The Singapore gaming market was recently characterized by a financial analyst as “flatish and boring”. Industry observers bemoan the lack of impetuses to get Singapore’s casinos back on a strong growth track. But how real or sustained was the strong growth they yearn for?

Singapore’s casino industry got off to a roaring start in 2010, accelerating from zero to over US$1.2 billion in quarterly revenue across two properties in the space of a few months. Then, almost as quickly as it ramped up, the business began to plateau, with market-wide revenue settling at US$5.85 billion in 2012 and registering a slight decline in the first quarter of this year.

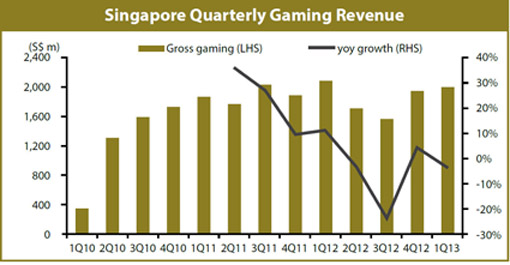

The chart below shows quarterly revenue from the start of Singapore casino operations in 2010. The casino at Resorts World Sentosa, operated by Genting Singapore, opened its doors on the first day of Chinese New Year in 2010 (which fell on 14th February). Las Vegas Sands Corp’s Marina Bay Sands commenced operations two months later on 27th April.

Source: Bloomberg and J.P. Morgan estimates

The 1Q 2010 Singapore gross gaming revenue tally was, therefore, generated by one property, in operation for only half the quarter, still working out the myriad kinks that manifest themselves following the opening of a market-first multibillion-dollar property. Thus, a big quarter-on-quarter revenue spurt going into 2Q 2010 was inevitable, as was an inflated year-on-year comparison by the time the 1Q 2011 figure came out.

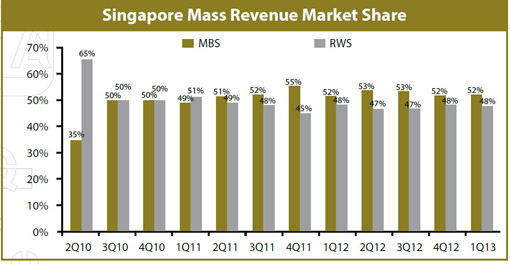

The RWS casino hit its stride within a few months. The smart money was always on Genting getting off to a quick start, leveraging the considerable competitive insights and assets it had gained from operating a monopoly casino in Malaysia since 1970, including an intimate familiarity with the wants and needs of players from Malaysia and Singapore and an extensive base of customers—many of whom belong to its loyalty card program— in the region.

Though LVS had already gone through a tough but enlightening Asia-acclimatization process with Sands Macao and The Venetian Macao, the company’s Macau lessons did not always serve it well in Singapore. The most notable rookie mistake LVS committed on arriving in the Lion City was transposing the games mix at its Macau properties to MBS. Unlike in Macau, where baccarat reigns supreme, roulette is predominant in Malaysia and Singapore, and the MBS main floor initially devoted too much precious floor space to card tables and too little to ones with wheels. But MBS soon spotted its mistake and moved quickly to reconfigure the floor. The market responded in kind, revenue at MBS spiked, and LVS started getting better acquainted with local tastes.

Source: Company data and J.P. Morgan estimates

RWS had started out with a convincing lead in the gaming revenue race thanks to its two-month opening head start and local knowledge and connections. Most believed the lead would endure for years, but MBS managed to overtake its entrenched rival by 2Q 2011, just a year out of the gate, and has maintained that lead up to now. That should perhaps have been the first hint that Singapore is a place where market dynamics can evolve rapidly, and saturation can occur quickly—especially when the industry concerned faces heavy regulation and suspicion, given its potential to damage the reputation of Singapore’s lucrative financial services industry. After all, it’s not the newly created dealer or hotel jobs at the integrated resorts that give Singapore the densest population of millionaire households in the world. By contrast, in gaming-dominated Macau, the casino boom has been a major factor behind the near-tripling of the city’s median salary within a decade to US$1,500 per month (as of 1Q 2013), though it has also hindered the diversification of the economy.

Although Singapore registered lofty year-on-year gaming revenue growth rates in the second and third quarters of 2011, the second-quarter comparison is an unfair one because MBS was only open for two full months in the same quarter of the previous year. Even the 3Q year-ago base is compromised because at the time both IRs were still ramping up and finding their way in a new market. In all subsequent quarters, from 4Q 2011 onwards, year-on-year growth has only climbed as high as about 10% while overall market revenue has even contracted in two of the more recent quarters, including a slight dip in the first quarter of 2013 and a precipitous decline of more than 20% in 3Q 2012.

Singapore’s casino industry has simply never sustained (over a year rather than an isolated quarter) Macau-scale growth against a properly established base of comparison. That doesn’t mean it isn’t a great investment for the two operators who got in, because even though they are capacity constrained—it’s unlikely they will be allowed to significantly expand their casinos in the foreseeable future—the duopoly arrangement conferred by the government’s commitment to not license any new casinos until at least 2017 has made the two IRs among the most profitable such properties in the world.

Source: Company data and J.P. Morgan estimates

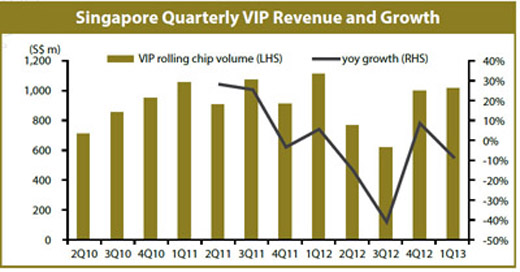

MBS turned in adjusted earnings before interest, taxes, depreciation and amortization of US$397 million in the first quarter of this year, though adjusted for luck it would have been $451 million. RWS had a disappointing first quarter, with EBITDA declining 33% year on year to S$250 million (US$198 million), though this was largely the result of a very low VIP win rate of 2.12% (versus theoretical of 2.85%). Adjusted for luck, EBITDA would have been around S$400 million.

Both properties have experienced significant fluctuation in their VIP win rate from quarter to quarter, as shown in the following table, and while it was Resorts World that took a hit in the latest quarter, it was MBS that suffered bad luck in the quarter before.

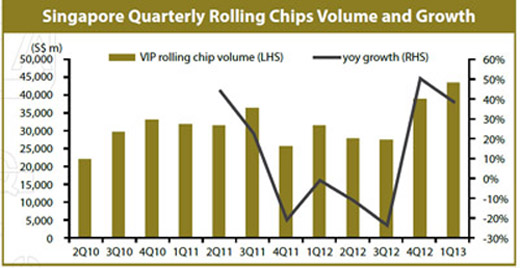

Though VIP revenue constitutes a much smaller proportion of overall gaming revenue in Singapore than in Macau, both MBS and RWS rely on a relatively small number of big whales to drive their high-roller businesses, leading to greater volatility, whereas Macau’s casinos have a much larger pool of VIPs providing sufficient liquidity to avoid regularly deviating too far from theoretical win.

Singapore’s casino industry has simply never sustained (over a year rather than an isolated quarter) Macau-scale growth against a properly established base of comparison.

The reason for the limited supply of VIP players in Singapore, of course, is that Macau-style junkets are barred from plying their trade in the Lion City. These junkets recruit players from mainland China—the world’s richest repository of high-rolling gamblers—and bring them to casinos in Macau. The junkets provide the vital functions of extending credit to the players and then collecting debts back on the mainland. The VIPs would be unable to gamble in Macau without credit from the junkets, owing to the Chinese government’s restrictions on its citizens taking money out of the country. The other consideration is that gambling debts are not legally enforceable in China, so casinos that extend credit themselves to mainland customers have no recourse to pursue errant debtors through Chinese courts.

The junkets currently active in Macau would gladly work with Singapore’s casinos in order to offer their clientele a greater choice of venue and also potentially to partake in the greater incentives enabled by the city-state’s much lower tax rate on VIP play—12%, which includes 5% on the gross and 7% goods and services tax, versus 40% on the gross in Macau. But the Singapore government, understandably wary of junkets and their reputed links to Chinese organized crime groups, has chosen to keep them out. Singapore’s fastidious Casino Regulatory Authority has so far licensed only three junkets, none of them active in Macau or apparently involved in any of the traditional junket activities beyond marketing to players. Known locally as “international marketing agents,” the three approved groups all work exclusively with RWS, and by most accounts do not bring in much business to the property.

Marina Bay Sands turned in adjusted earnings beforeinterest, taxes, depreciation and amortizationof US$397 million in the first quarter of this year, thoughadjusted for luck it would have been $451 million.

Even without junkets, however, mainland Chinese players account for about half the rolling chip volume at both MBS and RWS. Not surprisingly, this has led to the IRs being saddled with relatively high impairment charges and provisions for bad debts. The Singapore government has not given any indication that it will loosen restrictions on junket operators, and if anything is scheduled to impose stricter regulations covering VIP gaming this year, such as requiring players to draw down their entire qualifying deposit of S$100,000 before credit can be extended to them and imposing higher fines on international marketing agents for regulatory violations.

Source: Company data and J.P. Morgan estimates

Source: Company data and J.P. Morgan estimates

Despite these challenges, the outlook for the VIP sector appears decidedly more robust than that of the mass market. “The mass market story continues to be soft, and we believe will remain so for the foreseeable future,” says analyst Grant Govertsen at Union Gaming Research Macau. While Mr Govertsen does see room for margin improvement in the mass segment, he believes the casinos’ current efforts to acquire more premium-mass customers will have little near-term impact. As he explains, “With the local Singaporean market essentially maxed out, the focus on Malaysia and Indonesia continues—however, we believe that a significant portion of the high-value customers are likely already penetrated.”

Whereas Macau is acknowledged to have only served the tip of the iceberg of available gaming demand from mainland China, given the constraints placed on gaming growth in Singapore by government policy and directives, the latter market has already achieved a fair degree of penetration. The city-state’s government is also highly unlikely to soften its stance on these issues any time soon, from the casino entry levy on residents and injunctions on marketing to locals, to the effective ban on junkets and the reluctance to either allow the existing operators to expand their capacity or let new ones in. If anything, the government’s latest comments and initiatives suggest policy risk is on the downside.

Still, with annual hold-adjusted EBITDA at both Resorts World Sentosa and Marina Bay Sands hovering well above the billion-dollar mark, it’s not such a bad place for a casino operator to be. In the latest quarter, the US$5.7 billion MBS recorded in adjusted EBITDA is more than three times greater than that of Las Vegas Sands’ newest Macau property, the US$4.2 billion Sands Cotai Central, even though the former had suffered an unlucky quarter in the VIP sector, while the latter had a lucky one. So if return on investment is a key consideration in assessing a property’s success, Singapore’s plateau could arguably have Macau’s growth beat.

Positive Exchange

The arrival of casinos in Singapore has coincided with a steady appreciation of the local currency

The Singapore-listed operating entity of Resorts World Sentosa, Genting Singapore, reports its financial results in Singapore dollars, while Marina Bay Sands parent Las Vegas Sands reports in US dollars. With business at both IRs transacted in the local currency, LVS has enjoyed a significant windfall from the steady appreciation of the Singapore dollar against the US over the past three years.

In early 2010, just before the IRs opened, the Singapore dollar dipped to almost US$0.70. The Singapore dollar is now worth about 80% of the value of its US counterpart. In the first quarter of 2013, one Singapore dollar ranged from buying as much as 0.82 US dollars, to as little as 0.80. The US dollar conversion gain alone at 0.8 versus 0.7 is 14%

Source: Company data and J.P. Morgan estimates

Though there were clearly other more substantial drivers behind the pick-up in Singapore’s economy—the mainstays of which are manufacturing and financial services—since 2010 and the subsequent appreciation of the local currency, the casinos do appear to have made at least some contribution. Gaming is increasingly mentioned as one of the Lion City’s emerging industries, along with health care, education, information and communications technology and media.

The Singapore dollar has been gently trending down over the past two months, reaching S$1=US$0.79 at the end of May. The Singapore dollar’s dip reflects a mild economic slowdown, with GDP having contracted 0.6% year on year in the first quarter compared to a 1.5% increase in the fourth quarter of 2012.

The casino at Resorts World Sentosa has developeda string of big-budget family-friend attractions,including a Universal Studios theme park and the world’slargest indoor aquarium.

According to the most recent estimates provided by Singapore’s Trade and Industry Ministry, the weak 1Q economic performance was mainly the result of a contraction in the manufacturing sector, particularly within the biomedical segment. Manufacturing, which accounts for one-quarter of GDP, declined 6.5% year on year. Meanwhile, the services sector, which accounts for well over 70% of GDP and includes finance, gaming and tourism, grew 1.2% year on year.

The Singapore government’s primary proclaimed objective in legalizing casinos through the passage of the Casino Control Act in 2006 was to boost the Lion City’s flagging tourism industry. The two IRs built around the casinos have delivered on that goal.

The casino at RWS has developed a string of big-budget family-friend attractions, including a Universal Studios theme park and the world’s largest indoor aquarium. MBS, meanwhile, is an instantly recognizable structure that has come to define the Singapore skyline for many people. As one Singapore-based gaming analyst told Inside Asian Gaming, “It is very much an iconic attraction for people coming from all around the world. When you’re in the airport bookshops looking at the books on Singapore, I’d say 70% of them have Marina Bay Sands on the front cover.” Singapore’s tourist arrivals surged 20% year on year in 2010 to a record 11.6 million, following declines of 2% in 2008 and 4% in 2009 (notably, as the tourism slump reached its nadir in 2009, the local currency briefly traded below S$1=US$0.65). And while the casinos can’t take all the credit for the revival of Singapore’s tourism industry that has followed in the wake of their opening, the IRs undeniably serve as magnets for foreign visitors and have continued investing in and unveiling new attractions, helping visitor arrivals grow a further 13% in 2011 to 13.2 million and 9% in 2012 to 14.4 million.

The IRs have also benefited from the tourist influx of the past three years. While Resorts World saw gaming revenue slump in the first quarter on the back of a very low VIP win rate, non-gaming revenue rose 17% year on year, with the recently unveiled Marine Life Park attracting 7,400 visitors a day, and Universal Studios Singapore recording average daily visitation of 8,400. The property’s hotels had a 92% occupancy rate in the quarter at an average room rate of S$404.

At Marina Bay Sands, the hotel and shopping mall segments of the property saw year-on-year revenue growth of 9.7% and 6.7%, respectively, with room occupancy at 98.5% and the average daily room rate climbing to US$378 (S$472).

Although the Singapore Tourism Board is warning of an impending decline in arrivals, it appears both Marina Bay Sands and Resorts World Sentosa have established themselves as preferred destinations for better-heeled visitors to the city and especially those seeking premium dining and entertainment experiences.