At the turn of the millennium, few imagined how influential Chinese consumers would soon become in global markets ranging from natural resources to luxury goods. Or that they’d become by far the most coveted customers of the world’s casino resort developers, for whom catering to the rapidly evolving tastes of China’s rising middle class—and especially the sophisticated younger cohort within it—will be critical to success. Fortunately, Macau’s developers appear headed in the right direction

It’s become de rigueur for Macau’s casino operators to trumpet the extensive non-gaming attractions at their upcoming Cotai resorts.

One reason for doing so is to publicly make a case for a generous allocation of gaming tables from the government, which has officially capped annual market-wide growth in the number of tables at 3%. Assuming the cap is enforced, the resorts scheduled to open between now and 2017 will get substantially fewer tables than their operators are hoping for.

Melco Crown’s US$2.3 billion Studio City Macau, set to open mid-year, was built “with a capacity for 500 gaming tables,” according to the company’s co-chairman, Lawrence Ho, speaking at a media preview event for the resort in January. “But the truth of the matter is I have no idea how many tables we are going to get. That makes our faith in this market, and in the government, even more spectacular.”

Noting the government’s policy of basing the allocation of tables to each operator on how much they have invested in non-gaming amenities, Mr Ho stressed that only 5% of Studio City’s completed space would be devoted to gambling. He added, however, that “In order to invest in non-gaming we need financing from gaming,” and said the company “hoped” Studio City will be granted as many as 400 tables when it opens. That may be too optimistic.

ATTRACTING THE MIDDLE-CLASS MASS

There’s more to the non-gaming mantra than table allocations, though. The operators have recognized their businesses will increasingly depend on the strength of their non-gaming offerings, as the mass market supplants the once-dominant VIP segment and Chinese tourists become more discerning in their choice of travel destination.

In 2014, Macau witnessed its first year-on-year decline in gaming revenue since the arrival of foreign-operated casinos a decade ago. A dramatic fall-off in VIP play was the main cause. Historically the source of two-thirds of Macau’s world-leading gaming take, the high end was pummeled by slowing growth in the Chinese economy and an intensive crackdown by the central government on corruption, graft and capital flight. Analysts expect an even greater percentage decline this year.

As Mr Ho put it, “It’s time to rebalance” the market from its reliance on VIP revenue.

“As a company, we love the mass segment; the customer base of ours is a much higher margin business,” he said. “With the rise of the middle class in China and their consumption, that’s really the future of Macau and all gaming markets.”

The market has actually been rebalancing gradually toward the mass market since the end of 2011. VIP baccarat’s share of total Macau gaming revenue peaked at 74% in the second and third quarters of that year, and has been declining ever since, with its growth consistently outstripped by that of the mass market.

Yet the mass market also began to falter towards the end of last year, with mass table revenue falling 16% year on year in the fourth quarter. Mass revenue was up 16% in the third quarter of 2014, and prior to that had enjoyed an unbroken run of growth ranging from 29% to 42% every quarter since the beginning of 2011. VIP’s decline began earlier and is much more pronounced, with the 29% fall in revenue in the fourth quarter marking the third-straight quarterly decline.

There were several well-documented causes for the decline in mass market revenue. A total smoking ban came into effect on all of Macau’s main-floor gaming areas in October 2014, resulting in a 10-15% reduction in mass revenue, estimates Deutsche Bank’s Karen Tang. (The total ban superseded a 2013 requirement that 50% of the floor space at every casino be designated non-smoking areas). In response to the ban, casinos have reclassified some of their premium mass areas as VIP in order to allow players to continue smoking. Consequently, some of the reported decline in mass revenue is actually a result of the reclassification, adjusting for which, Credit Suisse analyst Kenneth Fong calculates that mass revenue actually only fell 10% in the fourth quarter, while VIP was actually down 32%.

The crackdown on illegal UnionPay card transactions that began in May last year has also adversely impacted mass revenue, particularly at the premium mass end. The China statebacked debit card had been widely used to circumvent China’s stringent currency controls—a role performed by junkets in the VIP segment—by mainlanders making bogus purchases in Macau, usually at jewelry or pawn shops, and in lieu of goods receiving the equivalent sum in cash minus a small commission to the vendor. Karen Tang wrote last May that illegal UnionPay transactions amounted to US$6 billion annually, equivalent to 12% of Macau’s mass-market chip sales. According to Inside Asian Gaming’s sources, though monitoring has been stepped up and illegal UnionPay transactions have been curtailed, they have not yet been completely wiped out. Thus, the full impact of the UnionPay crackdown might be felt only later.

Discounting the effects of the smoking ban and UnionPay crackdown would largely cancel out the mass-market revenue decline in the fourth quarter. Even without these two major drags, however, mass market growth would likely still have downshifted for a myriad of reasons, among them China’s slowing economy, the supply constraint imposed by the table cap, the lack of significant new attractions ahead of the arrival of the second wave of Cotai resorts and Macau’s infrastructure bottlenecks.

THE X FACTOR

Another variable that will have a profound effect going forward on Macau’s mass-market gaming revenue—and might already be exerting its sway in the market’s current softness—is the rapidly evolving tastes of China’s middle class.

At the turn of the millennium, China’s middle class was an almost negligible force. According to a study published in 2013 by management consultancy McKinsey & Company that’s come to be considered the definitive overview of China’s rising middle class, by 2022 more than 75% of China’s urban consumers will be earning US$9,000 to $34,000 a year, which, in purchasing power- parity terms, ranges between the average income of Brazil and Italy. In 2012, some 68% of urban Chinese households were already within that range, compared to just 4% in 2000, reveals the study. “The evolution of the middle class means that sophisticated and seasoned shoppers—those able and willing to pay a premium for quality and to consider discretionary goods and not just basic necessities—will soon emerge as the dominant force,” states an article in the McKinsey Quarterly titled “Mapping China’s middle class.”

The article outlines the division of China’s middle class into different generations, “the most striking of which we call Generation 2 (G2). It comprised nearly 200 million consumers in 2012 and accounted for 15% of urban consumption. In ten years’ time, their share of urban consumer demand should more than double, to 35%. By then, G2 consumers will be almost three times as numerous as the baby-boomer population that has been shaping US consumption for years.”

The article goes on to describe this fast-growing consumer group: “These G2 consumers today are typically teenagers and people in their early 20s, born after the mid-1980s and raised in a period of relative abundance. Their parents, who lived through years of shortage, focused primarily on building economic security. But many G2 consumers were born after Deng Xiaoping’s visit to the southern region—the beginning of a new era of economic reform and of China’s opening up to the world. They are confident, independent minded, and determined to display that independence through their consumption. Most of them are the only children in their families because when they were born, the government was starting to enforce its one-child policy quite strictly.

“McKinsey research has shown that this generation of Chinese consumers is the most Westernized to date. Prone to regard expensive products as intrinsically better than less expensive ones, they are happy to try new things, such as personal digital gadgetry. They are also more likely than previous generations to check the Internet for other people’s usage experiences or comments. These consumers seek emotional satisfaction through better taste or higher status, are loyal to the brands they trust, and prefer niche over mass brands. Teenage members of this cohort already have a big influence on decisions about family purchases, according to our research.”

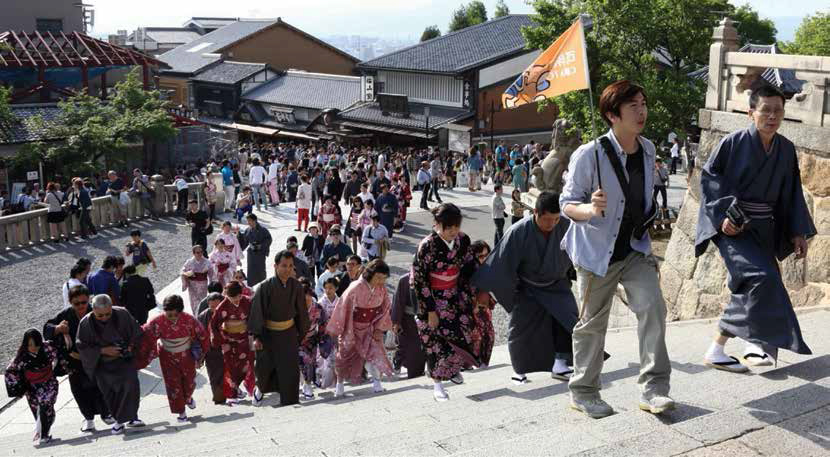

It’s Generation 2 that will drive the coming surge in Chinese outbound travel. Analyst Aaron Fischer of leading Asian brokerage CLSA predicts in a report published in January titled “Social Pressures—Chinese Tourists Keep Exploring” that outbound departures will double to 200 million by 2020. “Explosive projected growth in outbound Greater China travel numbers offers immense opportunity for countries to benefit from Chinese tourists’ desire for new experiences—from sightseeing to food, to hotels, to gaming and shopping. Tourists will become increasingly savvy, independent and demand high quality experiences and service,” says Mr Fischer.

While Mr Fischer believes Hong Kong and Macau will continue ranking as the top international travel destinations for Chinese tourists, he also expects outbound travel to other destinations to see faster percentage growth as holidaymakers seek more exotic locales. In absolute terms, however, Mr Fischer forecasts Macau will see the largest growth in the number of Chinese tourists, reaching 33 million in 2020.

“Macau will be a relative outperformer with the various new integrated resorts (to open from 2015 onwards) set to improve the city’s tourism infrastructure,” writes Mr Fischer. “We still expect Macau’s Chinese visitation growth of 9% to trail behind other further afield locations though due to its current high base.”

The CLSA report assesses the attractiveness of 26 major travel destinations using a model incorporating five criteria: hotel offerings, dining venues, tourist attractions, accessibility and shopping options. The destinations are awarded a weighted score on each criteria to arrive at a total score out of 100. Topping the list is Japan, with a score of 77. Hong Kong places fifth with 67, while Macau gets a fairly low score of 45 to come in at 15th place. Mr Fischer attributes Macau’s poor placing to a hotel supply bottleneck and lack of attractions, but points out “That is set to change with the new integrated resorts and the HK-Macau-Zhuhai bridge substantially improving the tourist capacity of the city. The desire to travel to Macau will also improve as each new integrated resort is expected to bring multiple non-gaming attractions to the table, which should change tourist’s perception that Macau offers nothing more than casinos.”

As Chinese travelers become increasingly discerning in their choice of holiday destinations, it behooves Macau’s casino operators to invest heavily in non-gaming amenities to ensure the city retains its allure. The offering that worked in the past—the opportunity to place a legal bet on baccarat along with whatever patriotic sentiment is engendered by visiting a city recently reunited with the motherland after four and a half centuries of colonial rule—simply might not cut it for the growing legions of sophisticated middle-class Chinese, for whom Japan, France and Korea rank as the top three aspirational places to visit. But importantly, this demographic is also one that can actually recognize what Las Vegas-style dining and entertainment is and be willing to pay a premium for it. If the new Cotai resorts succeed in creating a critical mass of Vegas-style offerings, the Westernized Generation 2 cohort could reasonably be expected to flock to Macau as they come of age.

Critical mass will be key. It is the sheer volume of the dining and entertainment on offer in Las Vegas that makes it a go-to destination for gourmands and clubgoers in the US, and supports its position as a leading MICE destination. In Macau, there’s already sufficient capacity to hold the biggest MICE events at Venetian Macao, but not enough hotel rooms to accommodate attendees of large-scale events. There are an estimated 150,000 hotel rooms in Las Vegas, compared to only 28,000 rooms currently available at Macau’s hotels and guest houses, of which 18,000 are categorized as five-star. Over the next two years, close to 12,000 new rooms will come online at new Cotai resorts developed by Macau casino operators, including Phase 2 of Galaxy Entertainment Group’s flagship Galaxy Macau (1,300 new rooms, suites and villas), Sands China’s Parisian Macao (3,000), Melco Crown’s Entertainment’s Macau Studio City (1,600) and the extension of its flagship City of Dreams resort with a fifth hotel tower (780), Wynn Macau’s Wynn Palace (1,700), MGM China Holdings’ MGM Cotai (1,600) and SJM Holdings’ Lisboa Palace (2,000).

Although non-gaming attractions were always going to be a big component of the resorts currently under construction on Cotai, previously, when gaming was looking so strong, the non-gaming elements might have been conceived in some instances as loss leaders that drive traffic to the casino. Going forward, however, it looks like Macau’s casino operators, like their Las Vegas counterparts, are going to look at non-gaming departments increasingly as potential standalone profit centers.

China’s Generation 2 could prove a game changer, enabling Macau to follow the lead of the Las Vegas Strip in diversifying its revenue streams. The best-case scenario for operators’ bottom lines would be for Macau to retain a strong gaming sector centered on the high-margin mass market, while also cultivating meaningful non-gaming revenues. After all, even with sizeable contributions from non-gaming departments, total casino resort revenue on the Las Vegas Strip only reached US$16.3 billion in the 2014 financial year, barely 37% of Macau’s gaming revenue last year. The concern then would be that Generation 2 might also end up debunking the notion of the insatiable Chinese appetite to gamble, just as younger generations in the US have turned away from gambling.