That is the question for a new poll that measures visitor habits. Vega$AT Survey uncovers what they spend, and where

It’s not news that the economy is in a recession and that Las Vegas, despite all of its glamour and glitz, is feeling the strain.

According to published reports, 2008 Nevada gaming revenues, through October, were down nearly 26 percent compared with 2007. Talk to any casino executive and they will likely tell you the operating environment is going to remain challenging heading into 2009. In fact, the 2008 decline was the biggest since the state began compiling data 25 years ago.

It’s one thing for casinos to get beat at the tables, it’s quite another when players aren’t showing up. But that’s exactly what’s happening, according to the findings of the just-released Vega$AT Index Survey, compiled by Clear Seas Research in partnership with Consumer Opinion Services of Las Vegas and Gaming Strategies + Insights.

The independent study, based on interviews conducted with 1,000 visitors to Las Vegas this past fall, offers a number of insights into trends shaping the casino capital today in key areas such as gambling activity, hotel accommodations, dining, shopping and entertainment and the economic dynamics impacting visitor behavior. Visitors were questioned on their attitudes, their spending and the levels of satisfaction they experienced.

The research team used a customized PDA technology software program that allows interviewers to conveniently and accurately record feedback from a number of locations on the Las Vegas Strip simultaneously, catching visitors in action when their opinions and perceptions are the most fresh and unbiased.

John Thomas, executive director of Clear Seas’ Gaming Insights Practice, describes the effort as a “comprehensive third-party approach to assessing the full visitor experience from both an economic as well as a satisfaction perspective.”

“There are studies conducted by individual casinos and other related groups out there which provide basic data on visitors, but the Vega$AT Index specifically goes deeper to explore visitor behaviors and satisfaction across a much broader spectrum of Las Vegas activities,” explained Thomas, who is program director for the Index. “This presents real benchmarking information.”

He added that with Vega$AT senior executives now have a strategic tool with which to compare their internal customer satisfaction survey results.

“In these difficult times, having relevant and timely insights on visitors is more important than ever,” he said. “This study reveals live data you need to help make those critical business decisions when resources are scarce and every investment dollar must be spent prudently. Without question, it’s not only important to know how your players rate you, it is sometimes more important to find out what they think of the competition.”

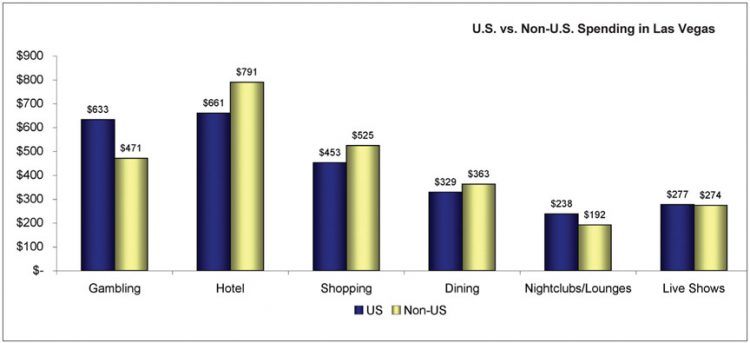

Among telling examples, one thing the study found is there are clear differences in spending and habits between U.S. and non-U.S. visitors.

All told, visitation to Las Vegas was trending downward 10 percent through October—the biggest decline since the aftermath of 9/11. But while the number of domestic visitors is down, visitation among foreigners may in fact be on the rise. Still, that may not be enough to offset current declines in revenue, according to the study, which found that visitors from outside the U.S. are spending significantly less gambling than their domestic counterparts. On average, Americans reported spending $633 of their total budget (or about 24 percent) on gambling activities, as compared to non-U.S, visitors, who reported spending only $471 of their total budget on gambling (18 percent).

Clearly, with the dollar trading at all-time lows, non-U.S. visitors are placing their money on a variety of other activities—everything from food and entertainment to gifts and shopping sprees—in an effort to maximize their total Las Vegas experience.

Some like it live

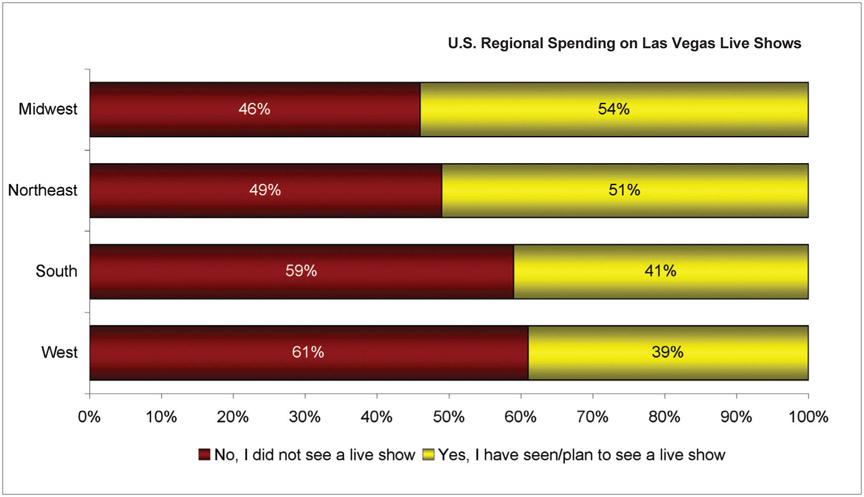

One of the more troubling trends for Las Vegas is the decline in the number of visitors who opt to take in a show. While casinos spend millions of dollars on live entertainment, less than half of all U.S. visitors go to shows. What the Vega$AT Index found was that visitors from the Midwest represent the highest proportion of show-goers, while those from the South and West stay away.

Who stays, who plays

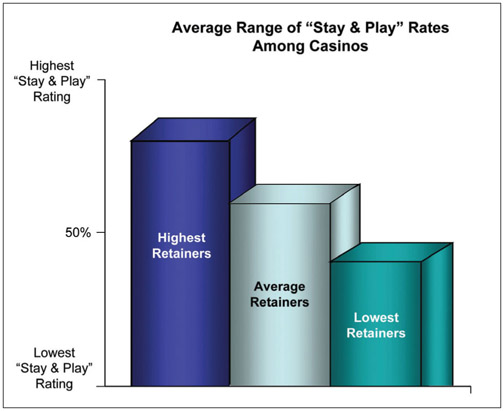

One of the most important findings to emerge from this initial round of Vega$AT interviews is that “stay and play” rates (i.e., the proportion of hotel guests that also spend most of their time gambling at the same hotel) vary dramatically by property.

Obviously, the better job a property can do to keep its guests in-house playing the games and taking in all of the amenities, the better it will do financially. Still, a large number of players say that they stay at one property but often find themselves playing at another. Certainly, given all the entertainment and gaming options on the Strip, players are going to walk. The challenge for casinos is to understand why they walk and where they walk to.

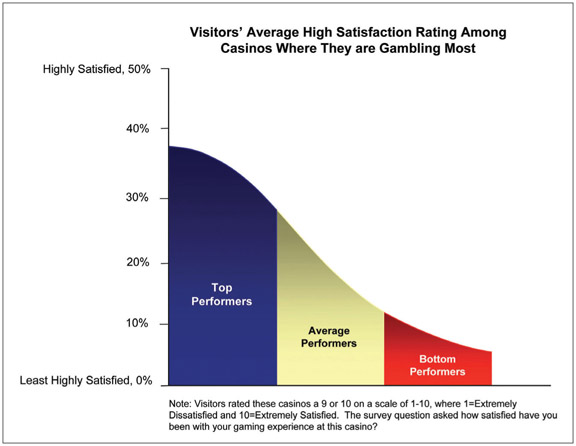

Satisfaction differs widely

When the pool of customers shrinks it becomes all the more important to maximize the draw to keep them on property. Vega$AT found clear differences in satisfaction ratings across venue types. Simply put, satisfaction ratings for Las Vegas casinos are not all that high. For a business that depends on quality customer service not a lot of players rate properties on a high scale.

“Every one of these visitors is going to go home and tell at least one person about their visit,” Thomas explained. “We know that the lower their satisfaction the more likely they will be to complain about their experience to friends and family—and these future visitors will be affected.”

U.S. and non-U.S. visitors differ dramatically in terms of their overall levels of satisfaction, with non-U.S. visitors posting consistently lower satisfaction scores compared with their U.S. counterparts. The biggest differences reside in gambling activities, where non-U.S. visitors are significantly less satisfied.

“Given that these non-U.S. visitors are already spending significantly less on gaming activities, these low satisfaction scores do not bode well for increased spending in this area,” said Thomas.

Vega$AT asked visitors, “In these difficult times, what is still bringing you out to Las Vegas?” Not surprisingly, the most common response is “for the fun and excitement”. The value proposition of Las Vegas is still relevant today even in a down economy. It’s up to casino operators to keep the magic alive and provide the type of fun, excitement and escape that people need.

The next collection of data for the Index will take place this month.

“We welcome the opportunity for Las Vegas venues to add their own custom questions to the Vega$AT Index,” said Thomas. “As we continue to build the Vega$AT Index data base we are sure it will quickly become the new must-have metric to gauge the Vegas experience.”

Reprinted with permission from International Gaming and Wagering Business (IGWB) magazine.

Clear Seas Research is a full-service marketing research firm specializing in both qualitative and quantitative research. In addition to interacting with different stakeholders in the gaming sector directly, Clear Seas interfaces with an extensive internal and external network of industry experts to ensure that the firm is kept up-to-date with industry trends. For more information on the Vega$AT Index, contact John E. Thomas, executive director of Clear Seas’ Gaming Insights Practice, at +1 248 786 1659; or via e-mail at: thomasj@clearseasresearch.com.

John E. Thomas is the executive director of Clear Seas Research and has 20 years of research experience in all aspects of qualitative and quantitative primary and secondary research design, implementation, analysis, reporting and presentation. He has an extensive background in customer loyalty research, advertising research, brand awareness/image tracking, product development research and product application/usage studies.

Glenn Goulet is a principal of Gaming Strategies + Insight LLC and has more than 25 years of market research experience. Since 1993, he has been exclusively researching the gaming and hospitality industries.