Yet another Macau casino operator may be forced to halt building work in 2009 because of the global credit crunch

Galaxy Entertainment Group may need to suspend construction of its flagship integrated resort at Cotai in 2009 because of a likely funding gap, according to Deutsche Bank.

If the cause of Las Vegas Sands Corp’s Cotai work suspension was too much bullishness, then the cause of any Galaxy suspension could be excessive caution.

By deciding to put back the opening of its Cotai IR until 2010 in the name of cash conservation, Galaxy is arguably robbing itself of the very money-generating machine it needs in order to maintain its liquidity and help pay back its debt. Instead, Galaxy has opted to drain cash from the business by paying off some debt first.

DB says it has identified a capital shortfall of approximately HK$2.1 billion (US$270 million) in Galaxy’s plans. At least a third of that is accounted for by the cash DB estimates Galaxy will spend this year in the debt buy back.

After the offer closing date on 29th December, GEG said it had received acceptances from investors for 48.6% of the bonds it offered to repurchase. The company will pay US$86.35 million (HK$670.1 million) for fixed and floating-rate notes with a combined face value of US$170.22 million. DB says that could leave Galaxy short of cash for the Cotai project.

Cold water

“Given prevailing market conditions, it in unlikely that the company will successfully raise the required funds, in our view,” says Deutsche Bank analyst Karen Tang in a review paper on the Macau market in 2009 published just before Christmas.

In essence, DB says the ‘cure’ of improving the medium term integrity of Galaxy’s balance sheet by clearing debt could be worse than the ‘disease’ of continuing to hold the debt. This is particularly the case because of the delay to the Cotai IR. DB does, though, acknowledge there will be one time and recurring benefits from the debt buy back in the form of reduced interest payments.

A number of analysts at various institutions had flagged as long ago as last November that Galaxy was likely to have a gap in its project financing. DB appears to be the first institution to state openly that Galaxy is unlikely to be able to plug the gap by going back to the money markets.

Vivian Fu, Senior Investor Relations Manager at GEG, told Inside Asian Gaming the company had no comment to make on the DB report.

Played down

Back in November, Galaxy played down the chances of the company needing further cash to complete the Cotai project. Some analysts remain sceptical of those assertions. They’re worried that the decision to delay the opening of the Cotai IR until 2010 from its scheduled first phase opening of mid-2009 will starve the company of much needed new revenue. They say such income is necessary, given that Galaxy’s other Macau gaming assets have underperformed relative to the boom times witnessed in the first eight months of 2008.

Galaxy says its decision to delay the opening of the Cotai mega resort and buy back debt is a sign of its commitment to responsible management and determination to control costs and maintain in the medium term the integrity of its capital funding. Galaxy’s original plan had been to open the first phase of its HK$10 billion Cotai resort, including a 1,500-room Galaxy-branded hotel tower, in the third quarter of 2009, followed by a 400-room Okura hotel and a 254-room Banyan Tree hotel by the end of that year. It’s been reported recently that Galaxy still needs to spend HK$7.8 billion (US$1.01 billion) to complete the Cotai IR project. The rescheduled opening spreads that spending over a longer period, in the expectation that revenues from Galaxy’s existing Macau venues can support the balance sheet.

Opportunity knocks

In early December, Galaxy seized the opportunity presented by a collapse in regional bond prices by announcing a US$180 million offer to buy back some of its fixed and floating rate bonds bearing a face value of US$350 million. This consists of all of its US$250 million guaranteed senior floating rate notes due in 2010 and up to US$100 million of the principal on its US$350 million guaranteed senior fixed rate notes due in 2012. Deutsche Bank estimates that if half of all the bondholders accept the offer, it will save Galaxy HK$128 million per year in interest charges.

“If 50% of the bondholders accept the offer, we estimate the annual cash interest savings to be HK$128 million, and there would be a one-time non-cash gain of HK$644 million in 2009,” says DB analyst Karen Tang

Ms Tang and others say buying back Galaxy’s bonds—even on favourable terms amounting to nearly half the price that investors originally paid—will drain the company of cash in the short term, without the prospect of a quick regeneration of liquidity now that the Cotai IR has been delayed.

| Galaxy – funding needs | |

| Funding needs | HK$m |

| Cash on hands – as of June 08 | 6,106 |

| New loan raised – Oct 08 | 300 |

| Operating cash flows (2H08-1H09, DB estimate) | 750 |

| Cash interest payment (DB estimate) | (352) |

| Outstanding capex contracted | (2,200) |

| Outstanding capex authorized but not contracted | (6,000) |

| Cash outflow from bond repurchase program | (702) |

| Funding shortfall | (2,098) |

| source: Deutsche Bank | |

Back to market

“If Galaxy is successful in repurchasing a significant amount of its outstanding debt, the reduced cash position further reinforces our view that Galaxy will need to go back to the market to raise new financing to close the funding shortfall,” says Ms Tang in her report on the economic outlook for Macau in 2009.

“Given prevailing market conditions, it in unlikely that the company will successfully raise the required funds, in our view.

“Hence, we continue to attribute zero value to the GalaxyWorld Resort as we believe Galaxy may have to suspend construction in Cotai,” explains Ms Tang.

In November, Galaxy described the decision to delay the opening of its Cotai integrated resort as a “tactical response to wider market conditions”. This was widely interpreted as a coded reference to the negative impact on Macau’s gaming revenues of China’s visa restrictions and of a regional economic slowdown influenced by the recession in North America and Europe.

Ratings scrutiny

Deutsche Bank isn’t alone in its scepticism regarding the state of Galaxy’s project funding. Moody’s Investors Service said in late November that GEG’s gaming unit, Galaxy Casino SA, was having its B1 corporate family rating and senior unsecured debt rating put under review for possible downgrade because of the company’s decision to delay the opening of the Cotai project.

Moody’s analyst and Assistant Vice President Kaven Tsang explained that while the delay could lower Galaxy’s overheads and spread out its capital outlays to some extent, it will also reduce cash flow.

“As a result, Galaxy’s key financial metrics will remain weak for the next two years and this situation could pressure its ‘B1’ ratings,” added Mr Tsang.

The essential concern for analysts is that despite a positive showing from StarWorld, Galaxy’s flagship property on the Macau peninsula, the company has had some difficulty gaining traction in the Macau gaming market in order to produce the kind of revenues that will allow rapid pay back on its project debt and on its amortised gaming licence fee (though HK$7 billion of the latter debt owed to the company’s founder was effectively written off late last year).

Underwhelming

Galaxy found it tough going in the Macau gaming market in 2008, even during the bullish first half of the year where the territory’s gaming revenues saw unprecedented 50% year-on-year growth.

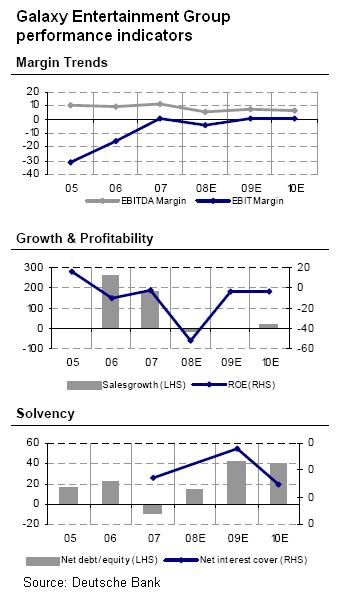

StarWorld, Galaxy’s Macau peninsula flagship, has had positive reviews from the public. It managed to capture a revenue share of around 6% of the entire Macau market all by itself soon after opening. However, it has been treading water since then and could do no more than hold its 6% market share in Q3 ’08, points out Deutsche Bank. In the context of the soaring growth of the Macau market in the first eight months of the year, that has to be viewed as underperformance.

StarWorld’s Q3 ’08 revenue was up 2% quarter-on-quarter to HK$1.71 billion. VIP rolling was up 12% quarter-on-quarter to HK$19 billion per month, representing a table hold of 2.2%, pointed out Deutsche Bank.

The venue’s mass table win was up 5% quarter-on-quarter to US$4,400 per table per day. DB adds StarWorld broadly maintained a 6% market share in Q3 ’08, with earnings before interest, taxation, depreciation and amortisation (EBITDA) up 21% quarter-on-quarter to HK$136 million. DB adds the property enjoyed a slight expansion on margin from 7% in Q2 ’08 to 8% in Q3 ’08.

But some of the company’s other assets have performed less well. At group level, Galaxy’s building materials unit has been hit by the rising cost of commodities and the rising cost of bulk transport.

And as we explain elsewhere in this edition, Galaxy’s CityClubs in particular have struggled to establish a niche audience and a clear marketing identity in the VIP market. That will need to change if Galaxy is comfortably to weather the rough conditions widely expected in 2009.