The Art of Jaw Jaw

Can Western operators do more to help themselves in Macau?

Galaxy has perhaps slightly less of a hotline to government than SJM, though it does appear to have got most of what it wanted in table terms for Galaxy Macau, its new project on Cotai due to open in the first half of 2011. Galaxy hasn’t, however, been entirely immune to the migrant worker controversy. Its Galaxy Macau construction site on Cotai was raided in April by inspectors from the Labour Affairs Office. But they were there to clamp down on sub-standard migrant worker accommodation, not the 800 migrants legally employed there on a live-in basis. The raids also had something of a stage-managed feel to them. Copies of notices giving Galaxy advanced warning of the inspections were found on site by local reporters covering the story. Talk privately to executives of the Las Vegas operators, and they will tell you they feel they are rarely given any leeway or benefit of the doubt by the Macau authorities when it comes to following rules and regulations, whereas they feel the Chinese operators are.

So can those foreign operators do something to improve goodwill with the authorities and therefore improve their market intelligence and market position, or are they ‘out of the loop’ simply by dint of the fact they’re not Chinese?

While not being Chinese does appear to be a handicap, they can still improve relations with the government. LVS started strongly on the goodwill front, and has been donating to local charities and community groups since it started operations in Macau in 2004. It also set up a local branch of the Sands Foundation, donating money to help the Sichuan earthquake victims in mainland China in 2008, and providing scholarships for local students to study at the University of Macau and other tertiary educational institutions.

Slow beginnings

Steve Wynn had a shaky start with the locals following a dispute with the government over legislation to allow casinos to write off uncollected gambling debts for tax purposes (it’s allowed in Vegas and Mr Wynn noisily demanded it be allowed in Macau as well—which could be part of the reason it still is not). He learned quickly, however. A few months before the opening of Wynn Macau in 2006, he famously purchased a Ming Dynasty vase for HK$78 million (US$10 million at current exchange rates and a world record for a vase) at a Hong Kong auction. He then immediately made a present of it to then Macau Chief Executive Edmund Ho. It’s now exhibited in the permanent collection of the Museum of Macau.

But while Wynn Resorts’ romance with Macau seems to be blossoming, these days LVS seems a little cranky with Macau—like a misunderstood lover that has showered his partner with gifts only to be given the cold shoulder.

From LVS’s point of view, the company may well feel a little aggrieved that having invested around US$2.7 billion in The Venetian Macao and Sands Macao combined, having created thousands of direct and indirect jobs to service the properties and being on the verge of spending US$4.2 billion more on its Cotai extension, it seems to be getting not praise and love from the Macau authorities, but negativity and heartbreak. There is potentially another way of looking at things. You need to grin and bear it. Imagine buying a Ming Dynasty vase and then not insuring it. And you need to keep paying the insurance premiums even if you feel they’re going up too quickly and you can’t see any immediate benefit. That’s arguably where LVS is at the moment in its Macau business and in its relations with the Macau government.

The second issue facing the Las Vegas operators—that of not being Chinese—is a more difficult problem to fix, even if you hire more locals at senior level. Even being ethnic Chinese, speaking the language and understanding the system isn’t enough to get you out of a tight corner with the Chinese authorities if you lose political support. Huang Guangyu, former head of the Gome electrical appliance retail chain and once China’s richest person, found that out recently. In mid-May, he was sentenced to 14 years in prison at the Beijing Second Intermediate People’s Court on the charges of bribery, illegal insider trading and illegal operation.

Nonetheless, in an operational sense, SJM and Galaxy do arguably have the commercial advantage of understanding Chinese consumers because the majority of their staff (if not their leaderships) are Chinese consumers themselves. And Chinese consumers are profoundly different—despite the rapid modernisation of China—in their tastes and ways of thinking than Western consumers, with whom the Las Vegas operators are most familiar.

In addition, SJM also has 40 years worth of infrastructure in venues, transport, marketing and casino management to help feed VIP and mass-market players to its casinos.

SJM also probably has the most capital efficient operation of all the concessionaires. Even its flagship property, the Grand Lisboa, was built at only a fraction (a first phase spend of US$640 million) of the cost of the properties put up by the Las Vegas operators. Such caution on capital spending helped protect SJM from the worst of the chill caught by the Macau market in 2008 by the twin effects of restrictions imposed on inward travel from China by the mainland authorities and the global credit crisis.

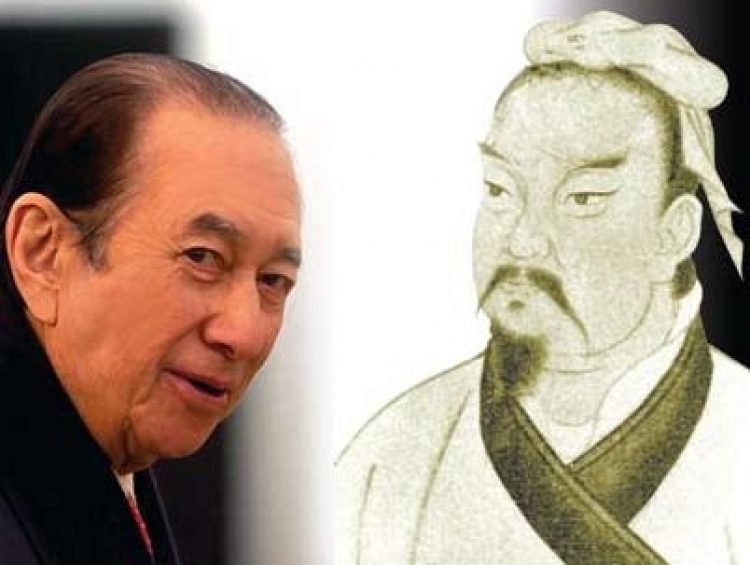

Dr Ho and his management have never suffered from a vice sometimes found in Western companies—that of pursuing a spending project even after the financial case for it has weakened.

“The general who advances without coveting fame and retreats without fearing disgrace, whose only thought is to protect his country and do good service for his sovereign, is the jewel of the kingdom,” as Sun Tzu puts it.

There may not be much romance in the soul of SJM, but there is a very healthy dose of pragmatism. When the effects of Chinese visa restrictions and the global credit crisis hit the Macau gaming market in late 2008 and early 2009, SJM sharply scaled back its plans for its new property, Casino Oceanus, next door to Macau Maritime Ferry Terminal. It had originally been conceived as a US$800 million, French designed, iconic structure shaped like a sailing ship. It ended up as a much more modest HK$1.5 billion (US$190 million) box—its humble beginnings as a former shopping centre barely disguised by a shrink wrap style blue plastic façade. It doesn’t matter. Oceanus helped to contribute towards the HK$12.7 billion revenue produced by SJM in the first quarter of this year.