James Packer appears to have won his battle to develop a luxury resort in Sydney the likes of which Australia’s gaming industry has never seen. Not that the outcome was ever in doubt. What happens next is more difficult to handicap

Australia’s long tradition of one market-one casino is history, swept away on a rising tide of Chinese wealth.

James Packer’s A$1.5 billion Crown Sydney Hotel Resort doesn’t yet have a development deal with New South Wales, doesn’t have legislative or planning approval, doesn’t have its all-important gaming license, but it’s looking like a go, barring a massive public backlash. Its swirling 60-story hotel tower, the tallest structure in the city at a planned 250 meters, is already penciled onto the skyline, and that was true for all intents and purposes at least as far back as last August, when Mr Packer’s Melbourne-based Crown Limited locked itself in as the exclusive resort developer at Barangaroo, a waterfront lot ideally situated on the edge of the Central Business District and the last significant buildable acreage on Darling Harbour.

There has been an air of inevitability surrounding Crown Sydney from the start. It had “done deal slapped all over it,” groused Richard Ackland, a columnist for the Sydney Morning Herald, writing last October.

No question. And deservedly so, perhaps, as it directly addresses mounting public- and private-sector concerns that New South Wales and its principal asset, Sydney, are missing out big-time on the Asia tourism boom.

This was detailed in stark terms in a report issued in June 2012 by the state’s Visitor Economy Taskforce:

Rendering of Crown Sydney

“NSW needs to confront the fact that its destination appeal has waned and it has lost its No. 1 status across a number of measures. It has been outperformed and outspent by competitor destinations in Australia and the Asia-Pacific region over many years and its competitive position has been eroded.”

The state “requires growth not only in visitor numbers but also in visitor spend,” the report said.

In other words, it needs to become more like its sister state of Victoria, whose share of international arrivals has increased as New South Wales’ has fallen. Victoria also happens to be home to Crown’s flagship resort casino, Crown Melbourne, the most popular attraction in Australia, according to figures compiled by Euromonitor International, and this is significant in light of the “high-spending, particularly high-yield international visitors, predominantly from China” which the Taskforce identified as NSW’s “key target market”.

Actually, casinos are the country’s second- and third-most popular attractions, too, if Euromonitor’s numbers are to be believed. Crown rival Echo Entertainment’s Jupiters Gold Coast in the state of Queensland booked 10.6 million visits in 2010. Echo’s monopoly casino in New South Wales, The Star, which sits on a cove of Darling Harbour within sight of Barangaroo, had 9 million. (The Sydney Opera House was back there somewhere at a mere 7 million.)

But Sydney has infrastructure problems. Mainly, it needs more quality hotel rooms. The city is running at better than 86% occupancy (“very high” by world standards, the Taskforce’s report notes), and average rates exceed $200 a night. It’s estimated that between 5,000 and 8,900 more rooms will be needed by 2020 to meet visitor demand.

It’s not a problem that is Sydney’s alone. The last decade has seen Australia drop from the world’s No. 3 destination for luxury travelers to No. 7, according to the Hurun Report, a Shanghai-based magazine that tracks trends among China’s burgeoning wealth class.

“My overall take is that I don’t think the Australian tourist industry in general has put much effort into the luxury consumer,” said Hurun’s Editor Rupert Hoogewerf in a recent interview with Australia’s Fairfax Media. “Ten years ago it was the preferred destination for Chinese tourists, full stop. But what’s happened, as other countries have come up, Australia has dropped down the list for luxury travel. I have not seen any events or media (advertising and marketing) from Australia that is targeting the luxury consumer. Basically they have coasted very nicely. It may not mean things are not happening, but they are on such a low-key profile compared to Singapore, which is all over China and targeting the top-end spenders.”

And there is this from a June 2012 report by Allen Consulting Group, which Crown hired to help the company make its case for Crown Sydney with the state:

“Most Asian cities have the added advantage of being lower cost economies where international tourist dollars stretch further. As it is very difficult for Sydney to compete in terms of price, it is essential for Sydney to differentiate itself by offering quality tourist attractions and tourism products.”

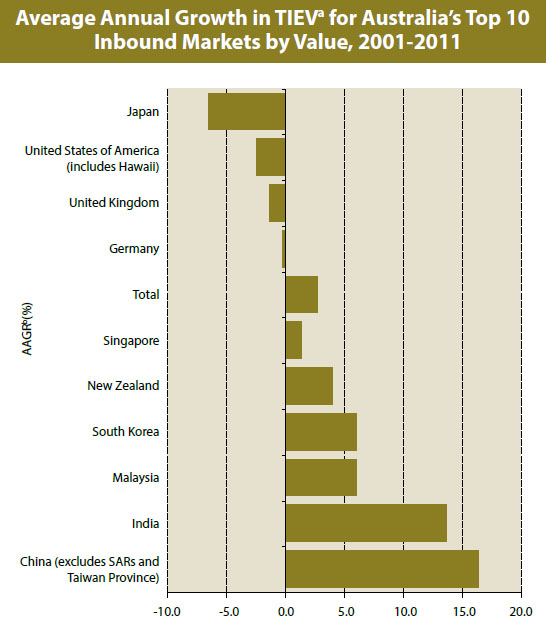

Source: Australian Bureau of Statistics, Overseas Arrivals and Departuresa

- Total Inbound Economic Value, (or tourism exports),

- Average Annual Growth Rate

It is an easy sell, all things considered, the idea that the city needs a better and more ably managed mousetrap than The Star, and it’s ultimately what won the day for Crown.

As Mr Packer wrote to the NSW Cabinet in June, “The Star has failed to capitalize on the opportunities provided by the growth in Chinese tourism, the massive Asian high-roller market and Sydney’s natural attraction as a superior destination for high-end tourists and VIP players.”

The case for Mr Packer as the man to turn the situation around was supplied by a blue-ribbon committee appointed last year by Premier Barry O’Farrell, who has made no secret of his belief that the casino tycoon would be good for Sydney and for New South Wales. Heading this committee was well-known banker David Murray, who used to manage the Australian government’s pension funds. Its advisors included a retired judge of New South Wales’ Court of Appeals. Meeting behind closed doors they weighed Crown Sydney’s merits against the monopoly status quo. Echo, which holds license exclusivity in the state through November 2019, didn’t go quietly but shook things up with a $1.1 billion counter-proposal, which it amended at the 11th hour with an interesting but unwelcome offer not only to share the market but to throw a pedestrian bridge across the harbor to link the rival resorts. The panel took all of eight working days from formal submissions to get its ducks in a row. The Cabinet took even less time to accept its recommendation and on 4th July approved Crown Sydney to move to the final stage of the process state law requires of so-called “unsolicited projects,” which means negotiating a binding offer with the government and obtaining the aforementioned approvals. It will cost Crown an up-front payment of $100 million to get the ball rolling.

“The decisive factor was the opportunityto introduce competition into the market.Sydney was falling shortof its potential share of the growinginternational gaming and tourism marketand has underperformedcompared with Melbourne.”— New South Wales Premier Barry O’Farrell

It also means Sydneysiders finally are going to get their say, and that could prove lively.

For Mr Ackland at the Herald, “Harnessing economic growth to gambling is such a hackneyed, failure-ridden experiment that it’s a wonder it’s being seriously entertained in this city.”

A grassroots petition is being circulated online opposing Crown Sydney, abetted by the likes of Alex Greenwich, an Independent for Sydney in the NSW Legislative Assembly. “Public submissions were not sought, there was no community debate and massive community opposition was ignored,” he says. “I asked for terms of reference and they were not forthcoming with that. The government has rushed every step of this process and they have changed the rules constantly.”

Greens MP John Kaye has been rather more blunt, calling it a “sham and the outcome a disgrace”.

Defending the government’s decision, Mr O’Farrell said, “The decisive factor was the opportunity to introduce competition into the market. … Sydney was falling short of its potential share of the growing international gaming and tourism market and has underperformed compared with Melbourne.”

He has an argument. In the decade up to 2011, Victoria grew its share of Australia’s total inbound visitation by 8% while New South Wales’ fell by 7%. The gaming comparison isn’t entirely fair, though. Crown Melbourne has three times more hotel rooms than The Star and 1,000 more machine games and far fewer pub and club slots competing for business. There are some 515 venues with machines games operating in Victoria, where total devices are capped at 30,000, versus more than 3,000 locales in New South Wales, where up to 99,000 devices are allowed. Crown Melbourne has 60% more table games than The Star and therefore more capacity to serve high rollers. VIP accounts for about 30% of Melbourne’s total gaming revenue. It’s around 19% at The Star.

“If you look at markets that have beenliberalized, the liberalization process tendsto grow markets over restricted-supplymarkets, and Sydney is restricted in termsof table supply.”— David Green, Newpage Consulting

Critics, however, point out that if the government was serious about competition it would have opened the market to outside bidders, as Macau and Singapore did, or at least hold a tender for the second license. “What Sydney gets from this chronically flawed process won’t be what David Murray’s committee outlined,” wrote Michael Pascoe in Business Day. “All that really happened was Echo’s Star monopoly being bumped into a ditch.”

But that hasn’t entirely been settled either, according to David Green, a former regulator in South Australia who heads the gaming practice at Newpage Consulting, based in Macau. “The New South Wales auditor-general has already said tender rules do apply. The AG reports to [the Legislative Assembly] directly. So it’s a very important position. And the government will be careful not to appear to buck it. I think it’s the reason why the advisory panel was set up, to see whether the government can entertain an unsolicited bid without going to tender.”

Supporters, on the other hand, point to the fact that no one else is stumping up $1.5 billion for tourism development in Australia’s largest metropolis, which has seen only one new five-star hotel since the turn of the century (Echo’s The Darling at The Star, ironically enough). That’s why Patricia Forsythe, executive director of the Sydney Business Chamber, calls Crown’s approval a “clear winner” for the city, and Ken Morrison, who heads the Tourism & Transport Forum, a national private-sector think tank, calls it “great news”.

“What we need in this city is a new tourism magnet,” he said, and Crown’s “will draw in thousands of new international visitors.”

Mr Pascoe is among the many who agree with this, at least in principle. But a proper discussion of it has been short-circuited, in his view. “What Crown skillfully scuttled was the opportunity for a genuine review of what New South Wales’ optimum gambling industry might be. The state is awash with opportunities for mugs to lose money—close to world’s worst practice when it comes to pokies—without a serious appraisal of how it all fits together.”

‘This Isn’t the End’

Or has that conversation merely been delayed?

In its report, the Murray committee said, “It is likely that Echo would be motivated to undertake at least some of its published strategic investment plans in response to the introduction of competition.”

Echo Chairman John O’Neill said only that the company is “exploring other initiatives”.

But it’s reported that Malaysian conglomerate Genting Group recently bought another chunk of Echo’s swooning stock to lift their investment in the embattled operator, which is also under a concerted Crown assault in Queensland, to more than 7%, and they’ve applied to regulatory authorities in NSW for permission to increase that above 10%.

Crown Melbourne

“I’m sure there is another angle they are pursuing,” said fund manager and Echo shareholder Paul Xiradis. “They are a world-class operator.”

Certainly they’re a resort giant every bit Crown’s peer, with holdings that include Singapore’s Resorts World Sentosa, the megaslot house at Resorts World New York City and a sizable chunk of land on the Las Vegas Strip where they’re planning a casino with several billions of dollars’ worth of hotels and other attractions.

As one prominent local investor put it, “This isn’t the end of the game.”

As for Crown Sydney, what the corporate literature promises at Barangaroo is “a landmark building instantly recognizable around the world” with 350 rooms better than Forbes 5-star at 55-70 square meters standard and suites and villas of 100-500 square meters. There will also be 80 luxury apartments for sale. Not much detail has been released beyond that. There will be meeting and exhibition space, some of it outdoors. There will be “luxury sun decks” and no doubt something suitably spectacular 250 meters up on the roof. The public spaces will be targeted at the well-heeled with celebrity chef restaurants, bars and lounges, high-end retail, a state-of-the-art spa and an infinity pool. Construction is expected to take three and a half years once all the approvals have been obtained and the gaming license secured. Crown wants to open the hotel by 2018, the casino the following year when Echo’s monopoly expires. Barangaroo should be fully redeveloped at that point, and Crown expects it will be welcoming an average of 33,000 visitors a day.

There is never mention of a “casino,” only a “VIP gaming facility,” a euphemism Mr O’Farrell and the government have readily embraced. It will occupy at most 20% of total gross floor area or 20,000 square meters, whichever is less—a considerable space, considering that slots are not allowed and there will be only 120 table games (“initially,” Crown says) together with their electronic multi-terminal variants. (No word yet on how these will be counted as part of the whole.) Main floor table revenue will be taxed at 29%, 10% on revenue derived from junket play, same as at The Star. This includes Goods and Services Tax and a community benefit levy of 2%. Crown wants the GST rebated on international play and domestic play outside New South Wales.

Plans so far call for 10 private gambling rooms, although play throughout will be on the basis of membership, “which aims to attract high-spend patrons,” Crown says, “similar to that operating in the VIP gaming areas at Crown Melbourne.” This is expected to limit participation by locals to no more than 5%.

But how the company and the state are defining “VIP” has observers somewhat confused. Crown’s submission to the government makes provision for “low-limit” tables priced at minimums that may vary from A$30 for baccarat to $25 for roulette to $20 for blackjack to the lower of wherever minimum bets may fall “from time to time” on the same games in the VIP areas at Melbourne. Macquarie Securities analyst Andrew Levy describes this as the “low side of expectations”. By comparison, minimums at Macau’s public tables have averaged something north of A$230 over the last 12 months, according to Deutsche Bank research. Crown Sydney’s definition of VIP, Mr Levy wrote in a note to investors, “does leave scope for higher-than-expected levels of cannibalisation of The Star’s existing customer base.”

Mr Xiradis called it a “game changer” in an interview in The Australian. “To me it doesn’t make commercial sense. I am suspicious of how the thing will work.”

A fund manager who declined to be named said, “Thirty dollars a hand is not VIP. That is a full-blown casino.”

Working from this expansive definition, Mr Packer told the government he is confident Crown Sydney will “almost treble the volume of VIP business coming to Sydney from Asia, and in particular China”—leveraging the value of Crown’s 33% joint venture stake in Macau operator Melco Crown Entertainment together with the company’s “extensive” pan-Asia sales network and its success at marketing to the high end at Crown Melbourne.

Mark Wilson at Deutsche Bank says Crown will need $23 billion in annual wagers in Sydney to achieve a return he would deem “adequate”. That shouldn’t be too difficult, given the $24.3 billion the company booked in VIP turnover at Melbourne in the six months ended in December. Crown won over the government in part by persuading it that Sydney was being “short-changed” on tax revenue on VIP compared with Melbourne, where the company generates twice as much from the overseas trade as The Star and half again as much from domestic VIP. TheStar boosted its turnover in the sector by 20% in the six months through December, but the total was only about half of Melbourne’s. Normalized for hold, The Star kept $72 million of it. Melbourne realized $327 million in VIP revenue over the same period, but normalization played a more significant role, its win rate having dipped to 1.23%, well below the expected range of 1.35%.

But in attempting to assess Crown Sydney’s prospects against this reputed underperformance on the part of The Star it helps to remember that VIP accounts at most for about 35% of Australian casino revenues, if that—and this is “VIP” rather broadly defined, as the project’s proposed minimums show—and Australia accounts for only about 3% of the Asian VIP market. Analyst Sacha Krien at CLSA believes Crown Sydney can boost this by $500 million a year, which in two years would lift the country’s share to 4%. But what will be the impact of increased competition elsewhere in the region? The Philippines will likely be home to four new integrated resorts in Manila by the time Sydney opens, and South Korea will have expanded at some level, and Taiwan and very possibly Japan will have opened up.

Crown doesn’t like the cannibalization discussion and succeeded in beating it back in NSW by claiming that far from slicing Sydney’s pie thinner it will improve VIP revenue at The Star by 15% within three years.

Mr Green doesn’t think it will be an issue either. “I think it runs against history,” he says. “If you look at markets that have been liberalized, the liberalization process tends to grow markets over restricted-supply markets, and Sydney is restricted in terms of table supply.”

“What Sydney gets from this chronicallyflawed process won’t be what DavidMurray’s committee outlined. All that reallyhappened was Echo’s Star monopolybeing bumped into a ditch.”

Crown is forecasting $1.4 billion in incremental gaming tax for NSW in Crown Sydney’s first 10 years of full operation, a period it calculates as commencing in 2022. Its submission to the state includes a guarantee of $1 billion in incremental tax over the first 15 years. The government, seizing on the public relations value of this, made its approval contingent on it and included it in its 4th July announcement to the media. What this will mean two decades from now, or how it would be enforced, is anybody’s guess. As it stands, Crown Sydney will have to make good on it without benefit of the monopoly its operating company has always enjoyed in Melbourne.

New South Wales figures to win however it turns out.

“I look at it as a competitive situation between two operators, one of whom has an extraordinarily better track record than the other,” says Mr Green. “Government can only gain.”

Buddha and Baccarat

In Wyong, about an hour’s drive north of Sydney on New South Wales’ Central Coast, they’re talking about building a full-size replica of the Forbidden City. Seriously.

Australian Chinese Theme Park, the enterprising entity behind it, puts the cost at A$500 million and has signed a purchase agreement with Wyong Shire Council for 15.7 hectares of land for a “tourist mecca” with a theater, a traditional Chinese courtyard, the obligatory panda attraction (no live animals, though), tributes to the architectural styles of the Tang, Song, Ming and Qing periods and a nine-story temple housing a giant Buddha.

“We were the fourth or fifth council they approached after everybody else laughed in their face,” Mayor Doug Eaton told China Daily.

Mayor Eaton isn’t laughing. He’s a believer. He says, “What this proposal will do is bring millions of dollars’ worth of tourism into the area—which will have a flow-on effect to the entire region’s economy.”

Tourism is big business in Australia, good for A$41 billion last year, almost 3% of gross domestic product. And China is big tourism. The Middle Kingdom passed the UK a couple years back as the second-largest source of inbound travel after New Zealand. One in nine visitors to Australia in the last year was Chinese, and this doesn’t count Hong Kong, Macau and Taiwan. The total, 659,400, was up 17.5% year on year, more than triple the rate of growth of foreign arrivals as a whole. Total inbound visitation, which is forecast to grow 4.6% in the year ahead, will largely be driven by this surge, China’s contribution expected to increase 15.9% this year and 10.4% next year, followed by Malaysia (13.9%), Singapore (12.5%) and India (7.5%). Asia, in fact, is now home to seven of the country’s top 10 tourism feeder markets, and the next seven years are likely to see the continent contributing more than half Australia’s projected growth in international travel. Forty-two percent of that is expected to come from China. By 2020, more than 1 million Chinese will be coming annually and contributing to the economy somewhere between $7 billion and $9 billion.

In anticipation, “Industry and governments need to deepen consumer understanding, strengthen distribution, develop tailored marketing campaigns, and appropriate product, as well as relevant policy frameworks,” says Tourism Australia, a federal government agency charged with promoting the country. The agency has trained 6,000 travel specialists in mainland China to target potential visitors.

In April, former Prime Minister Julia Gillard traveled with a highlevel delegation to the country’s No. 1 trading partner to lay the groundwork for an annual trade and tourism fair and to make the Australian dollar only the third currency (after the US dollar and the yen) to be traded directly against the yuan. In May, the country’s second-largest department store chain, David Jones, launched a partnership with UnionPay, China’s leading payment card provider.

For consumer sectors such as gaming and retail, it’s more than the sheer numbers, it’s the spending that makes China the brass ring. Its citizens contributed 17.5% of Australia’s total inbound visitor expenditure in the year ended 31st March, contributing almost $3.8 billion to the economy. They outspend all inbound markets, collectively and per capita (A$7,036), the latter at almost double the average of all international arrivals. Tourism Australia expects the Chinese this year will generate about 20% of the growth in visitor expenditure across the board, international and domestic. They already lead all nations in terms of visitor nights, they spend the most on stuff ($1,206), they’re second in entertainment spending ($204) and fifth in spending on restaurants and accommodation ($2,169).

And they’re decidedly more interested in casinos than kangaroos. Their gambling spend per trip—$506 on average for the year ended 31st March—exceeds everyone else’s. The only countries that come close are Asian, and one of them is Hong Kong, which is third at $390, just behind Singapore at $400.