While most of the big names were playing the region’s emerging machine gaming markets from the sidelines, a determined group of niche suppliers, most of them locally based, stepped up to fill the breach. Lesser-known, perhaps, but just as creative, in many ways more nimble, and certainly aggressive, today, they’re taking more floor share than ever

Long before the Chinese came flooding into Macau to explode the fiction that Chinese don’t play slot machines, Asians were dropping coins and spinning reels with all the avidity of their neighbors in far-off Australia and the Americas. The big multinational manufacturers were slow to catch on to this. But that’s a facile statement to make from the vantage of hindsight. Think back before Singapore opened up and Macau’s mass market took off, to the logistical obstacles the region posed, the fact that little was known in the West about the players and operators and how difficult it was to sell a board of directors in Las Vegas on the investment required to find out. These were, after all, tiny markets compared to the slot hangars they were selling into in the US, and largely opaque, at least by Western standards, and daunting from a regulatory perspective.

One effect of this—the greatest effect, really, the one that came to define East and Southeast Asia as the rich and sophisticated and intensely competitive machine gaming markets they are today—was the opportunity this presented to a handful of game developers that were based in the region and spoke the languages and knew the cultures more or less first-hand. Moreover, they aren’t hobbled by towering corporate structures and a lot of demanding Wall Street investors and analysts. They’re small companies, relatively speaking, or certainly they were, with nothing like the capital resources of the multinationals, but then they don’t have to sell thousands of machines either to justify their stock prices. This freed them to innovate and armed with precisely targeted products to move aggressively beginning a decade or so back into jurisdictions where most of the big names were reluctant at the time to tread.

All of these smaller games-makers can point to a unique provenance for the success they enjoy today. Some, like Singapore’s Weike Gaming Technology and Macau’s LT Game, leveraged their origins as operators to make some decisive calls about where they wanted to go as suppliers. The video gaming genius of the Japanese was a major influence on Taiwan’s Jumbo Technology, which began selling games into Asia’s club markets when Macau was still governed by Portugal. Aspect Gaming, a relative newcomer, was founded in Shanghai in 2008, but its management roots stretch back to Silicon Valley in the mid-’90s.

The other common denominator is that they’ve all grown up with an Asian industry that is all grown up now. As it extends from Kangwon Land to Kuala Lumpur, from Manila to Myanmar, it’s an industry comprised of tens of thousands of slots and EGMs spread across upwards of 300 casinos and clubs. Nevada’s non-restricted locations number at most only a few dozen more. Macau’s slot market alone booked US$1.79 billion in revenue last year from approximately 13,100 machines, second only to baccarat. Those slots generated almost 62% of the Las Vegas Strip’s machine win with 29% of the units. This year they’re on track to break $1.9 billion. If you dropped them into the US right now they’d equate to the nation’s seventh-largest commercial casino state by revenue.

Macau also accounts for a sizable majority (60%) of the 9,500 or so electronic table positions in East and Southeast Asia and will account for 65% of the growth over the next three years, according to estimates by investment brokers Union Gaming Research Macau. At that point, there will be at least 5,200 more seats region-wide than there are today, an increase of 40%.

Needless to say, none of this has been lost on the multinationals, which have responded impressively, leveraging their greater resources to get up to speed fast with an array of powerfully localized products, and as far as the larger casino markets go, asserting the dominance you’d expect.

That doesn’t mean the regionals are ceding any of the territory they’ve won.

“Our wealth of knowledge is far superior to suppliers based outside of Asia,” contends Ned Hsu, creative director of Jumbo and chairman of sister company Alphabet, which develops a cutting-edge range of games in its own right. He sees his companies as an alternative. “We believe so because we are based in Asia, which gives us the advantage,” and as a private company, “We are more efficient and flexible when we have to adapt to regulations and requirements for a market.”

Weike’s Chief Operating Officer Ray Poh also sees his geography as an edge, enabling the company to exploit what military strategists prize as interior lines of communication. “In terms of maneuvering around the market we’re probably more nimble,” he says. “Our entire team is in Asia so we don’t have to fly people in from Europe or America. We’re all based within the region. It takes us maximum about four to five hours to get to any location that we need to be.” There’s also the devotion to the region, which is what summoned these companies into being in the first place.

“Something like a new regulation: perhaps for the big suppliers, the international guys, they have to go through a corporate chain before they can get an answer,” Mr Poh contends. “And they have other markets to consider, and then whether the decision they’re making is actually for the good; it may not be, because their other markets are bigger than Asia. For us, Asia is our market. Asia is the biggest market for us. So concentrating on Asia itself, it’s very easy for us to make sure we handle all the regulatory changes, and make sure our guys that create the products visit Asia and they’re in tune with the psyche of the customers that are here.”

The operators you might expect to benefit from this the most, those with similar regional roots and a regional focus, while they don’t disagree, naturally they view the dynamics from their own perspective. “I think everyone is happy to try machines if the supplier looks like he’s going to help you out and be a partner,” says Tim Shepherd, executive director of Hong Kong-based Silver Heritage, which runs a popular casino outside Hanoi and owns and operates more than 1,000 slots around Southeast Asia.

“These companies we’re talking about, they have a very specific focus, they build for a specific market,” says Joseph Pisano, an industry veteran who has held senior roles with IGT and Entertainment Gaming Asia and now heads the Jade Group, a slot distribution and management company based in the Philippines. “Companies like Aristocrat and IGT, they have very large assets in the industry. When they look at products they look at it more on a global scale.” IGT is one of Jade’s clients, a list that includes European slot giant Novomatic and Seoul-based Hydako, the latter a decidedly smaller name with some well-designed games centered on an outsized cabinet called the Super Giant that features a 42-inch screen. Hydako’s games are deployed in Macau and in casinos on South Korea’s Jeju island. At Manila’s new Solaire Resort & Casino, they’re ranked the second-best performer on the floor, according to Mr Pisano.

But that doesn’t mean smaller is necessarily better, he says. “I think the biggest difference is product, and your small suppliers, your Aspects, your Hydakos, their product range is very limited, and for very specific markets. Some of the Macau companies have products that work in Macau, but they really haven’t been tested outside of

Macau yet. LT is one company that has been able to operate basically in a monopoly environment where they haven’t been exposed to competition.”

Aspect CEO Justin Nguyen likes heading a Chinese company whose motto, “Created by Locals for Locals,” is “a good indicator,” he says, “of both our advantage and our game development strategy”. But, he adds, in the end everyone’s looking at the same bottom line—“to create a more enjoyable gaming experience for the player that translates to higher ROI for the operator”.

“We see ourselves as being complimentary to the big global manufacturers,” he says. “We’re all part of a bigger ecosystem delivering entertainment.”

For Silver Heritage it’s about “the reach and familiarity with the regions in which we operate,” says Mr Shepherd, which implies, in his view, a certain community of vision. “Silver Heritage work in partnership with our suppliers to promote their games into newer markets. Suppliers who don’t want to join us don’t get the orders. Whether they be big or small companies that commitment to emerging markets has to be there. … When it comes down to it the bigger names tend to be able to see us as a partner regionally and worth the effort, we hope. That said, all the suppliers we are discussing here have very strong markets. I wouldn’t call any of them ‘small’ really. Less well-known internationally perhaps. Jumbo is very big in Taiwan, Weike in Malaysia, Singapore and now Macau. LT is super-strong in Macau and is flexing its muscles internationally, placing in casino across Asia.”

For a company such as his, which sees itself as very much an emerging markets story—with an expansion under way in northern Vietnam, plans to develop some 30 branded electronic gaming venues in the Philippines and a five-star resort brand on the drawing board in Nepal aimed at the vast India market—the more choices for his floors the better. Size doesn’t figure into it.

“We have bought from these names,” he says of the smaller suppliers. “I think, where we are expanding, all would do well on the floors of our clubs. They have some beautiful machines, with great names and a good track record nowadays. They price more competitively as well. If they do well on an ROIC then we’d order more for sure.”

And operators and suppliers agree on the opportunities available to them both from the growth of these markets as destinations.

“The advantage is in the larger properties,” says Mr Pisano. “If you’re operating a large property you’re going to have a larger product range. You can afford to put in some Aspect, some Hydakos, some Weike. If you’re running 1,500 machines you can put a bank of each.” In light of which, “It’s great to have them,” he adds. “If we look at some of these companies now, they’re building some very successful games at the moment. It gives your casino floor points of difference. At the moment, if we look at the industry it’s basically Scientific Games and GTECH.”

But that’s an opportunity as well. “Bigger but not necessarily better,” as Weike’s Ray Poh puts it. “Now they’re becoming even bigger and the competition is growing stronger but we know that we will be able to fight toe to toe with them. It’s definitely a lot easier for us to increase our market share than for them to maintain their market share. So we’re definitely in a position to grow, and now with all the consolidation we are sort of poised to grab any market share that we can whist they’re going through with all their changes.

” Mr Shepherd is counting on continuity. “Operators need stability of the sales team and the head guy in Asia. If they keep swapping these around it’s a sign that everything isn’t well, and it makes operators nervous.”

For Weike, the “challenge” is what never varies, says Mr Poh. “They have the scalability, they have the resources, they have a lot more things going for them than us, but we’ll continue to fight along. I guess it is like a David and Goliath kind of situation, but what we know is that we can create products as strong as they can so we don’t see it as a disadvantage.”

And as slingshots go, being local is not without value. “When it finally matures the Asia market will be the largest slot market in the world,” says Mr Nguyen. “Like so many things driven by the rising Chinese middle class. There is no precedent, and it is extremely dynamic. So if you’re not on the ground and Asia-focused when it happens, you might miss the boat.”

Spirit of the Game

ALFASTREET

Electronic roulette as we know it was largely the invention of Alfastreet, which emerged in 1994 from the furniture factory of the Počkaj family in Rodik, Slovenia, to become a global e-table leader by virtue of a spirit of innovation that hasn’t flagged in 20 years and never wavers from a commitment to Old World standards of engineering, craftsmanship and service. The company’s flagship multiplayer platform, the R8, is the embodiment of these traits: elegant, durable, immensely scalable—it strikes that balance between technological panache and fidelity to the “spirit of the game” which for Alfastreet represents the apex of achievement.

“Our philosophy is to make the games simple and efficient. That is our main goal when we develop any game,” says Sales Director Albert Radman. “We do modify our games to suit specific markets, but the basis is always the same. Simple and effective.”

The R8 is the “reference” for every ETG manufacturer that’s come after, as he sees it, and not without some justification. It’s carried Alfastreet to dominance in Cambodia’s 70-casino market, both on the borders and at NagaWorld, where the R8’s myriad strengths, principally as an automated roulette offering, have captured a majority of the Phnom Penh monopoly’s 400- plus ETG seats.

“They conquered Cambodia very early on,” says Silver Heritage’s Tim Shepherd. “When Poipet opened up they were there, and as casinos grew up in the 2000’s, and up until today, you can’t open a casino and expect to succeed on the EGT side without at least one eight-seater Alfa.”

The R8’s ergonomics has a lot to do with that. Supported by rigorous pre-release testing it plays out in ample leg room, a spacious 23-inch player interface and in the way each seat relates to its slightly convex screen surface (upgraded recently with fully adjustable RGB LED lighting) and to the centrally placed wheel.

Just this year, a more compact version was unveiled, the four-seat R4, so the quality and performance are now available at a size and price more amenable to smaller operations, a strong selling point in Asia’s vibrant medium-tier casino and club markets.

“Our goals are clear,” says Mr Radman, “we would like to see at least one Alfastreet machine in each casino and club.”

If it happens, the flexible, single terminal SL will be another big reason why.

The SL is the backbone of a rich multi-game offering comprised of popular e-versions of sic bo, baccarat, craps and an array of proprietary games that includes a big wheel unveiled earlier this year—Alfastreet Wheel of Fortune, it’s called, available both in live and automated versions—and an innovative virtual horseracing platform called Royal Derby that is being readied for release.

The SL also has enabled Alfastreet to compete for a healthy share of the stadium-style configurations that are growing in popularity across the region, most notably in Singapore, where optimal performance is a must because ETG seats count against both casinos’ statutory cap of 2,500 machine games. Alfastreet controls an estimated 35% of those precious seats, good for second-most in the market. So it’s not surprising that the company continues to reinvest in the platform. Recent upgrades include a 23-inch monitor, an optional second-screen and live video feed and full game statistics. The more plush SL Gold, identifiable by its namesake trim and richer wood and carbon insets, comes with R8-style adjustable lighting and supports optional control via smartphone. The latest iteration, the WIKY, sports an entirely new look around a more minimalist base and on top features a whopping 32-inch player interface.

People-Watching

ASPECT GAMING

Not many slot-makers would theme a game around Eric Tsang, a Hong Kong actor and comedian best-known as the host of a TV variety show that ran in the city for years. The fact that Aspect Gaming did points up the distinct Macau focus that is driving game development at this still fairly young company. China-specific themes predominate among the more than 20 titles Aspect has created to date, a list that numbers two standout 50-line performers, Fortune Cats and Backyard Gold, with a pipeline behind them bulging with several more.

CEO Justin Nguyen is a California-educated software engineer whose background in IT led him into the industry by way of Silicon Gaming, a Palo Alto upstart whose innovative mid-’90s slot concepts were fated to be ahead of their time.

Tony Payne, his executive vice president-Product Development, led Silicon’s game studio and would parlay a degree in film and television to become a producer for video game innovator Rocket Science Games. He’s been involved also in the creation of dozens of games for the US Class II, charitable games and lottery markets.

Quite a combined pedigree, and it hasn’t been easy replicating it in Shanghai, where Aspect was founded in 2008. “We’ve got some extraordinary people who have come to us from the mobile and console game industries and bring a wealth of knowledge and alternative perspectives with them,” says Mr Nguyen. “However, because casino gaming is not allowed in China, the vast majority of them have never set foot in a casino, let alone had any experience with slot machines prior to joining us. So of course this was frustrating in the beginning. I mean, how do you explain the subtleties of a reel spin?”

The team has come a long way since, and with its 22- inch Ruby and 37-inch Super Ruby cabinets Aspect has a robust hardware platform that will be turning heads at this month’s Macao Gaming Show with the unveiling of OneWall: an extended bank of Super Ruby’s transformed into what is essentially a high-definition movie screen with game and top screens synchronized to move content across the bank.

OneWall will launch in tandem with a new four-level progressive jackpot game called Sheng Xiao Chuan Qi, a Chinese Zodiac-themed offering that speaks a few volumes more to Aspect’s unique approach to design. Players get to choose a personal “Wild” symbol from any of the 12 animals of the Zodiac, and the interactivity extends to a feature called Win Track, a win-loss history indicator that encourages players to follow hunches to alter their bets up or down. Five-reel winning combinations are sweetened with payouts from a special “6th reel”. There’s also a mystery called “Neighbor Jackpot” that kicks in during the jackpot round to pay a random prize to another lucky machine on the link.

Aspect is moving aggressively into the remote space as well with a social gaming app called Grand Orient Casino available on Facebook, Android and iOS.

“We pride ourselves on spending a lot of time hanging out in casinos just people-watching,” says Mr Nguyen. “Of course, we’re interested in what players are playing, but we’re equally interested in what they’re looking at, where they’re having their picture taken, what they are eating, buying, etc. And when we see folks playing a casual game on their phone with one hand while tapping away at a slot machine with the other, you can bet that’s going to influence our game design.”

A Dragon by the Tail

JUMBO TECHNOLOGY

Taiwan’s Jumbo Technology is in many ways the archetype of the Asian-based supplier that honed its trade designing games for markets the big names wouldn’t touch.

“We are a privately held company and so we are able to approach the target market much faster and efficiently due to our corporate structure,” explains Ned Hsu, the company’s creative director and chairman of sister developer Alphabet. “The public companies have to adhere to strict compliance standards in their own countries which are not applicable to certain Asian jurisdictions that are in the process of developing their domestic gaming markets.”

Geographic diversity has always been Jumbo’s strong suit, and its current portfolio of 29 or so slot titles is weighted toward generic, cross-cultural themes.

The company has lavished more R&D on electronic bingo than any manufacturer in Asia and has not one but two innovative platforms to show for it: a flexible slant-top called EZ Bingo featuring a four-level mystery jackpot and Lounge Style Bingo, a stadium-style platform comprised of couches and personal flat screens centered around a GLI-certified mechanical ball-drawing machine the size of a ’60s-era Univac.

“They’ve done a great job with their bingo product, and they’ve been successful with their bingo product,” says Jade Group’s Joseph Pisano.

In Myanmar the company has been a major supplier going on 15 years and has clicked fabulously, in Laos as well, with a number of Chinese-themed titles, and the company moved decisively a little over a year ago to leverage a multi-level mystery progressive around this fact: Lucky Lucky, it’s called, and it shows off to great effect the animation and graphics skills for which the Taiwanese are justly celebrated. It’s supported by four equally colorful, high-volatility titles that play off the link theme: Lucky Dragons, Lucky Qilin, Lucky Phoenix and Lucky Lion.

The Philippines has been another winner for Jumbo, marked by the deployment of a casino management system from its sister company GAMA Technology connecting the entire estate of state-run operator/regulator PAGCOR and encompassing some 5,000 machine games. In all, the GAMA Casino Management System is connecting around 10,000 EGMs across the region.

Mr Hsu points out that GAMA was created to serve the needs of smaller operators—the sector, interestingly enough, that also spurred Jumbo’s prodigious growth as a supplier of electronic multi-player table games.

Long Dragon Baccarat, which has found particular favor in capacity-constrained Macau, is a multi-table variation on Jumbo’s automated Video Baccarat Multi Player, which introduced a technology that allows players to virtually “squeeze” the cards. Long Dragon targets another obsession of Chinese gamblers, their fondness for devising elaborate predictive systems based on the patterns formed by previous hands as these are colored into different types of grids (blue for “Player,” red for “Banker,” green for “Tie”), or nowadays as they’re displayed on the LED scoreboards fixed to every live table. Long Dragon takes its name from its “long dragon indicator,” the first on an e-table, a horizontal pattern of either blues or reds formed by an especially long series of “Banker” or “Player” wins, which players liken to a dragon’s tail and consider good luck. The platform goes this a step further, multiplying the appeal by connecting each player to up to eight tables simultaneously—that’s eight sets of past performances—and each table is set in a richly animated virtual environment brought to life on a 47-inch widescreen. There are some fun carnival-style features woven in as well, like random payouts for wagers on “Tie” or “Pair”.

A similar scope for interactivity is built into the company’s sic bo and roulette platforms, and Alphabet is expanding on these with fully automated multi-player platforms that envelop the bounce of the dice or the spin of the wheel in special effects lighting and sound. Alphabet Sic Bo and Roulette feature 22-inch touchscreen displays configurable in island or single-terminal settings, with optional side bets, random pays and the very saleable factor of faster game play than their live counterparts.

Total Solution

LT GAME

LT Game has about 60% of Macau’s roughly 5,500 ETG seats. The company’s lock on the prized multi-player, multi-game version that features live dealers, the version everyone wants to play, is even greater, in fact, it’s total, and accounts for upwards of 3,250 of those seats.

But if you’re thinking there’s nowhere to go from 100% but down you’d be wrong. LT’s Live Multi Game System, as it’s called, is protected by a patent from the Macau government, which fosters LT’s enviable position, indirectly, in other ways: with the table cap, for one, which has driven average minimum baccarat bets into four figures and makes Live Multi Game System invaluable as a low-cost alternative; and by prohibiting anyone not holding permanent residency in the city from working as a croupier, which has rendered Multi Game, by virtue of its ability to link dozens of betting terminals to a single dealer, a go-to solution for the labor shortage.

The fact that LT’s e-table share has doubled over the last two years says it all. The number of total LT seats in the market is up more than 30% this year, and with ETG positions in Macau expected to grow by 3,500 with the new resort openings on Cotai, the company’s lion’s share will only get … well, more leonine.

As an operator of three casinos and part of a fourth, Jay Chun, chairman and managing director of LT’s Hong Konglisted parent Paradise Entertainment, has kept a close eye on the labor and table cap issues as they’ve unfolded. And being a man with a tirelessly inventive mind he’s leveraged the success of Live Multi Game to devise a “Total Casino Solution,” as LT calls it— an all-electronic “chipless” gaming floor that requires minimal staff to run but retains just enough of the human touch—via platforms like Live Multi Game and a new e-baccarat hybrid—to represent something genuinely groundbreaking.

“If you want to set up a small-scale casino you can have everything there,” explains Chief Operating Officer Betty Zhao,” live tables, electronic table games, cash access, CMS, and also slot games.”

LT unveiled a prototype earlier this year with the return of full-scale gaming to the Macau Jockey Club, and the experience gleaned from that will be on display at this month’s Macao Gaming Show in an intriguing mix of live and automated tables and live-dealer hybrids, along with a unique multi-game link called Power Dragon, jackpot and tournment solutions and an array of supporting technologies covering self-service kiosks, ticket redemption and tableside currency validation and full floor-wide networking.

MGS is now in its second year as a competitor to G2E Asia, and it was founded, not surprisingly perhaps, by the indefatigable Mr Chun, who will have IGT co-exhibiting with him as part of a distribution deal that is likely to see a lot of LT’s games turning heads in the States.

“We are focusing on the US market,” says Ms Zhao. “Vegas is the gaming center of the world.”

The company already has 48 Live Multi Game terminals on the Strip (at The Venetian) and on Fremont Street (at the Plaza), and both properties plan to deploy more. Australia’s Crown Melbourne is also on board with 100, and more are slated to be installed there next year.

On to Victory

WEIKE GAMING TECHNOLOGY

Look just about anywhere in East and Southeast Asia and you’ll find a Weike slot machine. They’re in Singapore, Malaysia, Macau, in South Korea and the Philippines, in Cambodia, Vietnam and Myanmar, even in Nepal and Sri Lanka.

It takes solid products to achieve this. It’s the factor that is “central to our growth,” says Ray Poh, chief operating officer of Singapore-based Weike Gaming Technology.

“The other key to it is innovation,” he says. “We don’t want to just build standard games. The market actually sits up and takes notice when you innovate and put a little spin on different concepts.”

Markets have been noticing Weike since the late ’90s, when the company began expanding from club operations, principally in Malaysia, into game development, largely because the big international manufacturers couldn’t be bothered to customize games for its players

But it was the debut of Singapore’s IRs that was the real catalyst.

“That’s when we started looking at GLI certification and getting our platform up to speed,” Mr Poh recalls. “During this time we expanded into electronic table games and also systems as well to back up the entire operation.”

The company also got serious about building its talent base, notably with the addition of Andrew Masen, among others. A one-time game design manager for Australia’s Stargames, Mr Masen joined in 2008, and as vice president of Game Design and Development has nurtured the growth of an R&D team that now numbers more than 50.

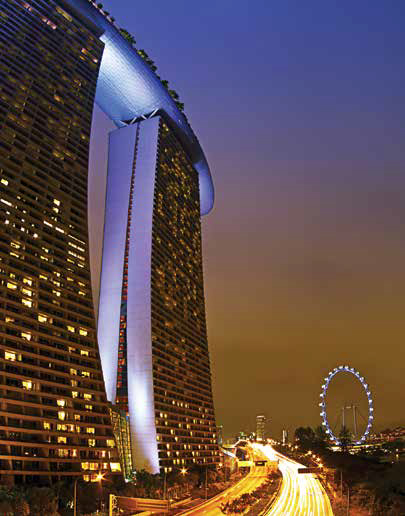

Weike has been rolling out an increasingly rich palette of games around solid maths and world-class graphics ever since. Today, the company enjoys around a 20% share of Singapore’s vibrant club market and has another 100 or so installations in Marina Bay Sands and Resorts World Sentosa—a creditable performance when you consider that both slot floors are capped by law at 2,500 EGM positions each.

The word spread quickly to Macau and the Philippines, where the high-volatility 50-line standalones that were making the company’s name in Singapore quickly found a niche, led by Qin Shi Huang, which packs a compelling gamble in the form of a multiplier that progressively increases during the feature and has been a stalwart performer in Macau and is still the most popular game for Weike in the Philippines five years after its release. More Chinese-centric themes followed on Qin Shi Huang’s successful math—Justice Bao, Wu Ze Tian, the slightly less volatile Duo Di Zhu Gold, based on the classic Chinese card game “Beat the Landlord” and featuring a unique 10-reel window configuration, and the high-volatility Cao Cao on the company’s innovative UltiWays series, where the third reel is divided into three windows for 768 ways to win.

There is also an exciting new multi-level progressive link undergoing certification that could hit the Macau and Philippine markets before the end of the year. Victory, as it’s called, is designed around the central imagery of the horse, an animal revered in Chinese lore for its associations with success and achievement. The four jackpot levels are represented by different-colored steeds, each of which figures prominently in the narrative of “pursuit” that is integral to the psychology of the big win, and this is carried through in the volatile free games multipliers and stack symbol maths built into its introductory 50-line base games, Fortune Meow and Legendary Archer.

The Infinity line of electronic multi-player baccarat and roulette games promises to be another potent weapon. Known for its innovative “squeeze-the-cards” technology, Infinity Baccarat has been a strong performer for the company in Laos and in the clubs in Vietnam, where Weike controls around 60% of the e-table market.

In the meantime, the company continues to grow its systems business. WeSystems has expanded into more than 100 properties across Singapore, Malaysia, Vietnam and Cambodia by specializing in a highly modular and affordable technology targeting the club and small-casino market. In Macau it currently connects around 600 EGMs in four casinos.

“We actually have a pretty big presence,” Mr Poh says of WeSystems. “That’s one thing that a lot of people overlook. It’s something different about us as well.”