino market. The key is to focus on new markets and such as Asia. In addition, developing new distribution channels beyond Facebook, iOS and Google Play as well as continually working on product innovation is a must.

Long story short, social casino gaming is a rapidly expanding market segment with new and emerging markets like Asia providing the best to enter and find success. As they say, a rising tide lifts all boats, and that is something we are definitely seeing through the Asia Pacific region.