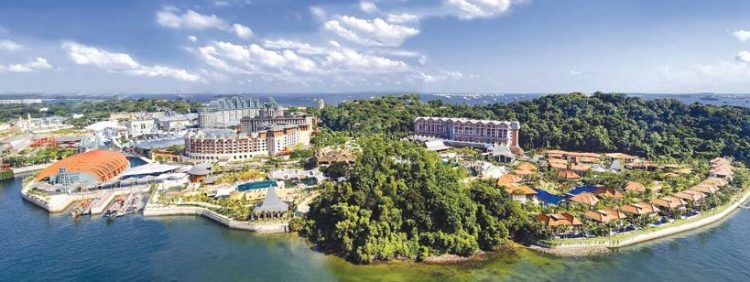

The challenges are many for Resorts World Sentosa as it enters its fourth year of operation. Singapore correspondent Alex Lobov outlines its positioning and prospects

Although Genting is a seasoned casino operator with clout and intercontinental scale, obvious questions pop up about the future of its sprawling S$6.59 billion (US$5.3 billion) Singapore property, Resorts World Sentosa.

The main tasks for RWS as it enters its fourth year are to ensure continued growth and differentiation. The casino will need to capitalize on the qualities that set it apart from its arguably more iconic and internationally recognized market rival, Marina Bay Sands. It will need to find a way to position itself more clearly to the international VIP market, leverage its brand in other gaming cities, and mitigate factors beyond its control, such as Singapore’s limiting tourism infrastructure and tough regulatory environment.

RWS suffered declining revenue over much of 2012, though the latest results point to a recovery as the year drew to a close. Parent company Genting Singapore reported net revenue increased 0.7% year on year and 18% quarter on quarter to S$792 million in Q4 2012, driven by a notable increase in VIP play, though the company’s mass-market segment remained largely flat.

The surge in VIP volume was underpinned by aggressive extension of credit as the business became increasingly top-heavy.

“Rising costs, falling margins and stagnant industry mass market are some of the concerns looming in the background,” warned a 21st February research note from J.P. Morgan. “While the market may be excited by the robust top-line growth in the short run, deteriorating earnings quality and cash-flow-generation ability could weigh on the stock price in the longer term.”

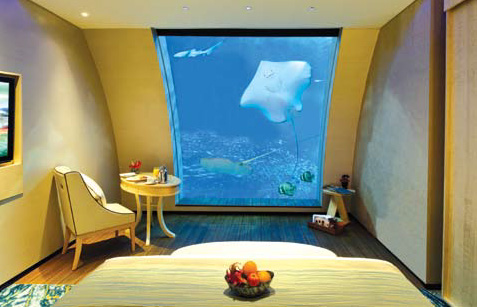

Bedroom in one of the recently opened Ocean Suites at Resorts World Sentosa

J.P Morgan also highlighted concern about the reliance of Genting Singapore (as well as market rival Marina Bay Sands) on a handful of whales: “We caution that the Singapore VIP market is very concentrated in a small group of high rollers which could cause a big swing [quarter-on-quarter]. We witnessed this situation in [the third quarter of 2011] when MBS’ VIP rolling chips increased 37% [quarter-on-quarter] and declined 36% in the subsequent quarter.”

The prospects for the high-end segment are unclear—the Singapore government has not given any indication that it will loosen restrictions on junket operators, and if anything is scheduled to impose stricter regulation covering VIP gaming this year, such as requiring players to draw down their entire qualifying deposit of S$100,000 before credit can be extended to them and imposing higher fines on international marketing agents for regulatory violations.

What RWS can call on is its solid network of VIP gamblers around the region. From the Philippines to Malaysia, Genting and Resorts World are brands that are established and still growing. RWS can aim to integrate its marketing campaigns and promotions more strongly via branded offerings such as network-wide loyalty cards, international perks and access to facilities away from VIP players’ home markets.

Mass Softness

Genting Singapore’s Q4 results were characterized by weak performance in the mass market, and there’s no clear growth impetus in sight. A 22nd February report from Union Gaming Research Macau stated: “The mass market story continues to be soft, and we believe will remain so for the foreseeable future. We estimate that mass and slots GGR was up in the low single digits on both a year-on-year and sequential basis, and we are forecasting largely flattish GGR growth in 2013. With limited top-line growth of mass market table games and slots, in our opinion, the company is focusing on margin improvement in this segment, which should be driven by improving the head count and further increasing dealer efficiency. Not unlike Macau operators, a concentrated effort on acquiring more ‘premium mass’ customers is under way, although we do not necessarily believe this will have a near-term impact. Further, with the local Singaporean market essentially maxed out, the focus on Malaysia and Indonesia continues— however, we believe that a significant portion of the high-value customers are likely already penetrated.”

The pursuit of the mass market in Singapore is stifled by the city-state’s restriction of promotional efforts targeted at locals. Indications as well are that tourism infrastructure is reaching capacity. Furthermore, Singapore is not blessed with a growing domestic market from which to draw demand from, like Macau, or even the Philippines.

What Genting can do to boost RWS’ mass-market appeal is further develop its brand and integrate it with its surrounding environment.

RWS sits on the resort island of Sentosa and draws a different type of crowd than Marina Bay Sands, which is located closer to the downtown business district. It feels more like a beach resort than a city getaway like its massive counterpart. It has fewer Singapore expatriate customers and business travelers than MBS does. Rather, it attracts a lot of families and holiday-makers who are interested in Sentosa—which translates as “peace and tranquility” in Malay—as a holiday and resort destination, not just a place with a casino. And RWS certainly has plenty of attractions, including 1,800 rooms across six themed hotels, celebrity chef restaurants and entertainment destinations like Universal Studios and the newly opened Marine Life Park. The job for RWS will be to convert these facilities into traffic on the gaming floor.

But RWS’ location on an island which for many locals is an acronym for “So Expensive and Nothing to See Also” presents challenges. The Singapore government earmarked Sentosa for development as a holiday resort for locals and tourists in the early ’70s, and since then, the island has reinvented itself as rapidly as the rest of Singapore has. RWS needs to play an active role in this continued development, from its marketing to creating new attractions, to ensure it is well positioned to take advantage of the rapidly growing Asian tourism market.

Family fun—the world’s first Sesame Street-themed ride opened at Universal Studios Singapore on 1st March