Touted as ‘the next Thailand’ on the strength of its inherent tourism appeal, Myanmar is looking to add legal gaming and integrated resorts to the mix. Indochina correspondent Richard Meyer looks at the country’s current gray-area gaming market and prospects

There’s a lot of buzz surrounding the reopening of Myanmar—ostracized by large segments of the international community during military rule from 1962 to 2011—to the global economy.

Hundreds of world leaders and industry chiefs converged on the country in June for the World Economic Forum on East Asia. Addressing the forum, Coca-Cola CEO Muhtar Kent compared the establishment of his company’s first Myanmar bottling facility to the fall of the Berlin Wall. That’s a grand vision, and the obvious caveat is that while Myanmar boasts 60 million domestic consumers, the vast majority are rural dwellers—76% are without electricity and more than 90% don’t have a mobile phone.

The obvious caveatis that while Myanmarboasts 60 million domesticconsumers, the vast majorityare rural dwellers—76%are without electricity andmore than 90% don’t havea mobile phone.

The country’s resources boom has, however, created a very wealthy minority and is attracting foreign investors aplenty. The ranks of tourists in the country are also swelling. Standing ready to serve them all is an evolving gaming sector. None of it is officially accepted, of course, but most of it is tolerated and functioning without significant interference.

Legal loopholes are aggressively exploited, ownership by influential individuals protects some of the operations, and a good deal of the action takes place in semi-autonomous areas where the national government wields little power. The country’s international isolation over the last few decades and the political climate that engendered have in some ways been good for its gray-area gaming sector. In certain parts of the country, especially in the capital, Yangon, the power structure has lent itself to the development of informal and lessthan- transparent arrangements. And the insurgencies in the so-called Black Zones have allowed for development that normally would not be allowed by the national government.

Myanmar has quickly become one of the most promising destinations for international capital.

In terms of scale, Myanmar’s gaming industry is on a par with that of Cambodia. The country has an estimated 60 gaming establishments. While most are small-sized slot parlors with spartan surroundings, there are also considerably larger establishments offering high-stakes table games for VIPs coming in from neighboring countries.

The industry in its current form is highly profitable and demonstrates strong underlying demand both from locals and those in neighboring countries willing to cross the border to play. The government is developing a plan that will allow for the operation of a number of legal gaming establishments—potentially paving the way for world-class integrated resorts run by publicly listed international operators. The consensus among insiders is that Myanmar could develop a comprehensive gaming strategy that leverages its natural advantages to become a key regional destination of the future.

The catchment area for Myanmar will be much the same as that of Cambodia: Thailand, China and Malaysia. While Vietnam lies a bit farther, Myanmar’s ascent could very well cannibalize Cambodia’s gaming operations.

The hope is that Myanmar could one day become the next Thailand.There are clears parallels. It is an overwhelmingly Buddhist country, blessedwith natural beauty and a friendly population.

Big Changes

Myanmar is undergoing rapid change. During military rule, the country was subject to a wide range of sanctions placed on it by Europe, the US, Canada and Australia. After reforms were initiated in 2008 and an election held in 2010, political freedom was greatly expanded, leading to the lifting of most major sanctions, including the US prohibitions against investment in and provision of financial services to the country.

Myanmar has quickly become one of the most promising destinations for international capital. The country is in desperate need of funding and foreign bankers see great opportunity across the board. Myanmar is rich in natural resources and has cheap, educated and productive labor. Meanwhile, it is short on manufactured goods, some of which can be produced domestically.

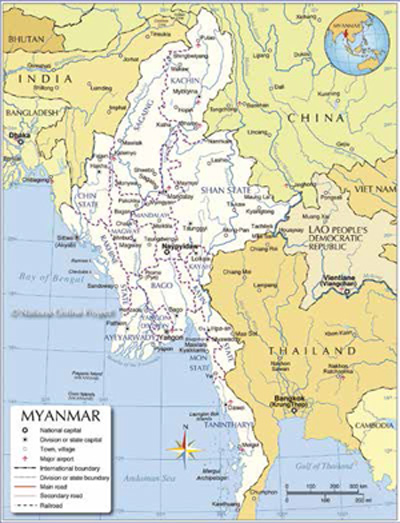

Tourism is one of the most interesting sectors for development and foreign investment. The country is largely undiscovered by foreigners and offers a wide range of scenery and experiences, from pristine beaches in the south to alpine mountains in the north, and in between crumbling former colonial cities, historic temples, monasteries, reclining Buddhas and lakes. Furthermore, as a result of the decades of international isolation, many of the tourist sites remain unspoiled. Tourist arrivals hit 1.05 million in 2012, up from 816,000 a year earlier, and are expected grow over the next few years.

The hope is that Myanmar could one day become the next Thailand. There are clear parallels. It is an overwhelmingly Buddhist country (90% of the population), blessed with natural beauty and a friendly population. Some observers suggest that Myanmar could eventually outshine Thailand. It’s slightly larger, more diverse and, due to the political fragmentation and insurgencies, it is not yet overrun. Thailand gets 21 million visitors a year, suggesting Myanmar could see its tourist traffic multiply over the next decade. The current target is for the country to host 7.5 million visitors by 2020.

Casinos are low-key and casual,with limited staff and little apparent security.The décor is decidedly minimalist—plastic chairs,old carpets and wobbly tables.

Myanmar’s transport and tourism infrastructure are a limiting factor; roads are poor, airports are too small, international air connections are limited—often provided by old clunkers—and hotels are too few, often expensive and in need of refurbishment. But money is being poured in—some from the Asian Development Bank and other mulilaterals—to address these deficiencies, in particular to improve accessibility and connectivity. Already, direct flights are available to Mandalay from Bangkok and soon direct scheduled international connections may be available to Naypyidaw, the country’s capital since 2006.

The erstwhile capital, Yangon, with a population of over 4 million, is the country’s largest city and center of commerce. Dotted around the city are about 30 gaming establishments that for the most part operate under amusement licenses. While they do offer games that are strictly speaking not gambling (such as the machine where a robotic arm is used to pick up a fuzzy toy), in the back of these establishments are a wide range of gaming machines, from slots to electronic baccarat, poker and roulette machines. The amusement centers also offer bingo and pachinko. The environment is low-key and casual, with limited staff and little apparent security. The décor is decidedly minimalist—plastic chairs, old carpets and wobbly tables.

The machines are also quite basic. Aristocrat slots are common, but they are circa 1980s models. Other brands include Sega, Aruze, Sigma, Cinematech, Huga, Apollo, as well as made-in-China clones and computer-based gaming applications. In some areas the gaming halls resemble Internet cafes, with banks of screens on long tables for customers.

Many of the arcades feature sliding shutter doors separating the amusement and gaming areas. Borrowing from the Japanese pachinko model—where prizes are given that can then be sold back to independent vendors located nearby—the gaming establishments in Yangon issue tokens that are exchanged for vouchers that can be converted by independent agents for cash at a discount to face value. According to Danny Too, vice president of marketing at Taiwan-based gaming machine supplier Jumbo Technology, the basic token costs 100 kyat, which is worth roughly US$0.10. Each token has five credits. At roulette, he says, the minimum bet is one token while the maximum is 1,500 credits, or roughly $150.

The amusement centersdon’t seem to fear theftor the authorities. Theyhide in plain sight.One is above a food courtright downtown.Others are in office andcommercial buildings.

The amusement centers have custom-built and -programed machines to print the credits receipts. Although these receipts could easily be forged, there does not seem to be much concern for security. After years of military rule, crime in the country is low. Gold shops near the gaming halls, for example, openly display their wares behind regular glass and without the benefit of guards.

The amusement centers don’t seem to fear theft or the authorities. They hide in plain sight. One is above a food court right downtown. Others are in office and commercial buildings. Many are located in and around Yangon’s colorful and sizable Chinatown. The names of the centers are fairly vague and do not suggest gaming: Avatar, Alibaba, Ever Happy, City Center, Fun World and Happy Valley. The word “amusement” is invariably mentioned somewhere on their signage.

The Andaman Seas and the Black Zones

Gaming venues operate in other parts of the country, and some of them are quite well-established and much larger than their counterparts in the capital. Thahtay Kyun Island, in the Andaman Sea near Thailand’s city of Ranong, has two casinos. The Andaman Club is a Thai-owned golf and casino resort set on 730 hectares. It has gaming machines and tables and offers roulette, blackjack, baccarat and poker. Treasure Island Casino, the largest gaming establishment in the country, is located nearby and offers both EGMs and tables. Access to the islands is relatively simple for Thais and people living and staying in Thailand or regionally. They can fly to either Surat Thani or Phuket and drive to Ranong. From there, the casino is a 20-minute, 5-kilometer boat ride away. Immigration procedures are simplified and no visa is required for Thais or holders of non-Thai passports.

The other major center of activity is Tachilek, right on the Myanmar-Thai border near Mae Sai and not far from Chaing Rai. It has more than half a dozen openly run casinos. They include: Regina Hotel Casino, with 12 tables and 30 machines; The Maekhong River, with two floors of gaming; the Allure Hotel, with an estimated 200 machines; The Golden Triangle Hotel, with 80 EGMs and 15 tables; and Las Vegas and the Aka, with only EGMs. An estimated 10 underground casinos are also active in the area. According to a source who has visited the gaming establishments in Tachilek, the gaming machines there are very productive.

Other border areas also have casinos. Win Win and the Paradise Casino are not far from Tachilek. The Wangpha Casino & Resort and Japanese-owned M’s Casino are in Myawaddy at Thailand’s Mae Sot border. There is also considerable activity on the Chinese border, and it has been that way for some time. Casinos are established at Mongla, in Shan State near Xishuangbana, China, and 16 kilometers south in Wan Hsieo, though this area suffers from periodic gambling crackdowns by Chinese authorities. In each region, the most common currency is used. In Yangon, it is the Burmese kyat. At the Chinese border, the renminbi is used. Along the Thai border, the baht predominates.

One major center of activity is Tachilek,right on the Myanmar-Thai border near Mae Saiand not far from Chaing Rai.It has more than half a dozen openly run casinos.

While these casinos operate in legal gray areas, the local authorities are relatively tolerant of them given the connections of some of the owners and the difficulty of enforcing laws in the Shan State, which is semi-autonomous because of formal agreements and the insurgencies. In some parts of the country, the influence of Thailand and China is stronger than that of Yangon. In Mongla, for example, utilities are supplied by China and the border is controlled by people from the neighboring country. Despite the ongoing peace process, there’s a good chance the localities will retain autonomy to a certain degree, enabling them to set their own rules regarding gaming. Small-scale operations, such as slot parlors, are almost certain to persist whatever happens.

In some parts of the country, the influence of Thailandand China is stronger than that of Yangon. In Mongla, forexample, utilities are supplied by China and the border iscontrolled by people from the neighboring country.

In the background, however, the national government is pursuing the establishment of a more formal and regulated gaming sector. At this stage, not much has been decided and there’s no set plan. But the government is quite serious about developing a gaming sector and is undertaking in-depth preliminary research. It is examining different options and looking closely at experiences with gaming elsewhere in the region, specifically in Cambodia, Laos and Vietnam, as well as Singapore and Macau.

Myanmar’s gaming initiative is being led by the Ministry of Hotels & Tourism, according to a person with knowledge of the discussions. While the Office of the Attorney General, the Ministry of Home Affairs and the Ministry of Finance and Revenue are all involved, and tax revenue is certainly one of the major factors behind the push for gaming, the primary motivation is boosting tourism.

Myanmar looks likely to follow Cambodia and Vietnam in only allowing foreign citizens to gamble at its legal gaming venues. It is also believed that the government will institute a two-tier licensing system. One will be for small- and medium-sized establishments, essentially allowing the existing operations to be grandfathered in as legal establishments. The government appears unwilling to simply drive the gaming venues currently in existence out of business or further underground. The other category covers large-scale casinos, enabling the development of integrated resorts.

Karen women dressedin traditonal clothingpresent garlandsto Karen National Unionsoldiers in Karen State,near the Thai-Myanmarborder. The KNU havewaged a war againstthe central governmentsince early 1949. The aimof the KNU at first wasindependence.Since 1976 the armed grouphas called for a federalsystem rather than anindependent Karen State.

Importantly, it seems likely that the government will restrict gaming to certain designated areas in the country. These areas have not yet been set, but the general sense is that the government does not want slots on every corner.

Observers suggest that gaming in Myanmar will be legalized after the 2015 general election—an election viewed as key to confirming the country’s reform policies. There are lots of other pressing issues to deal with first, however. The government is backlogged trying to update key laws to bring them into line with the new political and economic environment. Also, major challenges must be overcome before legal gaming is even possible in Myanmar. First and foremost are the cultural hurdles. Like Thailand, Myanmar is a Buddhist country and while Buddhist doctrine does not stipulate an outright ban on gambling, its teachings do seem to frown on the activity. It is possible that a push by the Myanmar government to legally recognize gaming could meet with resistance from the religious community.

Two aspects of the law need to be amended to pave the way for legal gaming in Myanmar. Apart from lifting the actual injunction against the activity itself, according to Edwin Vanderbruggen, a partner at VDB Loi Limited in Yangon, under the Contracts Act of 1872—still very much on the books—gambling debts are not legally enforceable in the country. While some workaround might be possible through administrative rulemaking, it is more likely that parliament will have to take up the issue, increasing the chances that the legalization of gaming will meet resistance.

Many other impediments lie ahead. The country’s myriad vested interests will undoubtedly interfere in the process, while inflationary pressures are mounting. Commercial rents are soaring and wage pressures are intensifying—over in Cambodia, the gaming industry has recently been struggling with workers’ wage demands and strikes. Still, given the enormous pent-up demand for gaming in the region as well as the country’s inherent tourism appeal, it’s a safe bet that international operators will flock to develop integrated resorts in Myanmar once the regulatory framework is in place to welcome them.

It is possible that a push by the Myanmar governmentto legally recognize gaming could meet with resistancefrom the religious community.