The Venetian Macau upgrades its expansive high-limit area, as all of Macau’s casino operators vie to develop their premium mass revenues

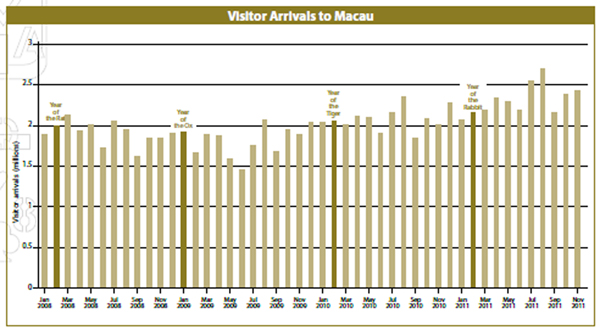

The lunar-based festival of Chinese New Year—this year on 23rd January—marks the beginning of the Year of the Dragon. Chinese New Year has come successively earlier in the Gregorian calendar since 2010, when it fell on 14th February (the Year of the Tiger). In 2011, it fell on 3rd February (the Year of the Rabbit).

The last time Chinese New Year was celebrated in January was in 2009, when it arrived on 26th January (the Year of the Ox). Macau casino executives tell Inside Asian Gaming that having Chinese New Year early in the Gregorian New Year can adversely impact visitation, with insufficient time between the two holidays for players to plan for and make two trips to Macau. In 2009, visitor arrivals to Macau in January and February combined declined 8.5% yearon-year. Although visitor arrivals declined 5.2% in 2009 as a whole, the early arrival of the Year of the Ox clearly exacerbated the slump. In 2010, when Chinese New Year returned to February, visitor arrivals in January and February combined rose 15.0%, slightly outpacing the 14.8% growth for the whole year.

Even though the Year of the Dragon will commence in January, the timing is not all bad, according to Union Gaming Research. In a research note, it pointed out: “The week-long Chinese New Year (‘CNY’) holiday officially begins on Monday, 23rd January, so the holiday will also enjoy the benefit of getting a head start as of Friday night, 20th January. This effectively extends the holiday period by an additional two days as compared to last year. In 2011, the holiday period began on Thursday, 3 February and therefore did not receive the benefit of a free weekend at the beginning or end. We note that while the PRC officially recognizes the CNY holiday as only three-days, it is commonly celebrated for seven days (the first of two annual ‘Golden Weeks’).”

Union Gaming Research Macau forecasts Macau’s gross gaming revenue to reach MOP28-29 billion (US$3.5-3.6 billion) during January 2012. It states: “This would imply 51% to 56% growth as compared to the previous January and 41% to 46% growth as compared to the previous February, which included CNY 2011. Further, GGR of MOP28bn to 29bn would be 4% to 8% higher than the previous all-time record of nearly MOP27bn in October 2011 (driven by the second of the two annual Golden Weeks).”

Putting a premium on mass

As Inside Asian Gaming pointed out in “Claw Back” in its February 2010 Year of the Tiger issue, anecdotal evidence from observation and from speaking to marketing executives at Macau’s casinos suggests that the increased visitation during Chinese New Year is heavily weighted towards the mass market segment. Although VIP play also increases during Chinese New Year, it would seem the holiday season presents a great opportunity to develop the mass segment in Macau.

Macau’s casino operators have long been accused of placing too much emphasis on VIP baccarat, which contributes over 70% of the city’s total casino revenue. Their focus appears to be shifting, however, and all the operators are now working on increasing their appeal to mass players—and especially to the premium mass—through upgraded facilities and marketing programmes.

Sands China Ltd is arguably the pioneer in courting the erstwhile long-neglected mass market in Macau—a mission it began in May 2004, when it unveiled the crowd-pulling Sands Macao, ending Stanley Ho’s effective 42-year casino operating monopoly in the city. Sands China now derives a greater proportion of its overall revenues from the mass market than any other Macau operator, and The Venetian Macao-Resort-Hotel in particular enjoys the status of a ‘must see’ destination for mass visitors to Macau.

Sheldon Adelson, Chairman of Las Vegas Sands Corp, the parent company of Sands China, stresses that his goal is to “maximize every opportunity” in every segment of the casino market. Nevertheless, Sands China’s management obviously appreciates the value of the mass market, estimating that the revenues of its mass-market tables generate a gross margin that is approximately four times higher than those of its typical VIP player tables. Furthermore, as Sands China points out in its latest annual report, “because mass-market players do not receive extensive complimentary services, including provision of hotel rooms, meals or other products or services, they contribute significantly to our non-gaming revenues.”

Within the mass segment, the bulk of revenues is likely to derive from premium mass (high-limit) players. Although there are no breakdowns available for how much of mass revenues comes from the premium mass, the common assumption of 20% contributing 80% is likely not far off the mark.

In an effort to create greater segmentation—and maximise opportunities—within its mass business, Sands China opened an upgraded high-limit gaming area at The Venetian on 7th January, in good time for the Chinese New Year influx of mass market players. “The project aims to bring players the most unique, luxurious and personalized gaming experience possible,” claims the company.

The new high-limit area spans 23,000 square feet, including a main table gaming floor space space of 13,000 square feet with 52 table games, consisting of baccarat, roulette, blackjack and poker. Another 5,000 square feet is occupied by the Ruby Room, which has 14 baccarat tables and provides Ruby and Diamond Sands Rewards Club members a personalised luxury tea cup, monogrammed cashmere shawl, personal slippers and a universal device charger. The remaining 5,000 square feet is taken up by the slots area, which contains 156 slot machines, including four exclusive VIP slot rooms. Within the VIP slot rooms, remote play is available on a 55” plasma TV and iPads, which also display TV channels and dining menus. The high-limit gaming area also features several sumptuous dining options, as well as a tea lounge that offers premium selections from The Venetian Macao’s very own resident tea master.

“The new spaces are exceptionally distinctive luxury environments offering expanded amenities and consistently superlative service, with attention to detail,” says Andrew Billany, Senior Vice President of Paiza and Plaza Operations, Venetian Macau Ltd. “Our new spaces will cater to our premium mass gaming guests and will set a new standard for a high limit gaming experience in Macao; we will provide a truly personalised service for both our high limit table and slot players.”

Interestingly, while Sands China is attempting to boost its appeal to more well-heeled mass market players, it has been scaling back its direct VIP business in an effort to improve its relationships with junket operators—the company’s earlier attempts to cut out the junkets (and the commission it pays them) and court VIP players directly coincided with underperformance relative to its peers in terms of revenue and EBITDA [earnings before interest, taxes, depreciation, and amortisation] growth. In addition to refurbishing its high-limit area, Sands China has also upgraded the areas it provides its junket partners to work within.

Macau’s other operators have also been boosting their premium mass offering through expanded and improved facilities, as well as loyalty programmes encouraging members to play more in order to qualify for greater benefits.

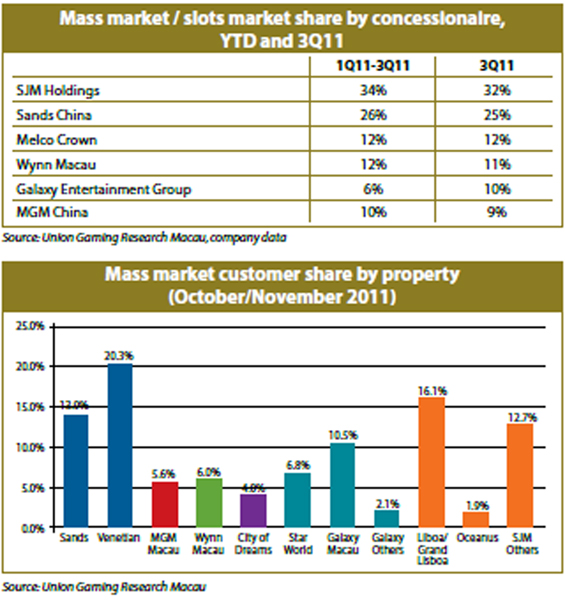

Although The Venetian Macao is clearly Macau’s biggest single mass-market draw, followed by Sands Macao, Stanley Ho’s SJM as a whole still commands the largest share of mass-market revenue, as shown in the table below. Union Gaming Research Macau tracks shares of mass-market customers by counting the number of casino shuttle bus passengers headed to each major property, with the results for the October/November 2011 period presented in the graph below.

Considered as a single entity, SJM’s Grand Lisboa and ‘old’ Lisboa constitute Macau’s third largest mass-market draw—Visitors throng to experience the distinctive Chinese style of these properties created by the local ‘King of Gambling’, Stanley Ho. Attractions include a statesmanlike bust of Dr Ho and a 218-carat ‘Star of Stanley Ho’ diamond—the largest cushion-shaped internally flawless D-color diamond in the world. The two Lisboas also offer some of Macau’s top-rated dining establishments, including Robuchon au Dôme, The Eight and Don Alfonso 1890.

According to Union Gaming Research Macau’s shuttle bus survey, City of Dreams has a mere 4.0% share of mass market visitor numbers, compared to Galaxy Macau’s 10.5%. The vast majority of Melco Crown’s mass revenues are earned at CoD (with the operator’s only other property, Altira, dominated by VIP baccarat) and those of GEG at Galaxy Macau (with its other property, StarWorld, also dominated by VIP baccarat). This suggest the mass visitors at CoD gamble much more per head than those at Galaxy Macau, since the mass market/slot revenue share of CoD’s operator, Melco Crown, was 12% in the third quarter of 2011, while it was 10% at Galaxy Entertainment Group. Part of the reason for that could be the recently-opened Galaxy Macau attracts a lot more casual visitors, who are not interested in gambling at all. Another reason could be that Melco Crown has indeed succeeded—as it frequently claims to have done—in drawing a greater proportion of premium players within its mass visitor numbers through such attractions as the US$250 million ‘House of Dancing Water’ show and glitzy CUBIC nightclub.

It is still early days for Galaxy Macau, however, and GEG could well pip Melco Crown in the mass-market revenue share rankings. As IAG reported in its interview with GEG President and COO Michael Mecca in last month’s issue, among the efforts to boost mass-market revenue at Galaxy Macau is the placement of a clearly demarcated high limit area in the centre of the main gaming floor, in addition to the operation of GEG’s Galaxy Privilege Club loyalty programme.

Efforts are also underway to increase the proportion of revenue derived from the mass market—and especially premium mass—at MGM Macau. In an interview with Reuters last year, MGM China Holdings CEO Grant Bowie stated: “I would like our mix to be 50/50 (VIP/premium mass). I think this is on the two- to five-year horizon.”

Meanwhile, Wynn Macau has long acknowledged the importance of the premium mass segment to its business, and higher-spending mass players are naturally drawn to the luxuriously-appointed property. In 2009, Wynn Macau opened several new areas with higher denomination tables “specifically designed to appeal to premium mass market clients who desire a higher degree of privacy and some basic amenities such as complimentary snacks and beverages,” stated the company. It added: “Wynn Macau attracts a large volume of premium mass market clients who are predominantly walk-in, day-trip visitors to Macau from China. Wynn Macau offers a variety of different promotions designed to attract and retain the growing premium mass market players. Our premium mass-market clients generally do not take advantage of the luxury amenities provided by Wynn Macau to the same degree as VIP clients, but Wynn Macau does have a variety of premium mass-market amenities and loyalty programs, including the Diamond Club, which offers a reserved space on the regular gaming floor and various other services unavailable to general mass-market clients.”