Las Vegas Strip casino giant MGM Resorts International beat analysts’ revenue expectations for the third quarter, recording US$2.49 billion, a 1% gain year on year, as mass-market gambling at the company’s Macau subsidiary helped offset a decline at its US tables and slots.

In all, the company posted a loss of $20.3 million, or 4 cents per share (NYSE: MGM), an improvement over Q3 2013’s 5 cent loss but missing the average analyst forecast of a 6 cent profit, according to FactSet data cited by Bloomberg.

Reinvestment in its core Strip holdings accounted for most of the loss, led by the refurbishment and rebranding of THEHotel at Mandalay Bay as the 1,117-room Delano.

In line with Strip trends the company is heavily focused on non-gambling revenue and is building an arena and a festival site on or near the Strip and is spending to attract more pedestrian traffic by pushing restaurants and shops closer to the sidewalk.

“Clearly, the Las Vegas visitor today is a much more well-rounded customer looking for many more attractions than just gaming,” said CFO Dan D’Arrigo.

Conventions are the other key for the company, which said it expects the sector to improe next year and beyond “That is critical to the success,” CEO James Murren told analysts during the earnings call.

The company’s US casino revenue in the third quarter was off $40 million from the same period last year, a 4% decline, also broadly in line with Las Vegas and domestic US trends as a whole. But revenue from main floor table games at the company’s majority-owned MGM Macau was up 34%, as the Chinese territory’s more profitable mass market continues to buck a downward slide in VIP revenue, which was reflected at MGM Macau in a 19% drop during the quarter.

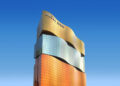

The company said it is slating a fall 2016 opening for its MGM Cotai megaresort.