Shares of Macau’s casino operators are becoming increasingly attractive for an increasing number of value investors and for a very good reason—they mint money

It’s been a wild romance between Macau and investors in its casino stocks, a passion borne aloft on 57% gaming revenue growth in 2010, 42% in 2011, an amazing 35% annually on average for the better part of the last decade. Sadly, for those bewitched by the prospects for more of the same, they’re looking at rates of growth forecast in the low double-digits this year and next and many are thinking the music is over. Then there are those who want a love to last and are willing to make a commitment for the sake of steady, sustainable returns. For them the rewards may prove to be even more satisfying.

Analysts say Macau is becoming eminently more marriageable in the eyes of this second group, who constitute a different breed in key respects from those who’ve bought the sector for the dizzying top line growth it’s delivered for much of the post-monopoly era. Notwithstanding a medium term in which revenue growth is likely to be more muted than in the past, it’s Macau’s overarching cash flow story that woos these value investors. They like the earnings colossus the industry has fashioned over the last decade both for its ability to support robust dividend returns while still funding the capital investment that will drive earnings growth and share price appreciation into the future.

“Your breadth of investors from around the world is massively changing,” says Sean Monaghan, senior Consumer and Gaming Analyst for HSBC out of Singapore.

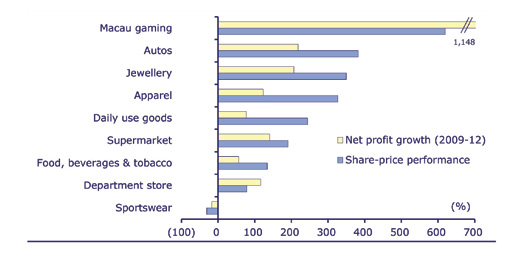

Here’s why: Since 2009, the industry has displayed not only extraordinary earnings growth—1,148% over the last three years, according to research published recently by CLSA Asia-Pacific Markets—but an outsized ability compared with other consumer sectors to turn earnings into cash and dividends.

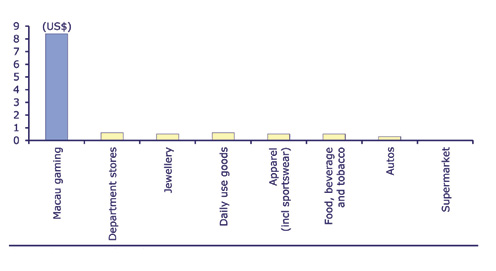

“Still Raining Cash” is the title CLSA assigned to a special report released in September that points this up with some compelling numbers: like of the US$35 billion the industry garnered in revenue last year, $4.2 billion was converted to free cash flow, a ratio of 11.9%; and $3 billion, 8.4%, was paid to shareholders as dividends. The conversion ratio among related consumer sectors—department stores, jewelry, apparel, food and beverage, automobiles and the like? Less than 1% for both.

Aaron Fischer, head of Asian Consumer and Gaming Research for CLSA, based in Hong Kong, also notes the high average return on investment for the entire sector in the post-monopoly era: about 40% since 2004, according to his reckoning, with some operators generating more than 100%, and the lowest at about 28%—“And that’s still very high,” he says, “because the cost of capital is very low, it’s roughly 12%, the way we have it.”.

Dividends paid by sector per US$100 of consumer spend

Source: CLSA Asia-Pacific Markets

In essence, Macau has been “de-risked,” is how Mr Monaghan puts it, and therefore is increasingly “investable” for large “yield” buyers for whom positions in the gaming sector would not have been an option in the past.

“Where before you had only a few companies that were listed, and they had high debt and new assets under construction which may not have been producing revenue, or if they were under construction they weren’t producing anything, now all of them are producing tons of cash,” he says. “They have paid off their original investments. Now they’re going into a whole new wave, and the whole gearing structure is radically different from what it was before. The industry from a market cap perspective is so much bigger than what it was, but far more relevant. Before you had difficulty predicting earnings, and now it’s easier to predict them getting much bigger.”

Dividends figure prominently in this, as you would expect. They’re a rarity in the gaming space everywhere in the world, yet they comprise a whopping $8 of every $100 spent in a Macau casino, CLSA’s research shows.

Grant Govertsen, managing partner of Union Gaming Research Macau, says, “You’ve got this unique dynamic where it’s still an explosive growth industry, but they’re also dividend-payers, which opens up these stocks to a class of investors who often limit themselves to only stocks that pay dividends. The companies that don’t pay dividends are in effect limiting their potential shareholder base. So I think ultimately you’ll see dividends paid by everybody.”

Currently, four of the six listed Macau names pay them—Melco Crown Entertainment and Galaxy Entertainment Group expected—at a yield that hovers around 6%, about twice the market average. Which speaks also to the fact that the sector continues to trade at relatively low multiples, suggesting many have yet to wise up to the cash flow story, or they remain fearful of slowing growth in China or the precarious state of the global economy or both, and this gets co-mingled with concerns the slowdown in gaming revenue growth this year and the fall-off in VIP play especially.

Share price growth has been strong overall, 620% the last three years, according to CLSA. But there aren’t many analysts who would tell you the group is getting the respect it deserves. At 10 times forward EV/EBITDA the sector is trailing historical averages by about 17%. On a price-to-earnings basis, at recent averages of 14 times 2013 estimates, it’s trading at a discount of roughly 40% to its peers in the hotel sector.

“For a lot of good quality consumer categories the P/E multiple can be 20 to 30 to 35 times,” notes Mr Fischer. “So we would say just on a P/E basis they’re cheap. We think the sector’s cheap on every valuation metric. Given that you’ve got good earnings visibility, cash flow visibility, dividend visibility, we don’t feel like that’s priced in.”

Mr Govertsen says, “How we would look at it is, OK, the mass market story over the next five, 10, 20 years should be absolutely dynamite. Sustained double-digit growth for the foreseeable future. Which suggests that all six of these companies really do have a very compelling growth story for a very long time horizon. And then you look at these things and they’re trading at historic low multiples and not too different from US gaming companies, for instance, regional riverboat operators, who are trading at only a slight discount to these names, and you look at the two growth profiles and they’re wildly different.”

‘Just the Beginning’

This evolution toward a more bankable business is accelerating as the market shifts from its traditional dependence on high rollers to one whose profits are derived more and more from an increasingly affluent, increasingly mobile and ultimately far more plentiful supply of low rollers. At an estimated EBITDA margin on mass-market revenue of 40%, versus 10% on VIP, the math speaks for itself.

The last 12 months show mass gaming revenue growing faster than VIP and at a steady rate of about 30%. VIP revenue growth year on year slowed from 24% in the first quarter to 7% in Q2 to a 1% decline in Q3. The three months ended 30th September were the first in 11 quarters that VIP accounted for less than 70% of total GGR. As a measure of VIP play over the last year, research by Morgan Stanley shows rolling chip volume dipped into negative territory in June (-2% year on year) and went negative again in July and August before rebounding for a 1% gain in September. But thanks to the haul from mass tables and slots, which was up a combined 36%, 30% and 27% in the first three quarters, total GGR has outgrown 2011 in every month this year, albeit at a steadily slowing pace. In a market that grew by a relatively modest 6% in the third quarter, the five operators that had reported as of this writing delivered a combined US$1.49 billion in adjusted EBITDA.

Three of the five reported year-on-year EBITDA increases:

• Sands China (HK:1928) $485.1 million (+24.1%). Net revenue: $1.62 billion (+36.3%)

• GEG (HK:0027) $338.3 million (+48%). Net revenue: $1.73 billion (+4.8%)

• Wynn Macau (HK:1128) $292.2 million (-1.3%). Net revenue: $910.5 million (-4.3%)

• Melco Crown (HK:6883/Nasdaq:MPEL) $226.4 million (-6%). Net revenue: $1.01 billion (-4%)

• MGM China Holdings (HK:2282) $152 million (+5%). Net revenue: $665 million (+7%)

• SJM Holdings (HK:0088) Consensus EBITDA: $245.4 million (+16%)

“The fact that even though China has slowed down, and Macau has slowed down, the earnings have been quite resilient at the companies,” notes Mr Monaghan. “And so global investors that used to play China consumer through other forms of consumer stocks are now looking at Macau and saying, ‘Hey, this is not as risky as we once thought.’”

Union Gaming sees next year’s revenue split between VIP and mass moving toward 65/35 for the first time since 2006, a more egalitarian customer mix that should justify more bullish valuations.

“I think you can make the argument that mass market is a much better business,” says Mr Govertsen. “Much more visibility. Sustainability. The reality is, the profitability of mass is so much higher than VIP that as mass continues to outgrow VIP on a significant basis I would argue that that average multiple of 10 times should actually go higher as mass grows as a percentage of revenues.”

He believes a 65/35 split could bump up EBITDA margins by 200 basis points. “Importantly,” he adds, “we don’t think this is reflected in consensus expectations yet.”

China consumer: Share-price changes (2009-12YTD)

Source: Bloomberg, CLSA Asia-Pacific Markets

Mr Fischer agrees. “Macau is massively undervalued. You look across different industries. What should drive shareholder returns over time is your cash return on cash invested. So if a company can build a property that costs $3 billion, borrow $2 billion and put $1 billion down, and then after four years generate a billion dollars, that’s 30%, or close to it, right. I mean, you don’t have to be an expert in the casino industry or an expert in finance to realize that if something costs $3 billion, you’re putting in $1 billion, and you get a billion every year in cash, that’s a good investment. Because you’ve paid your debt down in three years, and you’re sitting on an investment that’s going to generate you a billion every year. How can that be bad?”

As a play on the Chinese consumer’s increasing discretionary wherewithal, a play similar to luxury goods, Macau has only begun to hit its stride, he says. Then you factor in the advantages of the limited license market, the controlled pace of development on Cotai and the absence of meaningful competition elsewhere in the region, it’s difficult not to be a believer.

He says, “We think about Macau as a consumer category, whereas some people just focus on the gaming. And if you start thinking about it as a consumer category then you need to understand what’s happening in China and what’s happening all over Asia, which is very obvious—the middle class expanding massively. It’s not that complicated. We’ve understood how high the appetite to gamble is in Asia, and when you combine that with the massive explosion in wealth, it results in a very large market.”

Supportive governments locally and in Beijing are another positive.

“I think we’re seeing increasing government clarity on policy,” says Mr Monaghan. “I mean, there was a question mark at some point for some investors about whether Beijing actually wanted Macau to grow. But I think you can see that on Hengqin Island, and with all the infrastructure projects that are linking up to Macau, there must be an awful lot of long-term planning and support by Beijing.”

In support of his belief in the sector’s innate upside, Mr Govertsen speaks with enthusiasm of his frequent travels within China. “I always make it a point to talk to people,” he explains. “And these are generally places outside of Guangdong, which is the main source of visitation. So I’m talking to people in the outer provinces, people working in hotels and restaurants, the service industry. And without exception they all know exactly what goes on in Macau. Without exception, none of them have ever been here. And without exception, every single one of them has expressed that they want to come here. So it just gives me the reassurance that when the infrastructure is in place and wealth generation continues, you’ve got this massive, massive population of Chinese that hasn’t been penetrated yet. And unlike the US they’re probably not going to have the advantage of a casino down the block from them. So they’re going to have to come to Macau. And it’s just a really neat thing to think about, that certainly on the mass-market side of the equation, the game is just beginning.”