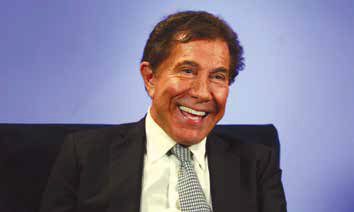

1 Sheldon Adelson

Chairman and CEO

Las Vegas Sands Corp.

Sheldon Adelson has built it and they have come in their millions. He has changed Las Vegas. He has changed Macau. He has changed Singapore. He will change Japan.

As veteran hotelier Michael Leven, chief operating officer of Las Vegas Sands, has said of him—“At the end of the day, you’re looking at a person who is a historical character.”

The casino empire Mr Adelson has built is arguably the most profitable in the world, certainly the most lucrative, with an enterprise value that pencils out as of 30th June at roughly US$50 billion. The $22 billion worth of assets that comprise it have no peer when you combine the scale of their offerings, their geographical diversity and the depth and potential of their markets.

Three-quarters of that asset value is in Asia, 46% of it in Macau, where LVS will have invested more than $9 billion by 2015 and where its Hong Kong-listed Sands China subsidiary is the undisputed leader in a mass market that is growing at triple the rate of VIP. Its four resorts generate more than 60% of corporate net revenues and more than 56% of EBITDA. Those ratios would be even greater except that Marina Bay Sands in Singapore is so profitable. In all, LVS generated US$1.37 billion in profits in the first six months of this year on $6.86 billion in gross revenues. Its pre-tax earnings in 2013 will exceed an eye-watering $4 billion. Asia will drive close to 90% of that.

Not that Mr Adelson has any intention of kicking back. He’s cast an investment eye on India. He’s already unveiled a prototype for a super-resort either in Ho Chi Minh City or Hanoi should Vietnam ever open its casinos to its citizens. He’ll change Spain if they let him. Plans for the $8 billion, 450-hectare EuroVegas complex he wants to build outside Madrid call for 12 resortscale hotels and six casinos with 18,000 slot machines and 1,600 table games. LVS has consulted with stakeholders in Japan, where a legalization proposal is making the rounds in the Diet, and is believed to be on the short list to develop something iconic in Tokyo or Osaka.

The 56 hectares the company controls on Cotai include two more developments slated for completion over the next three years: a $450 million St. Regis-branded hotel at the Sands Cotai Central complex and a megaresort across the street that will connect with The Venetian and Four Seasons—The Parisian, it’s called, a 3,000-room destination with plans for a freestanding replica of the Eiffel Tower and a price tag of $2.7 billion.

Mr Leven, who has known Mr Adelson since the 1960s, remembers him even then as the “penultimate entrepreneur, incredibly creative and wide-thinking, and incredibly optimistic, which is what you have to be to be a successful entrepreneur.”

His is the classic Horatio Alger story— born in the depths of the Great Depression, the child of immigrants, the cab driver’s son who has amassed a fortune valued by Forbes this year at $26.5 billion. It’s good for ninth on the list of wealthiest Americans. Only 14 people in the world are wealthier. He has owned 50 companies, by his count, since he first went into business for himself at the age of 12 selling newspapers.

“Honestly,” as Macquarie gaming analyst Joel Simkins has said, “you can put him up there with any of the big dreamers we’ve had—Sam Walton, Ray Kroc—the individuals who thought the unthinkable.

Mr Simkins remembers rating Venetian Las Vegas’ bonds back in 1998 as a junior analyst at Moody’s. “They were telling us, ‘We’re going to get $125 midweek from the conventioneers.’ People laughed. But the guy has had a tremendous ability for unlocking opportunities in gaming that no one visualized.”

As the man himself explains this, “It wasn’t what I saw, it was what I experienced. I was Las Vegas’ biggest convention customer with Comdex. And I had a couple other shows. This was my profession for a long time. So I saw it from a different viewpoint. People thought, the operators thought, that the purpose of Las Vegas was gambling. And I said to myself, the purpose of Las Vegas is the fungibility of money.”

It seems so obvious now. Yet he saw Macau with similar clarity. “The only way you can stop the Chinese from gambling,” he once said, “is lock the door and don’t let them in.”

That notion alone would have netted him a tidy fortune. Only he saw something more. He saw that in a place where 500,000 residents and several millions of tourists are crammed into 30 square kilometers on the doorstep of the most populous nation on Earth, the future belonged to those with land.

He likes to joke now that he thought LVS was being exiled when the Macau government directed him to a patch of reclaimed marsh between the islands of Taipa and Coloane which it figured might be suitable for a fireworks factory. The story goes that Steve Wynn passed when asked to join him in developing it. Of course, he went on to do what he’s done so many times when the odds were against him—he bet them.

“He’s not a corporate CEO, he’s an entrepreneurial CEO,” Mr Leven said of him. “A very broad strategic thinker—‘We’re going to build a business with my vision.’”

So it’s hardly surprising that processes and procedures, corporate hierarchies, legal and regulatory hurdles, diplomatic niceties, these are of little interest to him, and his businesses go through executives like his baccarat tables go through decks of cards. There’s the legendary pugnacious streak, a ferocity of will that often waits on men obsessed with the greatness of their schemes. At times, he’s seemed wired with an instinctive switch to attack mode, born perhaps of the hardscrabble childhood, in the face of any perceived hostility to his aims or to himself and the causes dearest to him. The Steve Jacobs imbroglio springs to mind, together with the US Justice Department and SEC investigations it has sparked—the libel suits and the relentlessness with which he has pursued them—the implacable hostility to organized labor, a major factor in the US in his princely support of the Republican Party over the years—and the staggering sums he spent to try to keep Barack Obama from returning to the White House, $100 million or thereabouts, more than any individual has been known to spend to influence any political campaign in the nation’s history.

But then he’s never acknowledged limitations, and unless he’s given up on his capacity for surpassing himself, he isn’t likely to start now. The tenacity, the combativeness, they come with the territory. Without them, Cotai might never have risen from the swamps, a swimming pool wouldn’t be floating in a city park 55 stories above the streets of Singapore, Paris might never come to China or El Dorado to the Iberian plains.

2 Francis Lui

Deputy Chairman

Galaxy Entertainment Group

Galaxy Entertainment Group and Sands China are locked in a tussle for the second spot in Macau’s market share rankings. The city’s previous monopoly operator, SJM, has managed to hang on to the largest share (inflated by its 14 “satellite” operations from which it derives only a small proportion of earnings).

Capacity appears to be one of the major determinants of who’s on top. Following the May 2011 opening of its Galaxy Macau megaresort on Cotai, GEG moved ahead of Sands. But the latter was able to reclaim its position with Sands Cotai Central, which opened in phases in April and September of last year. In Q2 2012, GEG commanded a 21.2% share of Macau casino revenue while Sands China had 17.3%. By the same quarter of 2013 their relative shares had flipped to 18.8% and 20.7%.

Come mid-2015, GEG is likely to not only once again overtake Sands, but also SJM, with the completion of Phase 2 of Galaxy Macau, which is set to kick off the much anticipated “second wave” of Cotai resort development. From there, the company is well-positioned for future development with the biggest land bank on Cotai at 2 million square meters, and, if it continues building its mass-market business at its current pace, stands a good chance of becoming by every measure the No. 1 operator in the largest casino market in the world.

Francis Lui has done so well holding his own against international stalwarts Sands, Wynn Resorts and MGM Resorts International that it’s easy to forget he has less than a decade of casino operating experience. It’s also somewhat ironic that GEG and Sands, the two companies tipped as most likely to grab the lion’s share of the market in the near future, owe their very presence in the city to each other. In fact, they were originally supposed to be partners.

In 2001, when the Macau government decided to introduce foreign competition to the local casino industry, it opened a tender for three gaming concessions, which unlike the two single-property licenses subsequently offered in Singapore, would allow concession holders to develop a potentially unlimited number of gaming venues in the city subject to government approval.

SJM, Wynn and Galaxy Casino, comprising the Lui family’s Hong Kong development company and Las Vegas Sands, won the bidding.

Although Sands had been keen to bid for one of the concessions, the city was then still an unknown quantity, and its casino industry was rife with murky associations and had a history of gangland violence. Sands may now be busily pouring billions into developing resorts in Macau, but it had originally intended to act merely as a management company and wanted an Asian partner to foot the investment bill. Furthermore, Sands wanted to ensure that should any problems arise that jeopardized its gaming license in Nevada, the partner could take over the concession.

Sands’ search for a suitable partner eventually led it to Galaxy, an entity that would eventually come to be controlled by the Lui family. The concession was granted prior to the conclusion of their management agreement, however, and although Sands and Galaxy gave assurances that it would be finalized within six months, it never was, and the government, eager not to delay the development of Cotai, decided the best solution was to disband the consortium, give Galaxy the concession and issue an independent sub-concession to Sands. The government eventually allowed the other two concessionaires to grant subconcessions, perhaps partly to prevent them crying foul, but also to open the door to more operators to hasten Macau’s tourism development.

So, inadvertently, Galaxy got a chance to cut its teeth as an operator. In July 2004, the company started running the Waldo, a third-party-owned venue, one of the four casinos of the City Clubs brand that Galaxy now operates. Waldo was the second casino to open following the end of Stanley Ho’s decades-long monopoly. Two months earlier, Sands had unveiled the glittering Sands Macao, which featured a crowdpulling interior design unlike anything the city had ever seen. Waldo, on the other hand, had been hastily converted from an office building, and its most notable feature was the garish neon sign out front. Still, Waldo’s concentration on the VIP market enabled it initially to out-gross the muchhyped Sands.

Armed with that experience, Mr Lui unveiled his first flagship, StarWorld Hotel and Casino, in 2006, and it was then that GEG’s brand identity began to emerge.

Owing to the relatively small footprint and limited amenities at StarWorld, that brand-building was initially defined by a strong service mindset and an ability to forge lasting relationships with players and junkets. That changed with the unveiling of the US$2.1 billion Galaxy Macau, which was shaped by the company’s determination not only to “give our customers what they want,” according to Mr Lui, “but also anticipate what they may want in the future.”

Mr Lui has a particular affinity for his clientele. A civil and structural engineer by training, he started his career in the late ’70s in the quarries of Hong Kong with his family’s construction materials business, and in 1985 started doing business directly in mainland China.

“If there is a person in Macau who understands what the Chinese customer will look like in the next five or 10 years it is probably somebody like me, who has been there doing business in China, seeing them evolving,” he says.

Then there’s the corporate culture. Mr Lui has been able to assemble an executive team that’s not only good at what it does but seems to be happy in the job. It begins with the humility that Mr Lui himself conveys and which stands as a key component of GEG’s success in a part of the world where personal relationships and social and familial networks are paramount in facilitating business and other dealings.

Galaxy also has capacity on its side. By October, 12 VIP gaming tables will be added at Galaxy Macau—the company has approval to add 50 tables this year under the government’s 3% cap on annual table growth market-wide.

Beyond that, in addition to Galaxy Macau’s US$2.5 billion second-phase expansion, GEG plans to spend as much as $7.7 billion to begin its third and fourth phases as early as the end of this year, with operations commencing in 2016.

The company earlier this year also completed the HK$3.25 billion ($417 million) purchase of the Grand Waldo casino hotel located near Galaxy Macau and has taken the property off the market for several months of refurbishments.

3 Lim Kok Thay

Executive Chairman and CEO

Genting Berhad

The Singapore government’s decision to legalize casinos in 2005 was arguably the impetus for Genting Group to embark on its ongoing global expansion frenzy.

Prior to that, since 1970, the company had been content to earn monopoly profits from Genting Highlands, recently renamed Resorts World Genting, which continues to enjoy an exclusive casino license in Malaysia. The catchment area for RWG covers Malaysia and Singapore, so Genting’s decision to vie for one of the two new licenses on offer in the neighboring city-state was viewed by many at the time as a defensive maneuver to hedge against expected cannibalization of its Malaysia operations.

Genting, led by billionaire Lim Kok Thay, pressed on with that bid even as other major operators, including Wynn Resorts, Melco Crown Entertainment and Caesars Entertainment, dropped out, saying the required investment was too high. The steep outlays demanded by the Singapore government eventually proved justified, of course, as the Lion City’s two IRs have gone on to become perhaps the most profitable casinos in the world.

Although revenue growth in Singapore appears to have plateaued and Genting’s property there, Resorts World Sentosa, saw revenue contract year on year in the first half of 2013, the returns still probably comfortably exceed Genting’s initial expectations and Sentosa has superseded Resorts World Genting as the group’s flagship, booking the equivalent of US$440 million in adjusted EBITDA in the first half against the Malaysia operation’s $291 million.

The outsized returns from Singapore have inspired an aggressive plan of global expansion funded by a US$7 billion war chest and interests in five publicly traded entities with a combined market capitalization of $46 billion and a portfolio of gaming, leisure and hospitality assets stretching from Singapore to the UK to the Bahamas, including perhaps the most lucrative slot floor in the US right now at Resorts World New York City.

The group also is looking at opportunities in Australia, where listed subsidiary Genting Hong Kong has applied to regulators in New South Wales and Queensland to increase its holding in Echo Entertainment, operator of Sydney’s only casino. The company may want to raise its stake in Echo to 25% and is “patiently waiting” for the go-ahead, says Mr Lim. “My guess is it will go on for a while.” Genting Hong Kong currently holds 6.6% of Echo’s ASX-listed shares.

Japan is also on the radar should Prime Minister Shinzo Abe’s government approve legalization, and a major expansion is in the works in and around the Malaysia casino. Plans call for a 3 billion ringgit (US$937 million) revamp and expansion at Resorts World Genting that will add 1,300 hotel rooms. The plan, slated for completion in 2016, includes a 400 million ringgit joint venture with 21st Century Fox to develop a 25-acre movie-themed amusement park that will feature more rides and attractions based on Fox film brands.

In the Philippines, Genting Hong Kong’s joint venture with Philippine property giant Alliance Global Group, Travellers International Hotel Group, has said it will spend US$600 million over the next three years on an expansion of their Resorts World Manila casino slated to include 1,100 more hotel rooms, a convention center and additional gaming space. Travellers also is developing one of the four IRs licensed for the Entertainment City resort complex on Manila Bay. A 2016 opening is planned for Resorts World Bayshore, as it’s called. Plans for the $1.2 billion project include 2,000-plus slot machines, 360 table games and a 1,440- room hotel.

Genting has big plans in North America as well. The company is a partner in Resorts World Bimini, a 750-acre beachfront destination in the Bahamas that opened in July with luxury villas, shopping and dining, a marina and a 10,000-square-foot casino containing 15 table games and 153 slot machines.

The company also is entering Las Vegas in a big way with its recent purchase of Boyd Gaming’s unfinished Echelon resort on the Strip. The site will be home to Resorts World Las Vegas, a phased extravaganza that will feature water attractions and amusements around a cluster of hotels. Plans include more than 400,000 square feet of restaurants and retail, 500,000 square feet of MICE space, a panda habitat, a replica of the Great Wall of China and a collection of terra cotta warriors modeled after the legions of little men unearthed from the tomb of China’s first emperor in one of the most famous archeological finds of the last century.

In the UK, where Genting bought casino giant Stanley Leisure back in 2006, the company runs 41 casinos, six of them in London. The largest of the group, Resorts World Birmingham, is under construction and slated for a mid-2015 opening.

Macau also looms large for Mr Lim, “But the door’s closed,” as he has put it. “When it next opens, we would be the first one knocking on that door and try our luck.”

The 62-year-old tycoon inherited control of the Genting conglomerate from his father, Lim Goh Tong, who founded it. He joined the company, whose far-flung holdings include palm oil production, utilities, oil and gas exploration and non-gaming hospitality, in 1976. He has been a director since 1986. He became chairman in 1993 and executive chairman in 2005. Genting Hong Kong, which he co-founded as Star Cruises, is the thirdlargest cruise ship operator in the world.

The family is ranked third on Forbes’ list of Malaysia’s richest, with an estimated net worth of US$6.6 billion.

4 Lawrence Ho

Co-Chairman and CEO

Melco Crown Entertainment

“The next wave of the golden age of Macau” is about to begin, proclaimed 37-year-old Lawrence Ho following the recent announcement that Melco Crown Entertainment’s profit in the second quarter had more than doubled year on year, underpinned by strong mass-market revenue growth at the company’s City of Dreams flagship on the Cotai Strip.

Having emerged assuredly out of the shadow of his father, Stanley Ho, one of the creators of modern gaming in Macau, Mr Ho is now leading Melco Crown toward regional expansion.

Through its Melco Crown Philippines subsidiary the company has partnered with the Philippines’ richest man, retail and property tycoon Henry Sy, on the development of a US$1.1 billion mixeduse resort with a casino—Belle Grande Manila Bay—to open next summer as the second of four IRs licensed for Manila’s Entertainment City resort complex. It will feature 1,000 hotel rooms and suites, 1,900 EGMs, 350 table games and what promises to be a vibrant assortment of non-gaming attractions.

Mr Ho is also striking out on his own, pursuing a casino deal in Russia’s Far East port city of Vladivostok, where he has concluded an agreement with a local entity for a controlling share in a resort set to open in phases beginning in 2014 and priced at US$700 million at full build-out.

Mr Ho’s is the first big name associated with Primorye, as the area is known. It is one of four “zones” the Russian government set aside for casino development back in 2009 after the industry was banned from Moscow, St. Petersburg and other major cities, where it was flourishing virtually unregulated and only lightly taxed. Mr Ho’s investment is being made through a Hong Kong-listed entity called Summit Ascent Holdings, one of five bidders the Primorye government has selected to present casino proposals. It is not known how many will be selected or when.

Until Mr Ho’s arrival, Primorye, which like the other zones is relatively remote, hadn’t struck a chord with investors, and to encourage development officials there are offering low capital minimums and tax breaks resulting in an effective levy on gambling revenue of zero. Now, Cambodia’s NagaWorld is also reported to be interested in investing, Primorye’s attraction being its relative proximity to northeast China, the Koreas and Japan. Beijing is about two and a half hours from Vladivostok by air, Harbin less than two hours. Casinos are prohibited in both China and Japan while South Koreans are permitted to gamble in only one casino in their country.

While Mr Ho has widened his regional purview, Melco Crown Entertainment remains firmly “on track and on budget” with its Macau expansion plans, he said during the recent second quarter earnings announcements. The company’s second Cotai resort, Studio City, is slated for a mid-2015 opening. Plans call for 300-400 gaming tables and 1,200 gaming machines, although, critically, the casino portion of the resort has yet to be approved. The prevailing sentiment is that it will be.

He also said he expects construction on a fifth hotel tower at City of Dreams to commence by the end of this year.

“This iconic additional hotel tower represents another powerful addition to our wide array of amenities and attractions that City of Dreams already offers its premium-mass and high-end customers, providing another tool to further extend our leading position in this key segment,” he said.

Melco Crown’s expansion plans will be aided by its improved liquidity and access to capital following its secondary listing on the Hong Kong Stock Exchange in December 2011. (The company has been listed on NASDAQ since 2006.)

The secondary listing coincided with the completion of a significant localization of the company’s top management, marking a distinct turnaround from the early days of the joint venture between Mr Ho’s Melco and Australia’s Crown Limited. Initially, a lot of the senior appointments had been former Crownexecutives from the Australian side of the partnership. This probably made sense at the time because of Crown’s extensive experience with running gaming operations in its home market. Gradually, however, as Mr Ho found his stride and felt out the market, the Crown managers have been going back home, and the company has gone from strength to strength as all senior positions have been assumed by locals.

“Because Lawrence Ho and the team are actually Chinese, and we grew up in this part of the world, we feel we understand the behavior of customers here better than anybody else,” explains Mr Ho’s second-in-command, COO Ted Chan.

5 Steve Wynn

Chairman and CEO

Wynn Resorts

Steve Wynn’s plate is piled high these days, with $2 billion in greenfield gaming investments planned in the US in the Boston and Philadelphia areas and a Web gambling license pending in New Jersey, where there’s talk he might buy back the Boardwalk casino he built a generation ago.

But by far most of what he’s tucking into is Chinese fare.

He delivered parent Wynn Resorts’ second-quarter earnings call from Macau, appropriately enough, given the dominance of the market’s contribution to corporate earnings, and it’s likely he’d been spending a good part of that time in the city poring over plans for his newly named Wynn Palace and touring the 20-hectare Cotai site.

More than $100 million in groundwork is under way there, the company said, and investors were happy to hear that the opening of the 500,000-square-meter, 1,700-room resort has been ratcheted up a year to the first half of 2016. Concerns about cost also were allayed with the assignment of a more or less final price tag of US$4 billion.

He colored in some additional detail as well. Wynn Palace will be reminiscent of Bellagio, he said, with a lake at the entrance bordered by restaurants and enlivened with fire and lights, which will sound to some a bit like Wynn Macau, but this will be on a more elaborate scale: the highlight is a sort of amusement ride: an aerial tram with gondolas in the shape of dragons that breathe smoke as they ferry visitors over the lake from the light rail station adjoining the property.

The overall theme he described as “flowers, floral things”—also reminiscent of Bellagio—but this will be quite distinct and will feature terraced gardens, floats, sculptures of various shapes and sizes, some as large as 12 meters across. “Our resorts have always had a special public entertainment piece,” he said, and at this one “The use of flowers, of water and natural light … has been taken to a new level.”

Steve Wynn, being the legend he is when it comes to design and execution, his shareholders like it when he gets ambitious, and both Wynn and its Hong Kong-listed Wynn Macau subsidiary have been trading at close to their 52-week highs—tasty Q2 dividends attached (US$1 and HK$0.50, respectively). As much as anything, though, the multiples Wynn commands are an expression of confidence in a strategy that refuses to cut corners with the luxury niche it’s established for itself, which enables the properties to succeed consistently at portraying themselves as “boutique” alternatives in spite of their obvious girth. Wynn will play poker on the Las Vegas Strip with 300 or 400 bps of occupancy in exchange for room rates that run at more than double Strip averages. There are a lot of moving parts involved in making that work, and it takes operational savvy to pull it off, and Mr Wynn, on old hand at competing in the toughest markets there are, is as savvy as they come. He’s added more prudent financial management to his arsenal, too, since relinquishing Mirage Resorts to Kirk Kerkorian all those years ago, and his skill at identifying and nurturing talented management is more in evidence than ever. This is serving him particularly well right now at the two Macau hotels, where gaming volumes have been slipping as competition on the peninsula intensifies in response to the growth on Cotai. But both are consistently Michelin- and Forbes Five Star-rated and neither is going to be budged from its position at the top of the market.

“Even when we came to Macau, we resisted the temptation to build a quickie, smaller place, to get in on it fast,” the boss has said. “We waited and we took our time. I think that that is exactly the way to go forward in China—very thoughtfully, very patiently, with great attention to detail.”

Those were the attributes that preceded Wynn Resorts to Macau in 2002, when such was Mr Wynn’s renown, his was the only non- Chinese company to be awarded one of the three new casino concessions.

And they aptly describe what he has accomplished in the market to date with operating assets the company values currently at around $5 billion and which delivered better than 94% occupancy in the first half at daily room rates averaging well above $300. Non-gaming revenues surpassed $118 million over the period. In all, Wynn Macau generated 70% of corporate EBITDA through the first half and 77% of operating income.

As for Wynn Palace, it “represents everything we’ve learned,” Mr Wynn has said. It will be “the single most important project in the company’s history”.

It’s a good location for it, too. It will be the first stop on the city’s new light rail network from Macau International Airport and the new Taipa ferry terminal under construction and the closest resort to both.

6 Ambrose So

Executive Director and CEO

SJM Holdings

As the last of Macau’s six licensees to receive land on Cotai, SJM was ready to hit the ground running there with an approach to development that is as innovative as it is expansive. Much of this comes down to the corporate leadership of Ambrose So, who is showing himself to be an ambitious and creative strategist.

A protégé of Stanley Ho’s, respected throughout the industry as a solid operational hand, in publicly traded SJM Holdings he has a company with HK$25 billion in cash and cash equivalents, minimal long-term debt and plans to take the brand beyond Macau. Reports are the company has toured Taiwan’s Penghu and Kinmen islands for possible development sites and is researching joint ventures in Japan, preferably Osaka, which Mr So says offers more developable space than Tokyo for doing something on a destination-resort scale.

On Cotai he’s gained a “leg up on competition,” as he puts it, by tripling the size of SJM’s footprint, currently the smallest at roughly 70,000 square meters, via a deal concluded earlier this month with the redoubtable Angela Leong, an SJM executive director and the mother of five of Stanley Ho’s children, to join up with 180,000 square meters she controls immediately south of it.

The blueprint for the HK$25 billion resort (US$3.2 billion) includes 700 table games and 1,000 machine games, a complement of “first-class” dining, entertainment and retail, and 2,000 hotel rooms, more than 200 of which will be apportioned to a Gianni Versace hotel under the terms of an agreement also announced earlier this month. It will be only the third hotel in the world to bear the name of the legendary fashion house and it will be a key differentiator for the resort among China’s brand-obsessed millions.

Another indicator of the unique nongaming attractions to come is contained in a deal struck with an influential cultural organization in Beijing to develop a “Wonderland of Art and Literature” at the resort featuring Chinese-themed performances, exhibitions and tourism-related promotions.

The challenge Dr So faces between now and the resort’s opening in late 2016 or early 2017 is keeping Macau’s largest casino operator at the top of the competitive heap in an increasingly crowded marketplace where much of the growth, certainly in terms of mass gaming, is already shifting to Cotai.

The company’s operating arm, Sociedade de Jogos de Macau, saw its citywide share of mass table revenues decline almost 7 percentage points in the first six months of this year from the same period in 2012, while its overall market share slipped from 27% to 25.3%. The loss of one of its four selfpromoted casinos to renovations and the closing of one of its self-promoted slot halls had something to do with that. Interestingly enough, though, the company actually grew its mass table revenue by almost 4% year on year in the first half. But such is the impact of Cotai.

Of course, the company also has to contend with the fact that 14 of the 17 operating casinos in its current portfolio are run by third parties under a variety of revenue-sharing arrangements. Generally, these are older, smaller, lower-margin venues mostly tucked into the neighborhoods of the Macau peninsula. Which is not to say they’re unprofitable. These “satellites,” as they’re known, contributed to the group a 7.8%increase in adjusted EBITDA during the first half on a 5% increase in revenues to HK$20.52 billion (US$2.6 billion). Total group EBITDA was up 11.6% year on year to HK$4.27 billion in the toughest operating environment the company has ever faced. Combined revenues were up 8.1%. Non-gaming sales were none too shabby either, up 8.3% to HK$323.7million (US$41.5 million).

The group’s flagship Grand Lisboa continues to shoulder the heavy lifting in admirable fashion. Visitation there was up 9% in the first half. Average daily room rate was up more than 4% to a robustHK$2,230 (US$285), and the hotel ran at 95% occupancy. Revenues across all segments of the property were up 12.6%. VIP was strong as ever, up 13% to HK$11.8 billion even after backing out the effect of a reclassification of 31 high-limit tables on the main floor as VIP.

Clearly, Dr So continues to make the most of the experience he’s gleaned from a relationship with Stanley Ho that dates back to the mid-1970s when he joined SJM’s predecessor, STDM, three years out of university. He was a longtime executive director of Dr Ho’s Shun Tak conglomerate, and like his mentor he moves in the highest circles of the Macau political establishment. He has been a director and a member of SJM’s senior management since the company’s founding at the end of the monopoly era. He was named an executive director in 2006, responsible for overall management and strategic execution.

7 Alvin Chau

Chairman

Suncity Group

Macau has more than 200 licensed junket operators, but one stands head and shoulders above the rest.

Suncity Group runs 18 VIP clubs with 284 tables in the city, and according to company sources, handles around HK$135 billion (US$17 billion) in bets each month. Still, more than commanding the largest share of rolling chip turnover, Suncity is the leading innovator among its peers, not only in its core business but also in pursuing other opportunities, from media and entertainment to IT solutions.

Suncity’s humble beginnings in 2007 saw 30 employees running a small-scale VIP operation at Wynn Macau. Its gaming division now has 1,200 staff and needs more. Hastening this expansion has been the youth and vigor of the group’s 39-year-old chairman, Alvin Chau, who balances an aggressive appetite for growth with an emphasis on caution in extending credit, enabling Suncity to avoid the liquidity problems that have plagued some of its less prudent rivals.

Suncity strives to distinguish itself from other junkets by providing its clients the most complete and highest-quality range of supporting amenities and services, and to that end has invested heavily in businesses outside the gaming realm. In 2008, the group established Sun City Tours, which offers comprehensive travel agency services in Macau. Suncity also owns SKY 21 Bar and Restaurant atop AIA Tower, offering panoramic views from one of the trendiest hangouts on the Macau peninsula. The group runs an über-exclusive boutique calledSKYLuxe within SKY 21, offering a collection of limited-edition and one-of-a-kind timepieces, jewelry and fashion accessories.

Suncity promotes its brand heavily by sponsoring big-name concerts and live performances. The group’s media investments often directly bolster its gaming and tourism businesses. The movie “Poker King,” starring A-list Hong Kong actors Louis Koo and Lau Ching Wan, was produced to support Suncity’s efforts to develop poker’s following among baccarat-focused Chinese players. High rollers at Suncity’s Poker King Club at StarWorld Hotel and Casino now play for the biggest pots in the world. Meanwhile, the Suncityowned e.travellers magazine and UO Macau— the leading Web site for Chinese visitors to Macau—aim to lure visitors to the city.

Although many of Mr Chau’s nongaming investments support Suncity’s core activities, others have larger standalone aspirations. Sun Entertainment Group, set up in 2008, has financed and produced a string of big-budget films, including the blockbusters “Vulgaria” and “Love in Time.”

One of the group’s greatest innovations in securing the loyalty of its customers is the Suncity Card, which not only offers points redeemable for retail, dining and entertainment purchases around Macau but also delivers discounts and other privileges. By swiping their cards at one of several conveniently located Suncity BTM Card kiosks, members can also access detailed records of their gaming activities and other spending and credit amounts they are entitled to at specific venues. Members can also avail themselves of an exclusive 24-hour concierge service.

Mr Chau has sought to further broaden the Suncity brand by making acquisitions in finance, media, real estate and health and beauty across Hong Kong, Macau and China. Other interests include the development, marketing and production of software andan iron mine in Indonesia. The company has two listed arms, Sun International Resources Limited and Sun Century Group Limited, and stresses its intention to continue diversifying into other sectors.

The sharp-dressed Mr Chau embodies the Suncity high-roller lifestyle, often pictured at elite parties in Chinese-language tabloids. But he’s known to work harder than he plays, and his professional achievements are widely recognized. Earlier this year, he was appointed to the Guangdong provincial committee of the Chinese People’s Political Consultative Conference, China’s parliamentary advisory body. Such appointments are generally reserved for senior business leaders in China.

8 James Packer

Executive Chairman, Crown Ltd

Co-Chairman,

Melco Crown Entertainment

Crown Limited wants to change its name to Crown Resorts, the better to reflect “the large investment Crown has made in its tourism infrastructure” and its “expanding domestic and global investments”—which, as rebrandings go, matches up nicely with Executive Chairman James Packer’s transition from lucky gene pool member to bonafide tycoon. At 46, he is Australia’s third-richest person, a billionaire six times over, with the eye of a world-class investor and holdings in gaming, media and the Web that span four continents.

The decision on the name will be made by Crown’s shareholders next month. Of course, it’s expected they’ll concur. If Mr Packer’s skillful dismantling of rival Echo Entertainment’s casino monopoly in Sydney has taught us anything, it’s that his ability to get what he wants is as irresistible as his father’s and grandfather’s. And he expects to replicate the feat in Queensland, where Echo’s status as sole operator in Brisbane hangs by a thread and investors as far afield as Malaysia and Hong Kong are looking to cash in Down Under on the wanderlust of China’s high-rolling millions. As the competition for them accelerates across Australia it will be surprising if it’s not James Packer who ends up at the wheel.

Crown currently is generating operating cash flow in the neighborhood of A$500 million. In the last year the company realized adjusted EBITDA of $758 million, a 5% increase, on $2.77 billion of revenue gleaned from casinos in Australia, Macau, the UK and the US. The core of those earnings are being generated in the most challenging operating environment of the four by the company’s flagship Crown Melbourne—a destinationscale 1,600-room resort that generated nearly $39 billion in VIP turnover during the year, a 9% increase—and Crown Perth in the capital of Western Australia, where a major remodeling and expansion campaign is under way, highlighted by a new 500-room luxury hotel slated to open in 2016 with an array of restaurants, bars, leisure and MICE facilities and sizable high-end gaming space.

Needless to say, what he’s planning for Darling Harbour at a projected cost of $1.5 billion will be on a grander scale than either.

That’s several years away, as we know, but that isn’t a bad thing given the money that keeps pouring in from the Chinese in Macau, where Crown’s 33.7% stake in Hong Kong- and New York-listed Melco Crown Entertainment delivered A$152.3 million in profit after adjusting for hold. Mr Packer is co-chairman of MCE and Crown owns 60% of its US$2.9 billion Studio City IR scheduled to open on Cotai in 2015 with 2,000 hotel rooms, 400 table games and 1,000 slot machines.

He’ll be counting another tidy pile of cash starting next year when MCE opens its US$1.3 billion joint venture IR at Manila’s Entertainment City with a planned 1,092 hotel rooms, 1,900 machine games and 350 tables.

In the UK, where Crown owns 40% of new-style operator Aspers, the company’s VIP casino in London, previously the famed Aspinall’s Club, generated the equivalent of A$33.3 million in normalized EBITDA. In the US, Crown owns 24.5% of Cannery Casino Resorts, which operates locals venues in Las Vegas and Pennsylvania.

Then there’s Sri Lanka, whose government has begun to entertain ideas of becoming the Indian Macau and where in one of Mr Packer’s cagiest moves to date Crown has secured approval for a US$350 million joint venture gaming resort in the capital of Colombo.

He has, as one financial blogger says of him, “a knack for discovering investments primed to pay juicy dividends,” and he’s also cast a roving eye toward the Internet, where Crown has owned a 50% stake in the Australian arm of Betfair, the world’s largest online betting exchange, for some time. Not content with that, he’s moved beyond the gaming space with investments in deals sites Scoopon and Catch of the Day and ASXlisted dot-com Carsales. More recently, he sold his stake in ASX-listed job site SEEK to take a significant interest in US-listed Zillow, a kind of real estate version of Expedia which he’s no doubt familiar with from Australia’s $5 billion REA Group, owner of realestate. com.au. Zillow, reported to have 6 million unique users, has taken off with investors in the States and had a market cap, as of this writing, of US$3.8 billion.

9 James Murren

Chairman and CEO

MGM Resorts International

MGM Macau is by far the biggest revenue generator in MGM Resorts International’s bulging portfolio of gaming, hospitality and entertainment assets, which also boasts 16 US casinos, including the flagship MGM Grand on the Las Vegas Strip and signature Strip resorts Bellagio, Mandalay Bay and The Mirage.

In the first half of 2013, MGM China Holdings, the owner and operator of MGM Macau, in which Las Vegas-based MGM Resorts holds a 51% stake, recorded US$1.6 billion in net revenue, well more than double the $604 million taken in at the company’s second-biggest earner, Bellagio. Of course, without the steady stream of Chinese highrollers being fed Bellagio and MGM’s other US properties by the Macau operation, the difference might have been even greater.

Prior to the $1.5 billion MGM China IPO on the Hong Kong Stock Exchange in May 2011, MGM had held a 50% stake in the Macau operation. Pansy Ho, daughter of erstwhile Macau casino monopolist Stanley Ho, held the other 50%. Ms Ho pocketed the proceeds of the 20% public offering and privately sold an additional 1% to MGM at the IPO price so it could assume a controlling interest. Ms Ho’s stake was diluted to 29%.

Given the property’s critical importance to the parent company’s earnings, engineering that buyout may be one of the smartest investments James Murren has made since becoming chairman and CEO of MGM Resorts in December 2008. He had joined the company as CFO in 1998, prior to which he had pursued a career on Wall Street that saw him lead a pivotal recapitalization of the company’s predecessor, MGM Grand Inc., in 1996 and culminated in a managing director’s position at Deutsche Bank.

Mr Murren is credited as the architect of the key acquisitions—Primadonna Resort & Casino in 1998, Mirage Resorts in 2000 and Mandalay Resort Group in 2005—that transformed MGM into one of the world’s largest gaming companies. They also loaded it with debt. Since 2008, he has led an extensive corporate reorganization and cost-cutting which together with a $3.8 billion refinancing kept the business afloat during the financial crisis and has helped it weather a challenging Las Vegas market since.

The major drag on the company’s balance sheet when the financial crisis hit was CityCenter, the $8.5 billion resort and retail mega-complex that was under construction at the time in partnership with Dubai World. Getting CityCenter open in December 2009 has to rank as another of his great achievements, but the resort has struggled to produce the earnings that were anticipated for it, and the cash flow contributed by MGM China has been crucial to Mr Murren’s ongoing efforts to manage the company’s US$13 billion-plus of long-term debt. MGM China generated $387 million in adjusted EBITDA in the first half of 2013, up 9.9% year on year. It also declared a special dividend of $113 million, of which MGM Resorts collects $57 million through its 51% share. MGM China has returned $312 million to the parent company so far this year.

While the herculean task of debt reduction has consumed the better part of Mr Murren’s five years at the helm—and to his credit he’s displayed some financial wizardry over this time—his strength as a strategic thinker has worked to keep the company as innovative and opportunistic as it is big.

Its MGM Hospitality arm has progressed from vision to reality, opening a luxury resort in Sanya on China’s Hainan Island in February 2012. MGM Grand, Bellagio and SkyLofts hotels are planned or in various stages of development in North Africa, in Dubai and Abu Dhabi and in India, and a number of five-star properties are being mapped for cities across China in partnership with renowned Diaoyutai State Guesthouse. Investment firm Union Gaming Research Macau considers the tie-up with Diaoyutai to be “an underappreciated driver of VIP business to MGM Macau”.

MGM China, meanwhile, continues to hold its own as a single-property operation in an increasingly competitive, increasingly multistore marketplace. Support is anticipated to arrive by mid-2016 with the opening of a Cotai resort, the official groundbreaking for which was held in February. Described by Mr Murren as “our most stunning resort and casino yet,” the property will have 1,600 hotel rooms, 2,500 slots and up to 500 gaming tables. The construction budget is set currently at HK$20 billion (US$2.6 billion).

10 Edward Tracy

President and CEO

Sands China Ltd

Ed Tracy may not have brought to Macau the flashiest of CVs, but here he’s been for three solid years, two of them as CEO, the pilot in the engine room of the Las Vegas Sands money machine, where he’s currently directing capital expenditure commitments of more than US$3 billion.

Since formally taking the helm in July 2011 he’s overseen a period of growth and prosperity at Sands China that is remarkable in every respect, not least for its success in re-establishing key relationships with the junket industry and for advancing the development of the brand through a series of significant non-gaming attractions.

He’s been a pivotal figure as well for the welcome level of comfort he’s provided the investment community and the political and regulatory establishment.

He’s provided something else in the process, rather more rare in the often tumultuous world of upper management under Sheldon Adelson, and that’s stability at the top, which will prove critical in the months ahead in the wake of the recent departure of Chief Operating Officer David Sisk and Vice President of Casino Operations Hugh Fraser.

Certainly Mr Tracy’s steady hand was critical to getting the first three stages of the US$4.4 billion Sands Cotai Central resort complex up and running. And it has positioned the company not eight months since SCC’s third hotel was fully built out (and with a fourth under construction) to jump right into a major new project planned for its last developable parcel on Cotai. This will be The Parisian Macao, fully themed, as the name implies, with 3,000-plus rooms and suites, a freestanding half-sized replica of the Eiffel Tower and a projected cost of US$2.7billion, including land costs. Opening is expected in late 2015 or early 2016.

His effectiveness has shown through equally on the operations side, where he has restored Sands China’s standing at the high end of the market and kept the group cranking at full speed as the dominant force in the territory’s mass gaming boom.

He’s got SCC ramping up nicely across all sectors. Slot handle was up 272% in the six months ended 30th June. Mass table drop increased more than fivefold. A corporate-wide expansion of VIP capacity launched earlier this year helped triple rolling chip turnover at the property in the six months that ended 30th June. Plans are in the works there to add another 3,700 square meters of gaming space with 100 table games over the next year.

EBITDA was up 39% to US$709.5 million at mass-market leader The Venetian in the first half, driven by a 38% surge in main-floor table play. The Venetian and SCC combined generated more than three-quarters of a record-setting $1.28 billion in six-month group EBITDA on total revenues that surpassed $4 billion. This extended beyond the gaming floor, too, with substantial increases posted in room sales (+45%), F&B (+59%) and retail (29%).

An impressive run so far, all things considered, for a man who was entirely new to the China market when he arrived in August 2010. His 20 years in gaming up to that point were spent in the United States, where he served as Donald Trump’s CEO in Atlantic City in the early ’90s and later ran a chain of riverboat casinos in the Midwest.

At The Venetian he’s got the most expansive physical plant in the market and he’s been employing it well, bringing a parade of Chinese and Hong Kong headliners to perform at the 15,000-seat Cotai Arena and taking it further with spectacles on a Las Vegas scale, among them two sold-out shows this month by pop star Rihanna.

The strategy, which also envisions Macau as a destination for bigtime boxing, really took flight in April with the professional debut of two-time Olympic gold medalist Zou Shiming, whose bout at the arena reportedly was viewed by more than 100 million Chinese on state broadcaster CCTV. He returned to the arena for a rematch in July, prompting his celebrated trainer, Freddie Roach, to remark, “I think I’ve got a new home.”

Top Rank’s Bob Arum, who is promoting a highly anticipated Manny Pacquiao bout at Cotai Arena in November, says he envisions holding four to six fights in Macau a year. The Pacquiao spectacular, which will feature young Zou on the undercard, will be the Filipino superstar’s first fight outside the US since 2006.

There are reports, unconfirmed as of this writing, that the arena also will be hosting the first Ultimate Fighting Championship in China and that will happen later this year.

In July, Tracy & Co. brought a slice of Hollywood to town via a licensing deal with DreamWorks for a number of interactive family experiences at Sands Cotai Central that feature the studio’s Shrek, Kung Fu Panda and other characters from its popular animated films.

Next: The Asian Gaming 50 – 2013: 11-20