Casinos could provide a much-needed boost to Saipan’s ailing economy, but the gaming proposal as it currently stands doesn’t make sense for operators

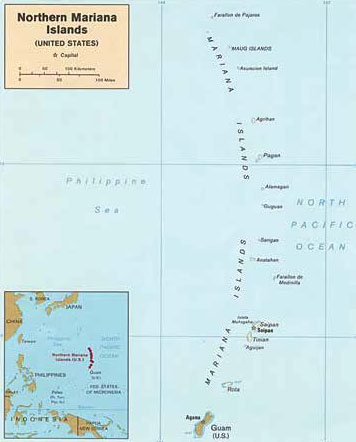

While Saipan is a remote island in the Pacific Ocean, far from Southeast Asia and China and accessible mainly by indirect connections and charters, and while it may not seem at first to be an obvious place for the development of gaming, the potential for a certain type of casino may very well exist. It will never be another Macau, or even another Cambodia or Jeju, but it may have a limited role to play in the Asian gaming market. The main challenges for the territory—the US Commonwealth of the Northern Mariana Islands (CNMI)—have less to do with geography and connections and more to do with strategy and ultimately politics.

People will likely never plan a trip to the CNMI just for gaming. For players inclined to travel for gambling, Asia has too many better options closer to home for most. The distances and logistics are indeed daunting. Only two major airlines make direct scheduled flights to Saipan, Delta Air Lines from Tokyo and Osaka and Asiana Airlines from Incheon, Busan, Osaka, Hiroshima and Tokyo, and the journeys are about 3.5 to 4 hours. Delta, Japan Airlines and United Airlines fly to Guam from Japan. United also flies from Manila, Honolulu and Hong Kong to Guam, the last a five-hour flight. From Guam, it is 45 minutes on a prop plane to Saipan. Direct charter flights are also being organized from major Chinese cities.

People will likely never plan a trip to Saipan just for gaming. For players inclined to travel for gambling, Asia has too many better options closer to home for most.

The initial and main draw of Saipan is the sand and sun. CNMI, like many Pacific islands, is blessed with pure waters and pollution-free skies. There has been very little industry in the group, and a population that’s never been above 100,000 has put relatively little stress on the environment. What’s available on Saipan is hard to find in Asia, even in places like Thailand—and in many cases, the azure waters in the region require local air or boat connections to access. On Saipan, the main beach is 10 minutes from the airport. For Chinese travelers especially, CNMI is attractive. The numbers indicate increasing interest. In March 2013, Chinese visitors totaled 9,021, up 33% on year. Charter flights were being organized from Guangzhou, Shanghai and Beijing as of early this year.

CNMI is part of the US, but under a special program visitors from China and Russia are allowed to visit the islands visa-free for 45 days (they must have a confirmed roundtrip ticket). A separate Guam-Saipan visa waiver program adds a few more countries and territories to the list, including Hong Kong and Taiwan. A chance to visit the US without going through the expensive, complicated and sometimes unsuccessful process of applying for a US visa can be a strong draw. Years ago, a similar loophole attracted Japanese tourists who wanted to get quick and easy exposure to a US destination and a chance to buy products, especially alcohol, duty-free.

The commonwealth is desperately in need of tourist and gaming dollars. Over the past few decades, its economy has been hit on all fronts. Japanese tourists stopped coming in great numbers about a decade ago. As they became wealthier and gained rights to travel visa-free to more exotic destinations, and as prices came down in Japan, they were less inclined to visit Saipan. Japan Airlines stopped direct service in 2005. The Asian economic crisis, the terrorist attacks of September 11, 2001, and the Great Recession of 2008 kept tourists from coming from other destinations and replacing the Japanese. The overall decline has been dramatic. Since hitting a peak of 726,690 in 1997, total tourist arrivals fell to a low of 369,012 in 2011.

The commonwealth is desperately in need of tourist and gaming dollars. Over the past few decades, its economy has been hit on all fronts.

Saipan was also hit hard by the collapse of its textile industry. Up until 2009, the local government had autonomy over immigration policy. While part of the US, the government of CNMI was able to issue its own visas. It was also free to set its own minimum wage (US$3.05 an hour until 2007). This led to companies establishing clothing factories in Saipan, bringing in cheap labor from poor Asian countries and manufacturing products labeled “Made in the USA.” That abruptly ended after a series of articles and documentaries exposed sweatshop conditions in CNMI. The federal government took over immigration policy and required the minimum wage to converge with the federal rate over a number of years (the minimum wage is now $5.05 an hour in CNMI).

The closure of the sweatshops caused the economy to collapse. In 2008, GDP fell 12.1%. The following year, it dropped 19.8%, according to the Bureau of Economic Analysis. The population dropped as well. It fell 22.2% between 2000 and 2010, though the drop from the peak to the trough was probably as much as one-third. The government’s fiscal position has deteriorated along with the overall contraction. Its budget peaked at US$237 million and fell to $102 million in 2012. The biggest problem, and the one most relevant to gaming, is the fact that the Northern Mariana Retirement Fund is near insolvent—it is expected to run out of money in 2014—and desperately needs a series of hefty cash infusions. While tourism has started to recover, revenues are not going to grow fast enough to make up for the shortfall. Gaming is seen as one way to bridge the gap.

But the plan as currently envisioned may not be successful. While many believe that gaming would bolt on nicely to the CNMI economy, the way the industry is set to be structured may not make business sense. Under a recent bill sent to the CNMI House of Representatives, operators will be required to pay a sizable upfront fee. A 40-year monopoly would cost US$80 million, the first $40 million payable in year 1 and the rest after 20 years. Three licenses would go for $30 million apiece and be sold under similar payment terms. A full 80% of the government proceeds from gaming would go straight to the pension fund. But operators might not be interested. The island is probably asking for too much up front to make it worth anyone’s while.

“There has always been good potential for gaming in Saipan,” says Ben Lee, managing partner, gaming developments and marketing, IGamiX Management & Consulting Ltd. “The problem is the pension issue plays a big role.”

The idea of casinos on Saipan is also generating a measure of skepticism and resistance from stakeholders and the public. Travel agencies in Japan have said that casinos probably wouldn’t draw tourists and could even deter some from visiting the commonwealth. Many people go to the island because of its unspoiled beauty and gaming could negatively affect the image of the place. Anthony Pellegrino, a leading businessman on the island, has asked on the pages of the Saipan Tribune whether gaming is right for the CNMI and whether it will deliver strong and sustainable growth for the commonwealth. Others have posed similar questions during public hearings in the past (the current bill is the third regarding casinos in recent years). Historically, the public has failed to support the introduction of gaming. A casino law was passed in 1979 but defeated by referendum. The 2007 Saipan Casino Act was also voted down by the people, while a petition last year to have the issue of legalized gambling placed on the ballot failed to get enough signatures.

Many people point to the casino on Tinian, a CNMI island near Saipan, when making the case against gaming on the main island. The Tinian Dynasty Hotel & Casino has failed to make a profit since it was opened in 1998, recently fell behind in paying its employees, has not been able to pay all its local taxes and was raided by the IRS in April this year for possible reporting violations. Two arrest warrants were issued. While there are many extenuating circumstances that help explain why that operation has failed to gain traction, such as limited and expensive transportation to the island, it is seen by some as a test case for gaming on Saipan. Meanwhile, a casino on Rota, another island in the group, closed last year.

Mr Lee says that gaming is still possible on Saipan. He believes it just needs to be priced correctly and targeted at the right market. Casinos catering to people who have had their time on the beach and want something else to do, or to those waiting for their flights home, might work and could generate some revenue for the government. Most of all, the upfront costs need to be reasonable. Other jurisdictions, such as Cambodia, have realized that this is the way to earn the most over the long term. If the operators are attracted, money can be made through salaries and taxes paid. If the cover charge is too high, operators may simply choose not to come at all.

Gaming floor at the Tinian Dynasty Hotel & Casino